We do.

Much has been made in recent weeks about supply chain data providers changing historical metrics. Users across the industry have been coming up with their own theories, scrambling to match and compare historicals with their provider, and wondering what they can consider to be “truth.” You’ll never guess where I’m going with this. Well, maybe you should, since it’s the title of the blog…DATA INTEGRITY MATTERS!

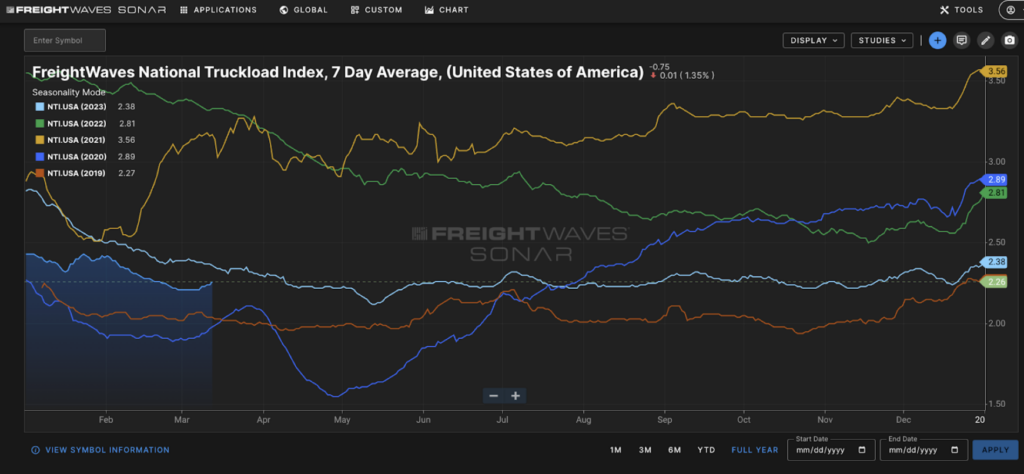

SONAR isn’t yet the longest-running or most-used data source in the trucking world (but we’re getting there!). Part of that is due to the nature of this organization. Other companies in our market spend the majority of their time focusing on broker and carrier operations (e.g., freight matching, routes and fuel, carrier/broker scoring, etc.). The mission of SONAR is transparency: data gathering, data science, creating indices and building accurate market information. The difference may not seem clear at the surface, but the problem listed above helps us uncover how distinct and valuable this difference really is.

SONAR was originally built through partnerships with many of the industry’s leading technology companies. Pairing supply chain data from various modes, geographies and points in the freight lifecycle gave users a more complete picture of the transportation and logistics world. SONAR then partnered with leading industry players to add extra data to build trustworthy rates and strengthen market trends with the creation of the TRAC consortium. Today, SONAR is made up of more than $1.7 trillion in annual global data across 300,000 various data points, conveying volumes, rejections, prices and trends to help companies make smarter decisions. Most of this data has at least 5 years of historical analysis behind it.

And change is the impetus for this blog. SONAR adheres to IOSCO data integrity principles, the gold standard for data handling and delivery. This means that the company has strict protocols around delivering data and maintains historical information in such a way that our data can always be trusted. Things can and will impact the way we present trends in the future as we continually seek to improve and deliver with accuracy, but you can be assured that SONAR’s primary focus will always be on remaining a neutral and transparent partner for the whole transportation and logistics world.

So what? What difference does it make? And who should care about this? Well, this means that every person — from the newbie on a brokerage floor to a supply chain executive — can rely on real, unbiased data to make actionable decisions for their business. They can act faster, smarter and more strategically based on real truth. And that’s why the biggest brands choose to partner with SONAR. Partner with SONAR to grow your supply chain, and you won’t look back…and if you do look back, always know you can trust the data.