Use our calculator to find out.

By increasing the number of loaded miles per day your drivers drive by 1% and your rate per mile by $0.03 you will make more per week #WithSONAR.

#WithSONAR you can save up to per week through better bid negotiations and more effective management of your routing guide.

#WithSonar you can add 1 more load per person each day and increase $5 margin per load, earning your company an extra per week.

Disclaimer: Every company’s circumstances are unique. Fixed and variable expenses, market conditions and operational factors vary. Unforeseen events may also affect results. Calculated potential results reflect the consensus expectation of FreightWaves’ experts. Actual results may vary.

Automotive suppliers and OEMs can save millions of dollars by applying high-frequency freight market data to their own transportation networks to understand where their rates paid and carrier service levels are out of step with the broader market. FreightWaves SONAR’s automotive industry data makes it possible for automotive shippers to monitor rates, capacity and volume in multiple modes of transportation, from ocean containers and air cargo to truckload.

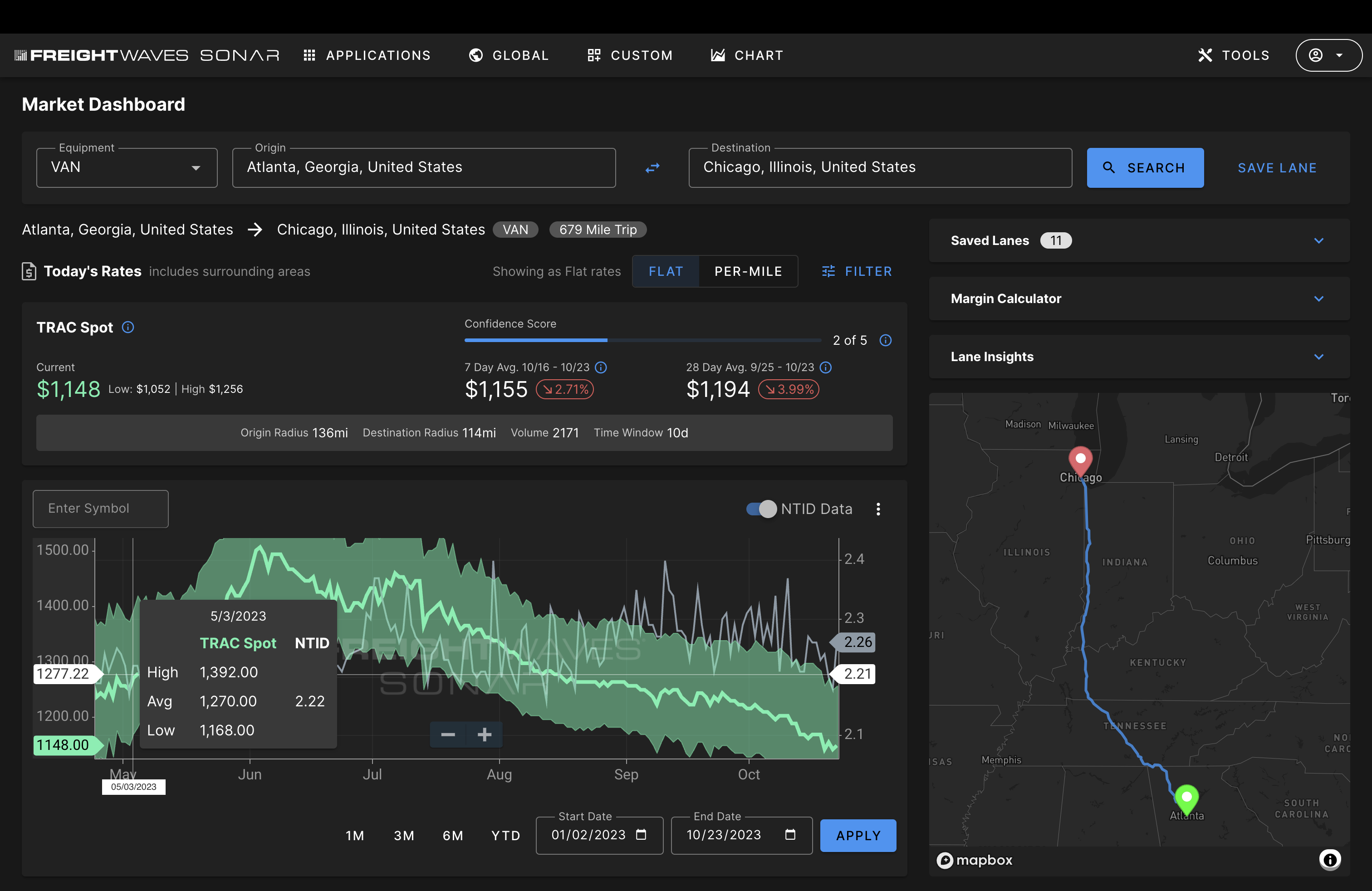

SONAR produces the fastest truckload, air cargo and ocean container data, collected at the point of booking, to give automotive supply chain leaders an edge:

FreightWaves SONAR provides the fastest view of global freight markets, allowing automotive manufacturers and shippers to make strategic and tactical decisions about ordering, network design, freight procurement and modal strategy.

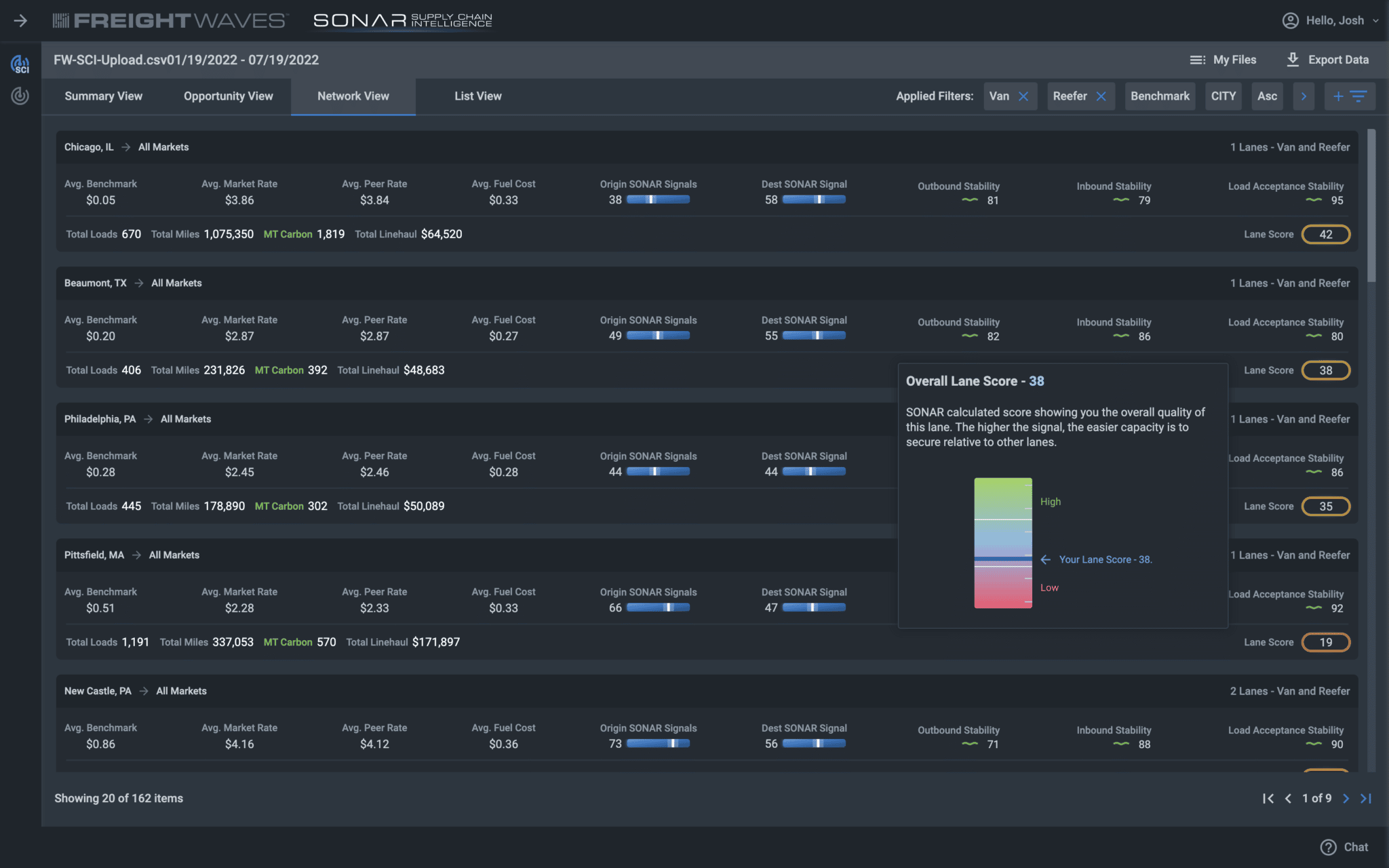

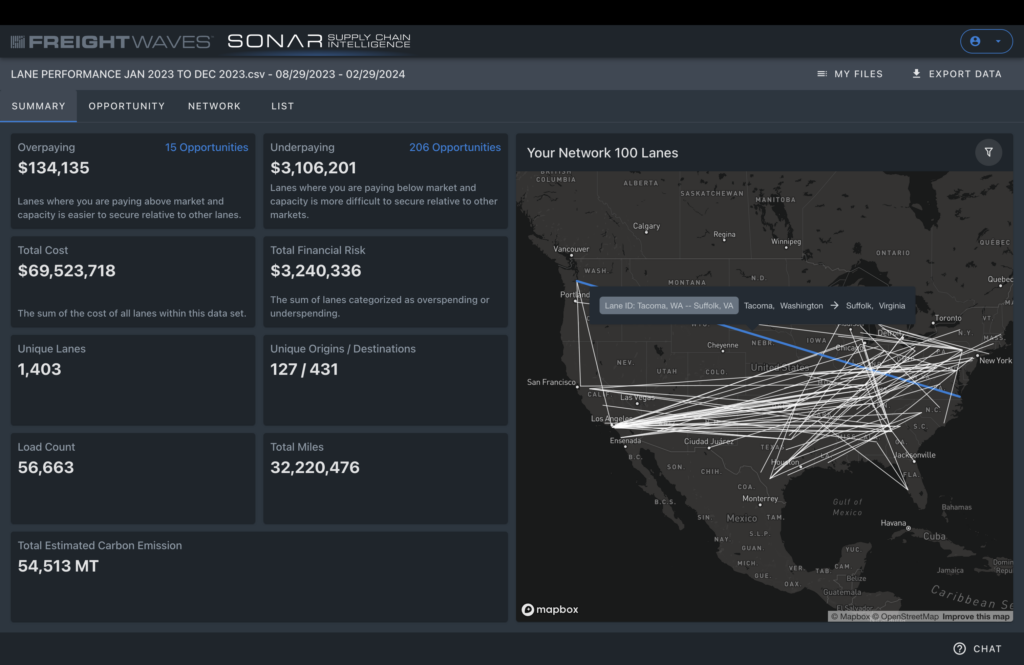

Summary View provides a control-tower-level dashboard of all uploaded lanes and summarizes:

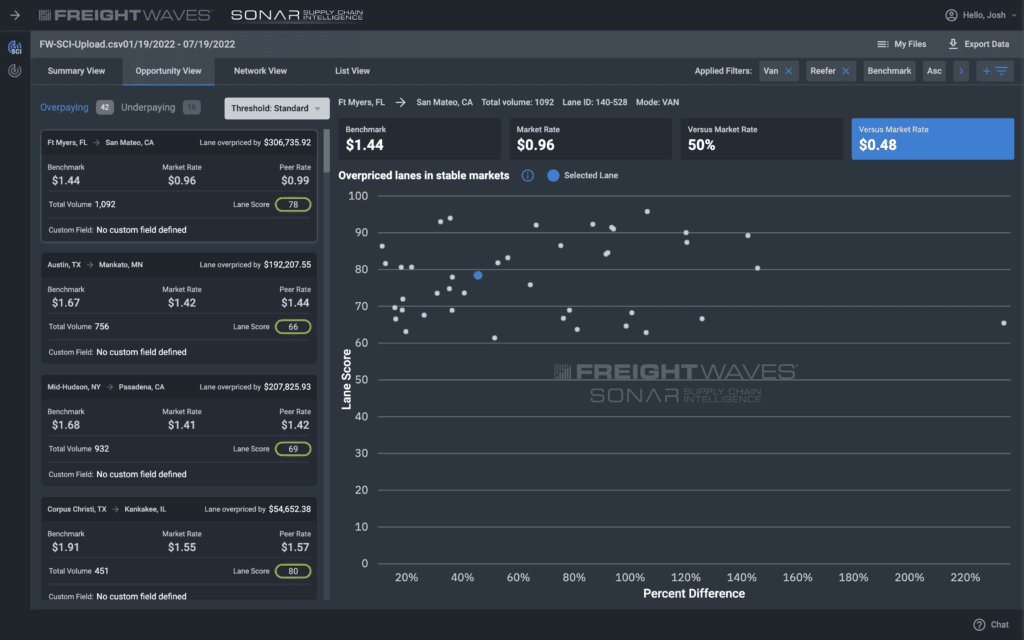

Opportunity View outlines total freight spend risks and opportunities: