Photo by Jim Allen

Long-lived, loose freight market environments are extremely challenging for freight brokerages, but if the market tightens sharply, many brokers will experience a nightmare scenario, with all of their contracts falling under water.

Many brokerages’ books of business consist of a mix of transactional spot and managed transportation/contract activity. Tight markets favor pursuing the former, while loose environments make it easier to target the latter. Ideally, a brokerage would leverage the tight market environment to secure more contract business, but this is easier said than done.

The current environment is one that has been loose for an extended period of time, and we’re seeing an increasing risk for it to turn sharply tighter in the next year. Freight brokers have to offer rock-bottom prices to win either spot or contract business. The contract business provides an added layer of risk due to long-term commitments through an uncertain period.

All market variants have challenges, but this one is arguably the most difficult. The domestic freight market has been on a rollercoaster since 2017, and the pandemic injected jet fuel into the equation.

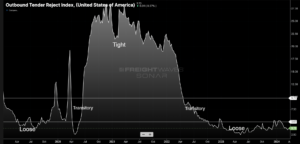

Using the past five years of tender rejection rates as examples of the various market types, there have been no scenarios where we’ve seen a relative balance between carrier capacity and shipping demand. The market has bounced between ultra loose and ultra tight.

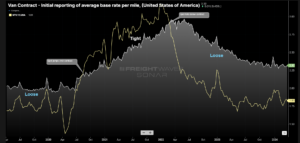

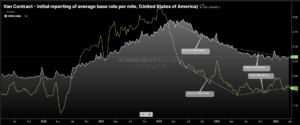

Tight markets like the one in 2021 are characterized by spot rates being above contract rates and tender rejection rates averaging above 10%. Brokers’ main challenge is locating capacity with shippers being relatively easy to find, but margins tend to be high on the spot market.

A loose/oversupplied market is characterized by spot rates being well below contract rates and tender rejection rates averaging below 5%, as is currently the case. Brokers struggle to find any revenue at all, and anything that is booked tends to have little to no margin potential.

The transitional states between tight and loose environments are very different, with one being much easier than the other.

When the market is loose, brokers have to find rates at break-even or below cost levels in order to win or maintain business. Once the market tightens and rates move higher as they did in 2020, carriers abandon these agreements for more lucrative moves. Since the pure broker has no control of the assets, they are overly exposed to covering loads at a much higher amount than they agreed to with their shipper accounts. As a result, the broker is at risk of chasing too much business, with a high risk of service failure and losing money with rock-bottom prices in this environment.

An all or nothing approach is not the only solution. While requiring more attention to detail, brokers can identify lanes that have lower risk to target low end prices while focusing on building carrier bases in higher risk lanes and pushing service.

As the Market Turns

The freight market is already showing signs of turning. Contract rates for dry van loads (VCRPM1) have slowed their decline dramatically over the past year, dropping 13% in 2022 to 2023 and 6% from 2023 to 2024. Spot rates — excluding estimated fuel costs comparable to a standard fuel surcharge (NTIL12) — are already trending higher.

Applying the rate of decay to contract rates, they should be flat to slightly higher by the end of the year and rise in 2025. This is rarely how it happens, but the market has not shifted quietly over the past seven years.

Capacity is exiting at a record pace, but it has still not overcome the record growth experienced in 2021–2022. Active operating authorities data skews high due to the reluctance of carriers to notify anyone of their exits. With all of these factors at play, the market is moving (slowly) toward a shift.

This version of the freight market is the most challenging for a broker as they have to outlast the downturn and build resilience for when the shift finally happens. Brokers have to be more informed and strategic if they want to increase their odds for survival, but if they make it, the reward is bountiful.

To learn more, get in touch with one of our experts here.