Most floor brokers land in the industry almost by accident. It’s rare that anyone ever says, “I want to be a freight broker when I grow up”…it either happens by referral from a friend or a random job posting. But once you enter the industry, it is nearly impossible to leave.

Brokers are typically paid low salaries with very high commission potential. They often take home commission checks — which are based on how they meet certain KPIs or metrics — once or twice per month. Once they get their first four-digit commission, they are hooked. Money is the driving factor for almost every broker I talk to…something I refer to as the “golden handcuffs.” The harder they work, the more they get paid. The more they negotiate, the more they get paid. The more phone calls they make, the more they get paid. Most brokerages do not have a cap for their commissions, so the sky’s the limit when it comes to what they can make. As a result, most people who want to make six figures in a brokerage end up working their fingers to the bone.

But it’s not just about the money. Most brokerage floors feel like a college party, often with competitive personalities, loud music, footballs being thrown, ping pong games and phones ringing off the hook. The people who thrive in that type of environment will excel in a brokerage. You can and will build friendships that will probably last a lifetime because you spend more time with your coworkers than with your family, so you better make sure to pick the right second family.

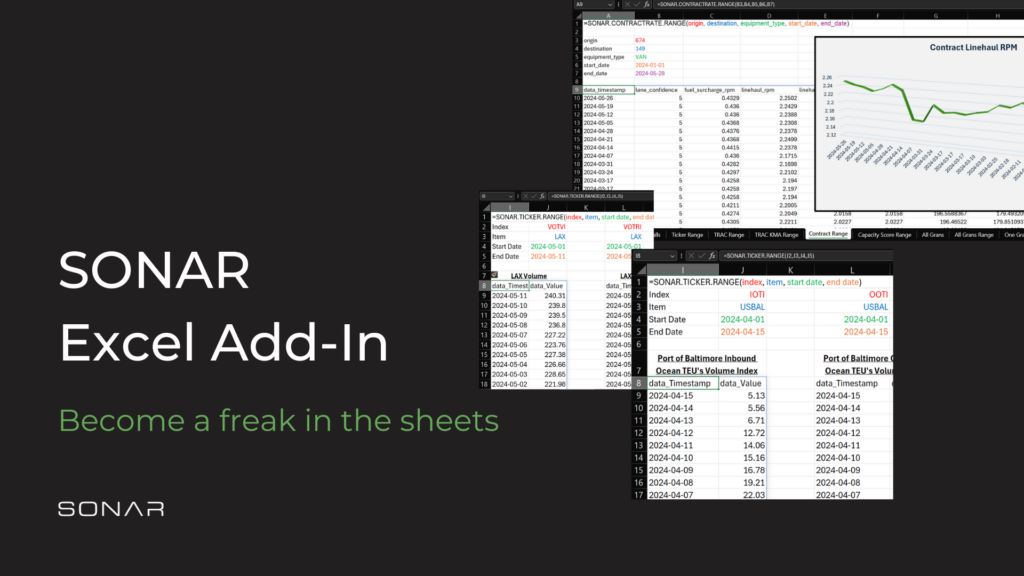

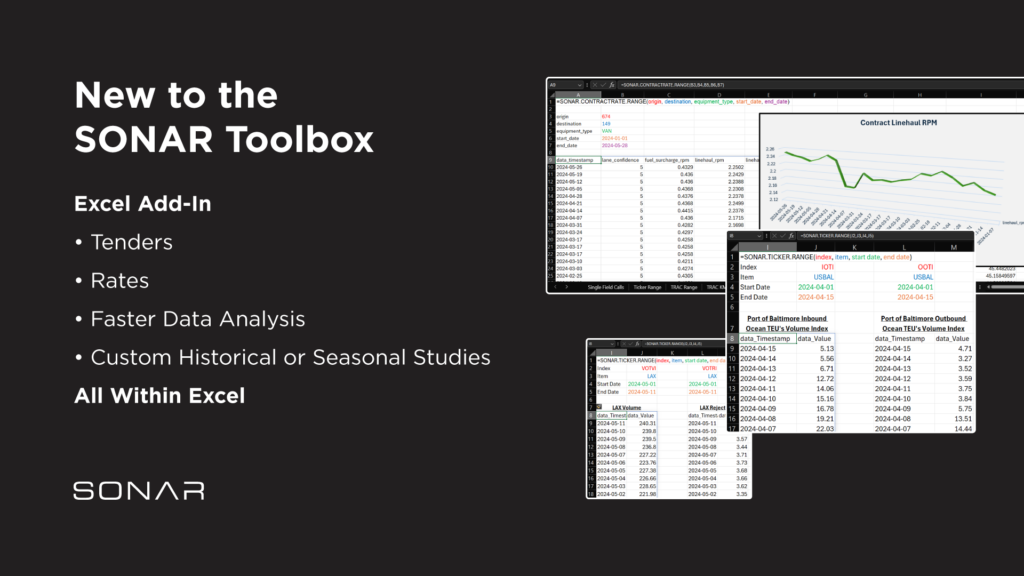

While the money and atmosphere can go a long way, finding yourself in the right brokerage is critical to long-term success. The industry has shifted dramatically over time, with hundreds if not thousands of technology offerings entering the mix that promise to improve efficiency and maximize margins. The choices are endless, so it can be difficult to know where to start when selecting new tech to add to your stack.

When selected carefully, new technology and data can help employees feel more empowered and gain more knowledge about the overall market and industry. The majority of the old, tired technology that has been available for decades isn’t evolving with the market. While they may claim expertise due to their tenure in the industry, the failure to adapt to the constantly changing environment leaves users behind the curve.

At SONAR, we take pride in being the only provider in the industry to have real-time or near-real-time data, backed by a team of market experts and customer success professionals who have decades of industry experience. We equip floor brokers to know what max buys to set while giving the CFO at that same brokerage confidence in their forecasting for the next quarter and year. SONAR’s proprietary data is second to none and enables users to track container shipments coming into the U.S., monitor freight volumes and rejections happening in Los Angeles or elsewhere, and gain an understanding of consumers’ buying habits in order to be better prepared for when the market changes…whether it’s in your favor or not.

At the end of the day, having a successful brokerage requires having a competitive edge to ensure differentiation in the market, and having the right technology in your tech stack is a great start. If you’re working for a 3PL and looking to win in today’s challenging market, SONAR can help you do just that.

Ready to get started getting empowered? Reach out to our team to learn more today.