Hurricane season is one type of disruption to the freight market that, while seasonal, are extremely hard to predict. What’s even harder to predict are the impacts to the freight market when a hurricane makes landfall.

Predictions for the 2024 Atlantic hurricane season indicate that it could be one of the most active and most severe seasons in quite some time. So far, that prediction has already come to fruition as Hurricane Beryl kicked off the Atlantic hurricane season with a bang, becoming the earliest Category 5 storm (sustained wind speeds of 157 mph) on record.

The freight market was also quite disrupted as the area had about 48 hours to prepare for the storm to make landfall.

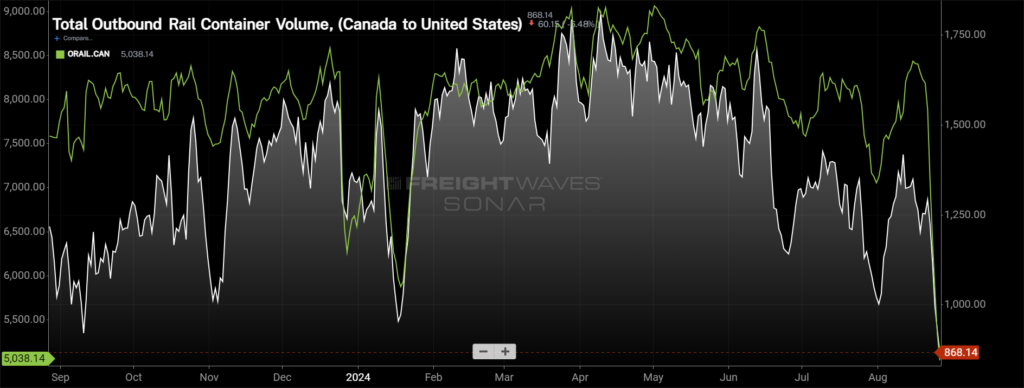

Data covering the impacts from the storm highlights how hurricanes can have isolated effects that become outsized if they hit certain regions.

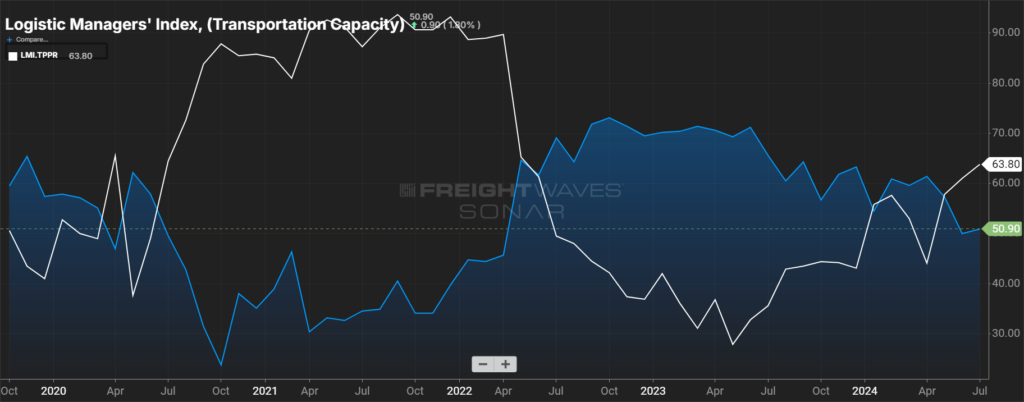

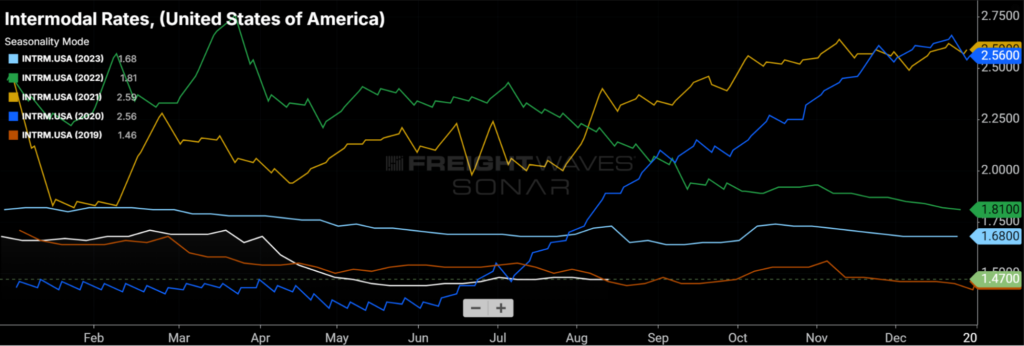

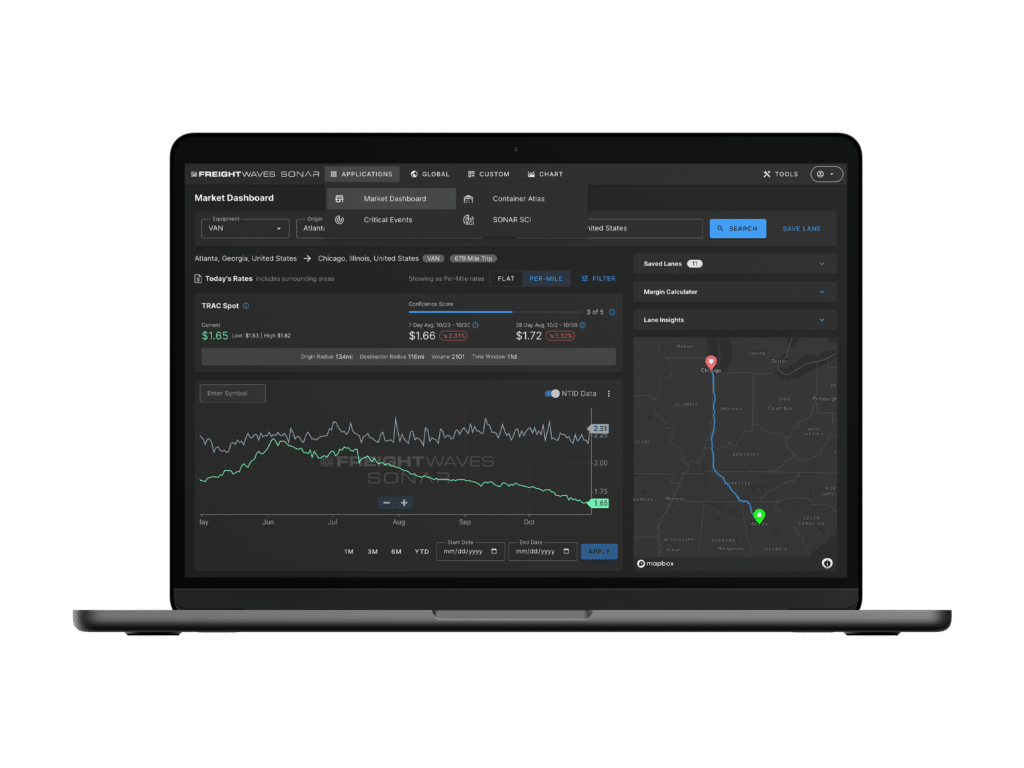

Apart from the hurricane, the timing of the Fourth of July was working against the market as capacity was just starting to return after the holiday. Within FreightWaves SONAR, the Inbound Tender Reject Index shows carrier sentiment around a given market based on the percentage of tenders that are being rejected in a given market.

Around the Fourth of July, when factoring in tender lead times, rejection rates peaked on a national level on July 2 and then retreated (as expected) following the holiday as capacity returned. In Houston, the story was very different as carriers continued to avoid the market for nearly a week after the holiday until the storm cleared and damage was assessed. Inbound tender rejection rates in the Houston market peaked on July 11, three days after Hurricane Beryl made landfall and a full week after the Fourth of July.

Outbound tender rejection rates also show when there are capacity challenges in a given market. Houston has been dealing with higher rejection rates since mid-June, not as an impact from Hurricane Beryl, but because the traditional decline after the Fourth of July hasn’t appeared.

The traditional ebbs and flows of capacity in the freight market around holidays appeared at the national level around the Fourth of July. Rejection rates tend to increase ahead of the holiday as drivers come off the road and subsequently decline as drivers return, almost immediately following the holiday.

In Houston, that story was very different: Rejection rates stayed elevated throughout the holiday but have remained at elevated levels ever since — one of very few markets to experience this and by far the largest freight market where it has occurred.

The reason? Carriers put driver safety first, holding equipment out of a given market that is being disrupted until it is safe to enter. This creates capacity disruptions in the market that can take up to a week for network fluidity to return. Thus, tender rejection rates have stayed elevated in the Houston market while the overall market experienced a return in capacity rather quickly.

To learn more about how hurricanes can impact your domestic supply chain, connect with one of our experts!