Logistics leaders are tasked with the daunting work of balancing the importance of cost and service within their transportation budgets. Climbing costs can eat into an organization’s reserves, while poor service can result in damage, delays and unhappy customers. Both of these scenarios ultimately threaten a company’s bottom line.

The transportation landscape can be difficult to navigate, and compromising on either cost or service can feel impossible. It is important to note, however, that this is one situation where companies can, in fact, have their cake and eat it too.

There are a few steps companies can take when striking a balance between transportation and service quality.

- Utilize data.

With climbing costs and continued unpredictability, it can be easy to romanticize the “good old days.” Today’s supply chain teams, however, have at least one serious advantage over their predecessors: data.

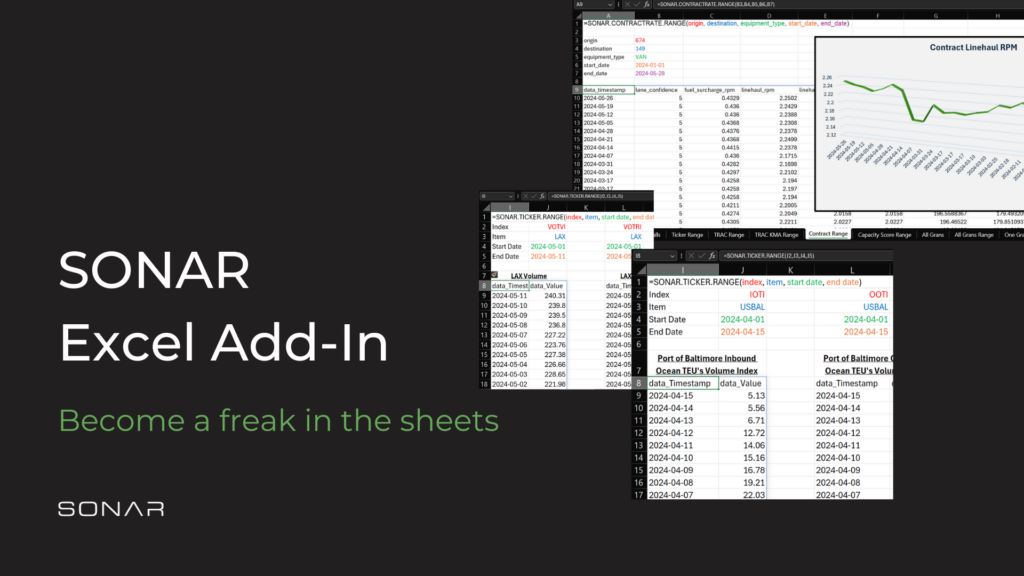

Companies can utilize near-real-time, dynamic data from sources such as FreightWaves’ SONAR to understand what is happening in the market today and predict what will happen in the future. Additionally, logistics leaders have access to a wealth of benchmarking tools to help them better understand what is happening inside their own companies.

This wealth of information equips shippers to understand their strengths and weaknesses, negotiate better deals and anticipate rate changes before they occur.

- Maximize efficiencies.

Once supply chain teams understand both the state of the market and their own operational standing, they can take steps to make their business processes more efficient — from maximizing warehouse space to shipping on off-peak days.

By saving money internally, enterprises are able to free up more funds to ensure quality transportation service, even during rate spikes. While this method does not directly rescue transportation spend, it has the same positive impact on the company’s bottom line.

- Build relationships.

At its core, transportation is still a relationship-oriented industry. The connection between a shipper and a carrier can go a long way toward simultaneously cutting down costs and ramping up service. As in all areas of life, folks offer better deals to their friends.

In order to strengthen these partnerships, supply chain teams should focus on perfecting “shipper of choice” behaviors, including cutting down on detention time, providing accurate appointment windows and providing perks for drivers. They should also consider that honoring their existing contracts, even when lower rates are available elsewhere, will make carriers more likely to remain loyal when the market shifts back in their favor.

At the end of the day, a company’s success — or failure — is determined largely by the end consumer’s experience. For this reason, it would be logical to prioritize quality service over decreased spend. It isn’t that simple, though. Companies cannot spend money already eroded by shrinking margins, no matter how good the service is. That is why working hard to strike a balance between spend and service is crucial. Fortunately, logistics leaders are equipped with more tools than ever before to help them do just that.

Want to see what SONAR data can do for you? Click here to connect with us!