Understanding How Labor Disputes Impact Freight Markets

The freight industry requires the ability to handle potential labor disputes in stride, which highlights the need for flexibility within supply chains. Labor disputes, while relatively infrequent, have become increasingly impactful to the overall freight industry, especially during the past few years.

Since the COVID-19 pandemic, we have seen numerous disputes between labor unions and companies. Just to name a few: the Teamsters and Yellow, the Teamsters and UPS, the International Longshore and Warehouse Union and the Pacific Maritime Association, and most recently, the Teamsters Canada Rail Conference and railroads CPKC and CN.

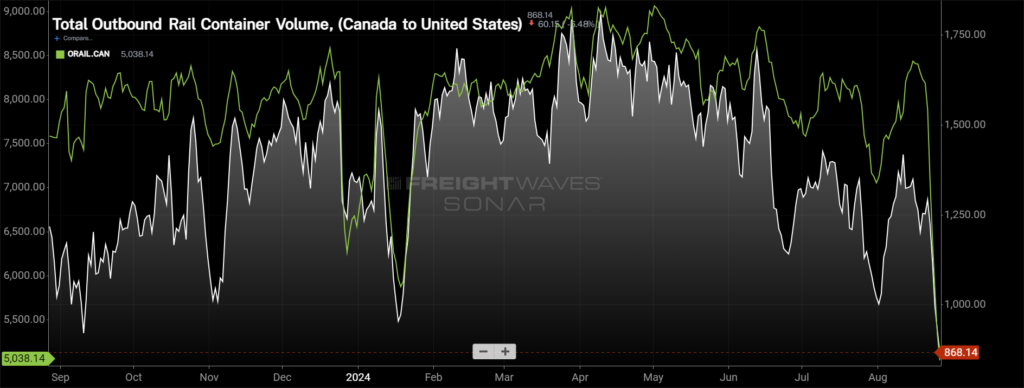

The most recent lockout with the Canadian rails lasted only 17 hours, but impacts to the freight market were almost immediate. Within 24 hours, total container rail volumes originating within Canada dropped significantly. The decline was more pronounced than any holiday impacts during the past year, highlighting the effects that labor disputes can have on the freight market. In the week following the initial lockout, container volumes originating in Canada fell by nearly 40%.

The next potential labor disruption is on the horizon between the International Longshoremen’s Association (ILA), the union that represents workers at the East and Gulf Coast ports, and the United States Maritime Alliance (USMX). The current contract between the ILA and USMX is set to expire Sept. 30, and the potential strike would begin Oct. 1.

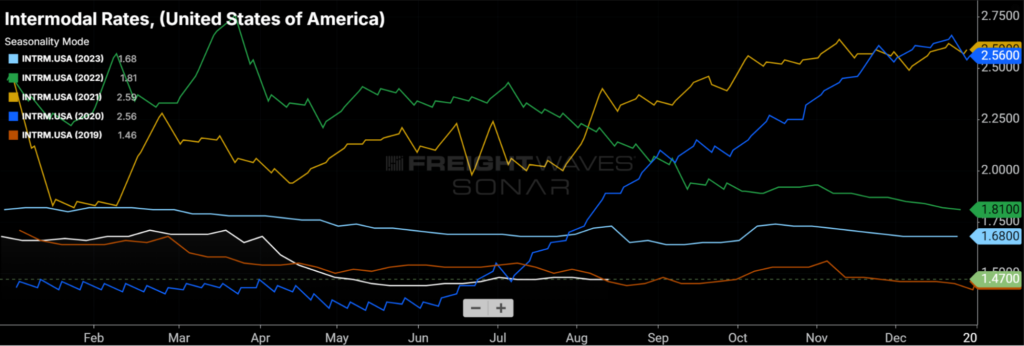

With this labor dispute at the ports, the time frame moves up even further as decisions have to be made earlier on how to move goods into the country if there were a halt at the ports. The timing of the potential strike also plays a factor as it would be right at the tail end of the ocean peak season.

What would the impacts of this strike be?

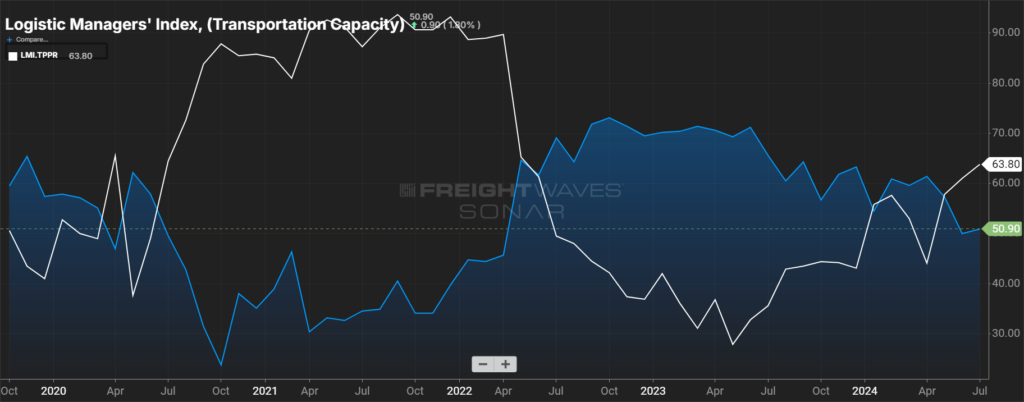

There would be a continued shift of containers into the West Coast ports, which has already been happening this year. For example, Port of Los Angeles volumes in July were 17% higher than last year.

For those operating complex supply chains that use ports on both coasts for imports and exports, understanding how potential labor disputes will disrupt supply chains is vital to ensure no revenue is lost by delays at ports (or in other modes) due to goods not being available when consumer demand arrives.

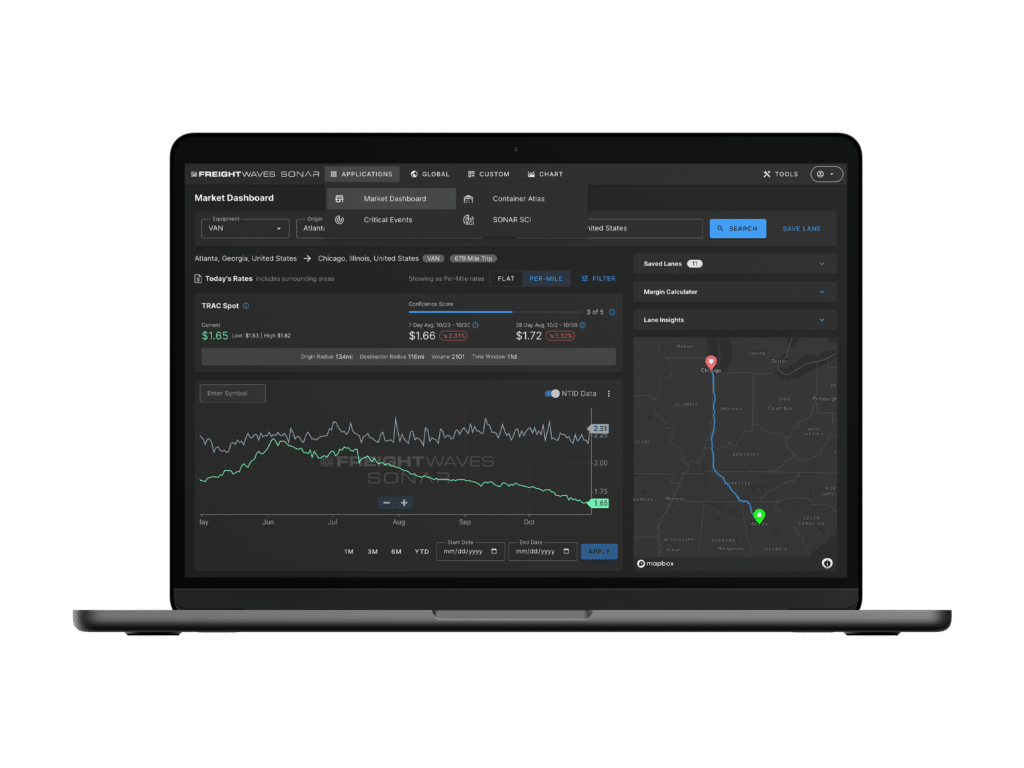

As the freight industry faces uncertainty with potential labor disputes on the horizon, now is the time to act. Leverage the predictive capabilities of FreightWaves SONAR to stay ahead of disruptions and safeguard your operations from costly delays. Subscribe to our newsletter for updates, tips and offers.