Use our calculator to find out.

By increasing the number of loaded miles per day your drivers drive by 1% and your rate per mile by $0.03 you will make more per week #WithSONAR.

#WithSONAR you can save up to per week through better bid negotiations and more effective management of your routing guide.

#WithSonar you can add 1 more load per person each day and increase $5 margin per load, earning your company an extra per week.

Disclaimer: Every company’s circumstances are unique. Fixed and variable expenses, market conditions and operational factors vary. Unforeseen events may also affect results. Calculated potential results reflect the consensus expectation of FreightWaves’ experts. Actual results may vary.

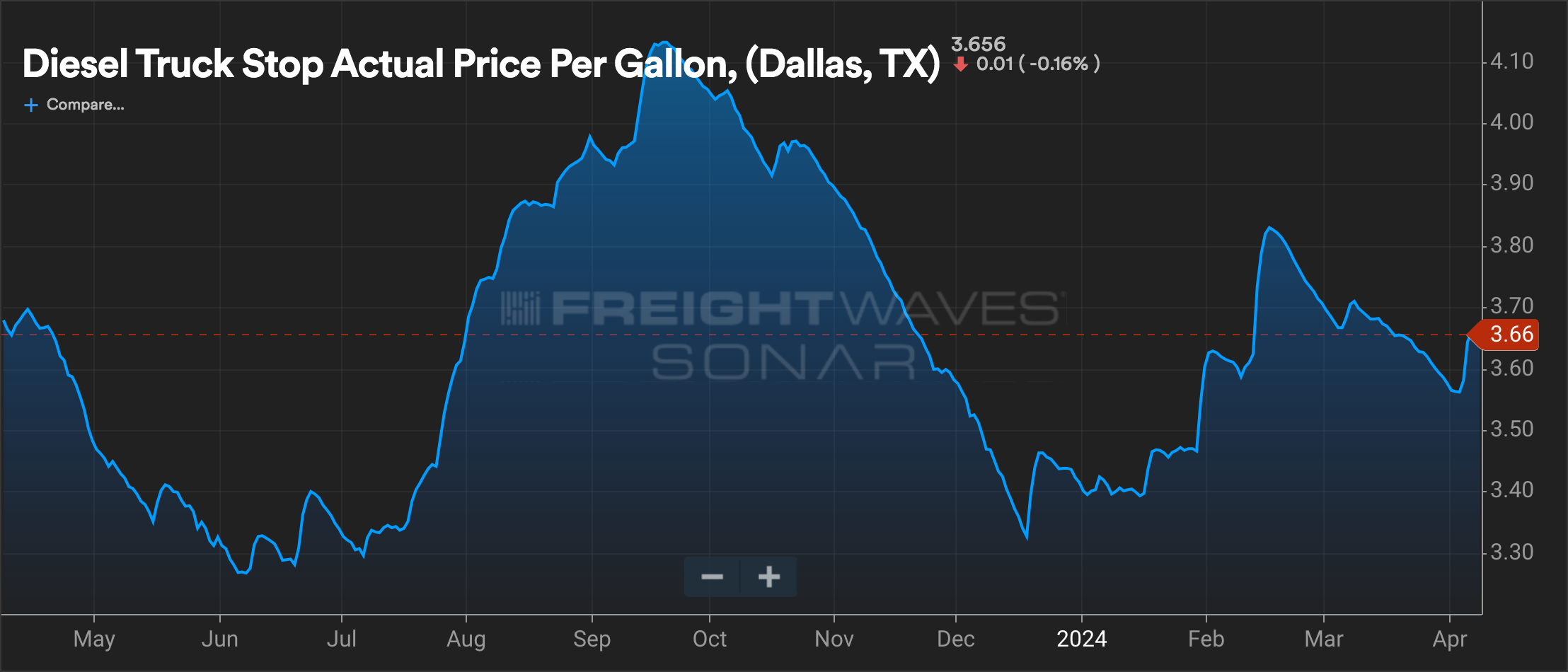

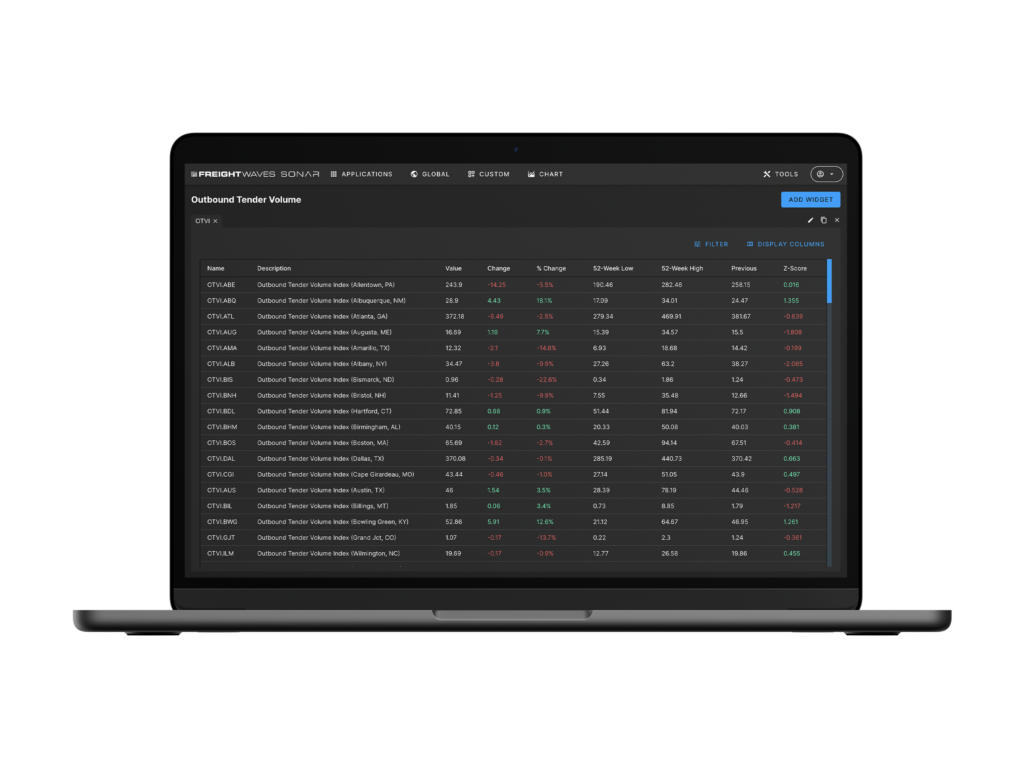

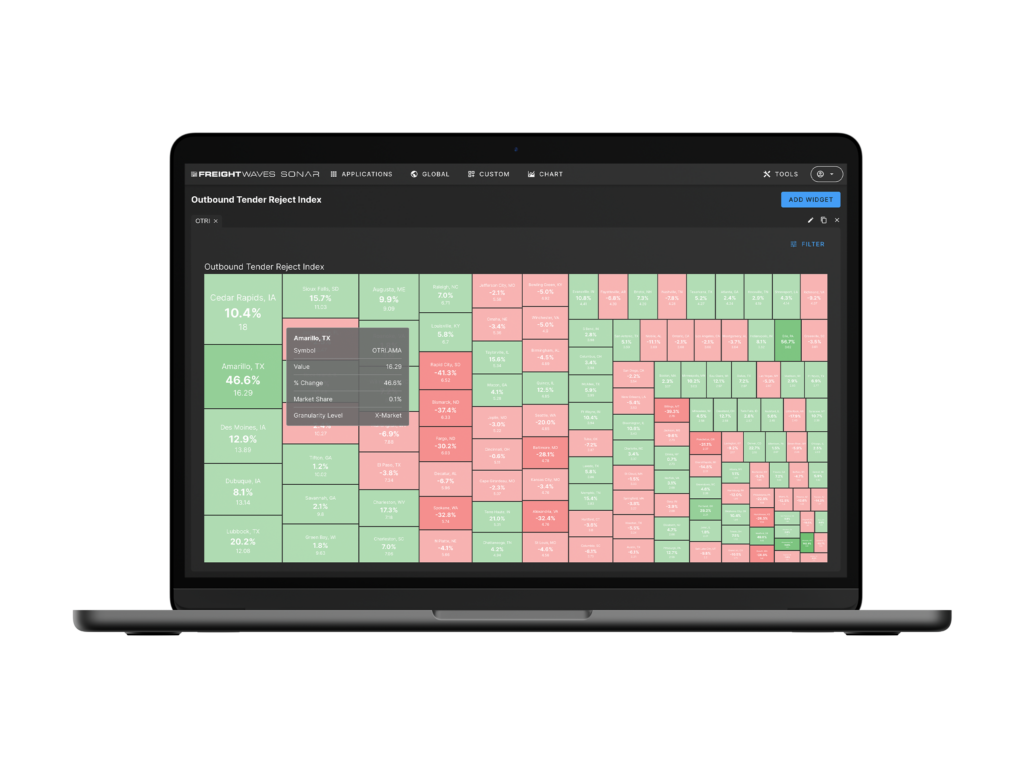

SONAR truckload data sets include contract and spot truckload rates as well as volume and capacity trends.

The SONAR data intelligence platform equips carriers with actionable insights to make data-informed decisions – despite market fluctuations.

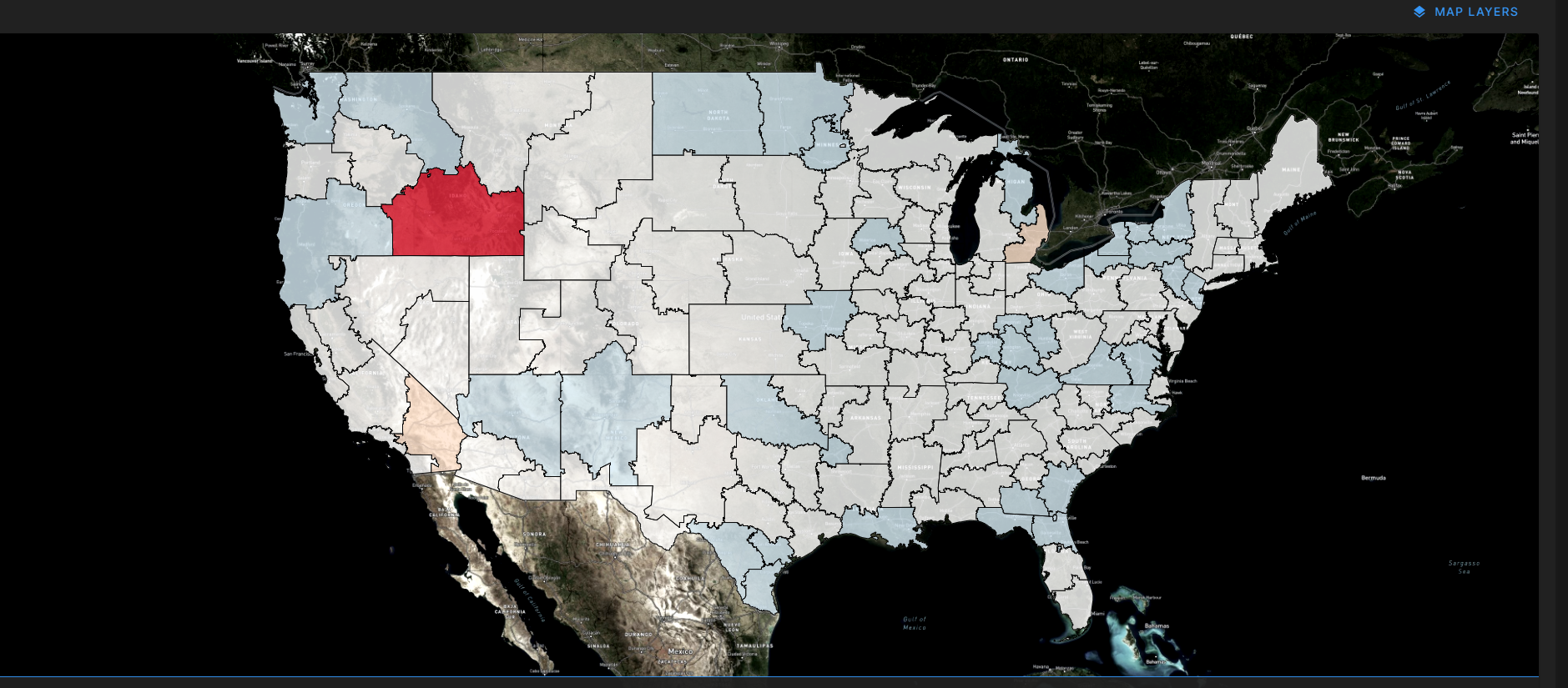

Displays where freight is available

Tracks capacity availability