Paper and packaging manufacturers and brokers face several key challenges in today’s market. Better data intelligence is crucial for these companies to ease obstacles such as:

Use our calculator to find out.

By increasing the number of loaded miles per day your drivers drive by 1% and your rate per mile by $0.03 you will make more per week #WithSONAR.

#WithSONAR you can save up to per week through better bid negotiations and more effective management of your routing guide.

#WithSonar you can add 1 more load per person each day and increase $5 margin per load, earning your company an extra per week.

Disclaimer: Every company’s circumstances are unique. Fixed and variable expenses, market conditions and operational factors vary. Unforeseen events may also affect results. Calculated potential results reflect the consensus expectation of FreightWaves’ experts. Actual results may vary.

Paper and packaging manufacturers often struggle to optimize their supply chains in ways that synchronize with broader business and consumer cycles. Often, paper and packaging companies serve CPG brands and retailers, sitting well upstream of the consumer, and lack visibility into real-time demand. Paper freight procurement strategies are often at odds with market dynamics, and the companies are aggressive where they should be conservative (and vice versa).

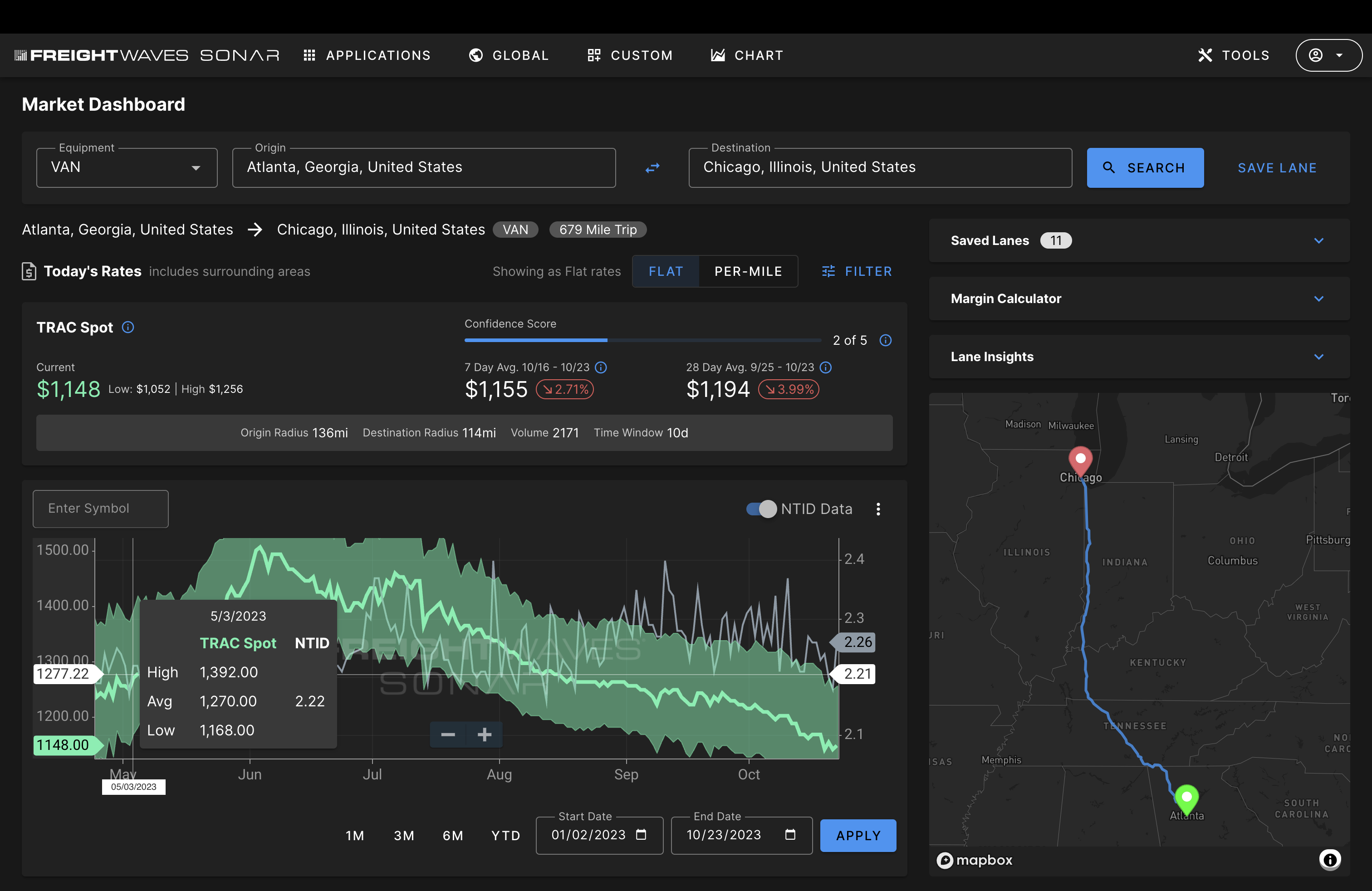

FreightWaves SONAR delivers high-frequency transportation data collected at the point of booking to give paper and packaging companies an edge in paper freight procurement:

FreightWaves SONAR provides high-frequency, multimodal freight market data to paper and packaging companies so they can rapidly respond to cyclical inflections and optimize their transportation networks for cost and service.

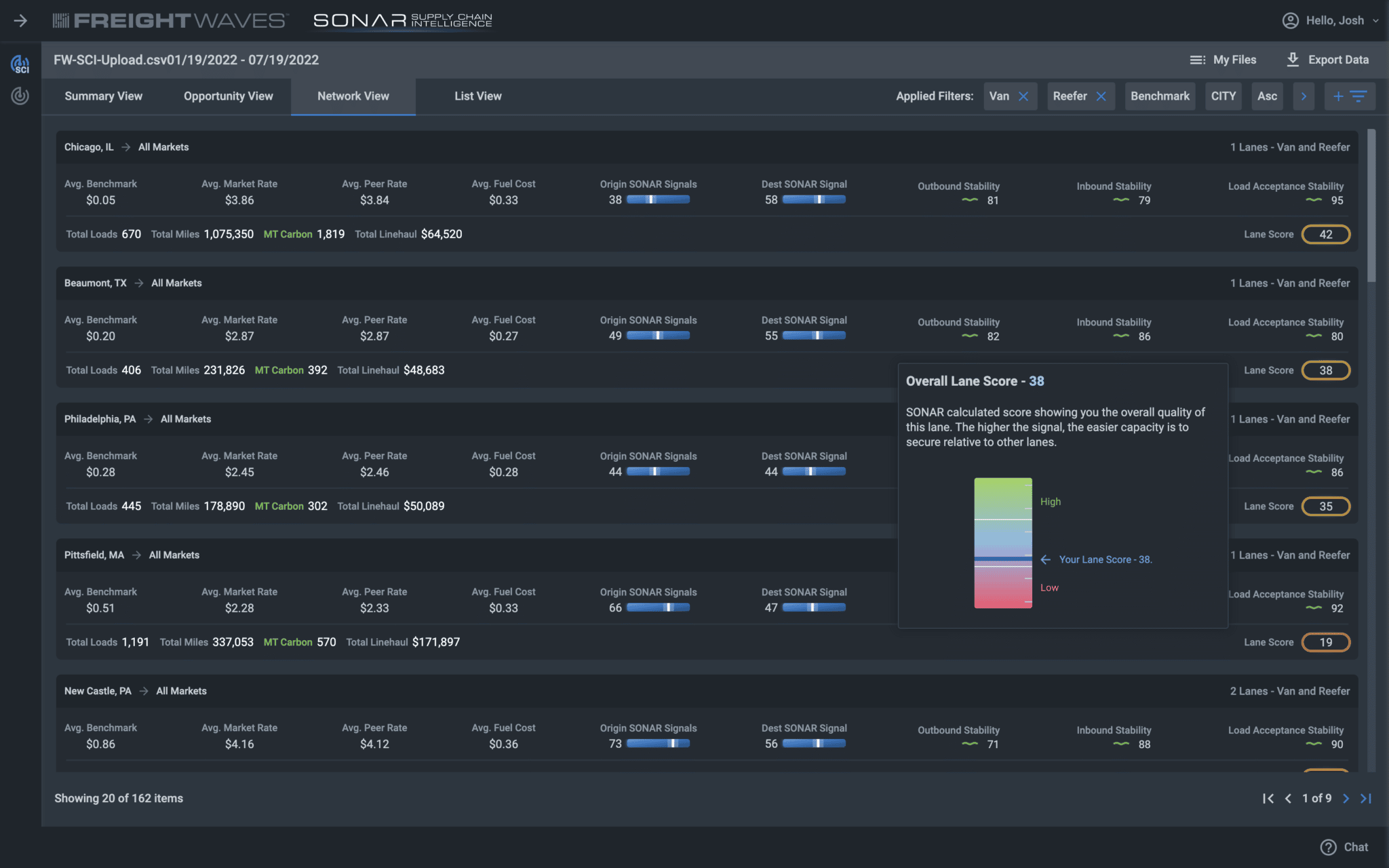

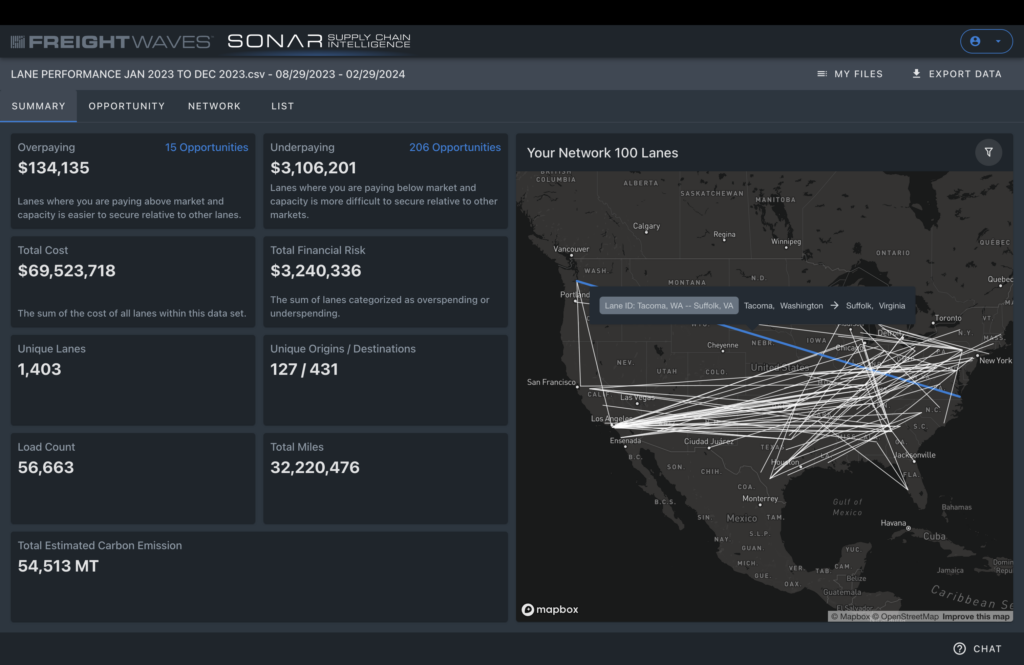

Summary View provides a control-tower-level dashboard of all uploaded lanes and summarizes:

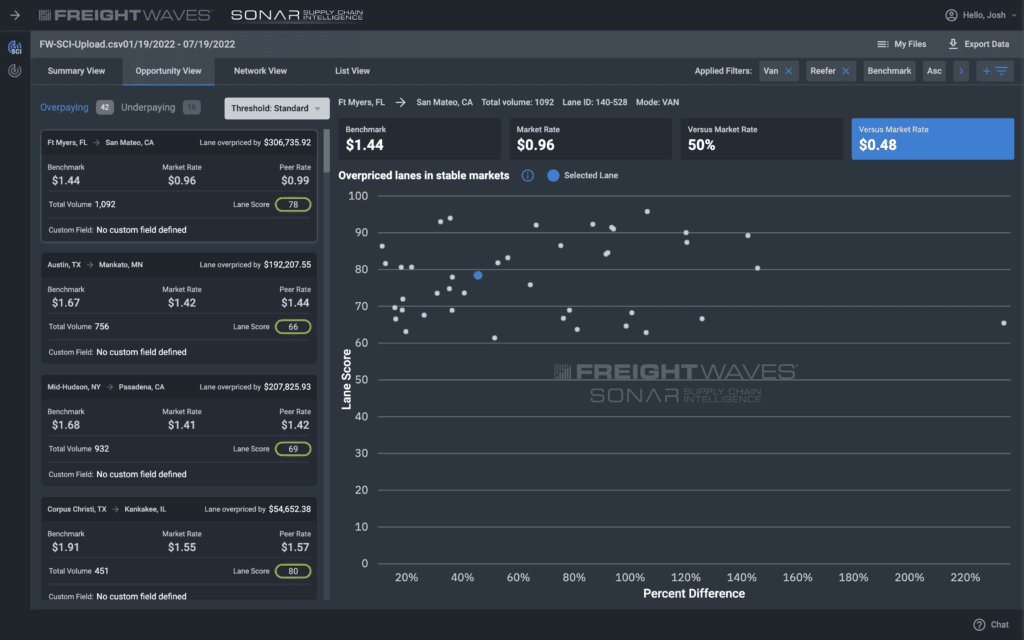

Opportunity View outlines total freight spend risks and opportunities: