Freight procurement has serious problems. It’s “broken” in the sense that when the market shifts, shippers don’t get the service they’ve agreed to pay for and volumes awarded to carriers are withheld and withdrawn. Contracts don’t hold up.

The lack of a mechanism to tie contracts to prevailing market conditions creates enormous inefficiencies in freight transportation. What used to be an annual bidding cycle has turned into a quarterly and sometimes nearly constant process. Rebidding the same lane multiple times each year is labor-intensive, but it also introduces friction in relationships, creates distrust and blocks supply chain partners from making strategic commitments to each other.

How bad is the problem for shippers? Tender acceptance can range from 98% to just 75% over the course of a freight cycle, causing disruptions to supply chains that result in charge-backs, stockouts and lost sales. For carriers, the problem can be even more catastrophic: A major customer pulling its freight over a pricing dispute can be enough to send a trucking carrier into bankruptcy.

Earlier this month, at the Future of Supply Chain event in Cleveland, FreightWaves introduced a solution to help stabilize the relationships between shippers and transportation providers and align incentives on both sides of the marketplace: Index-Linked Contracts.

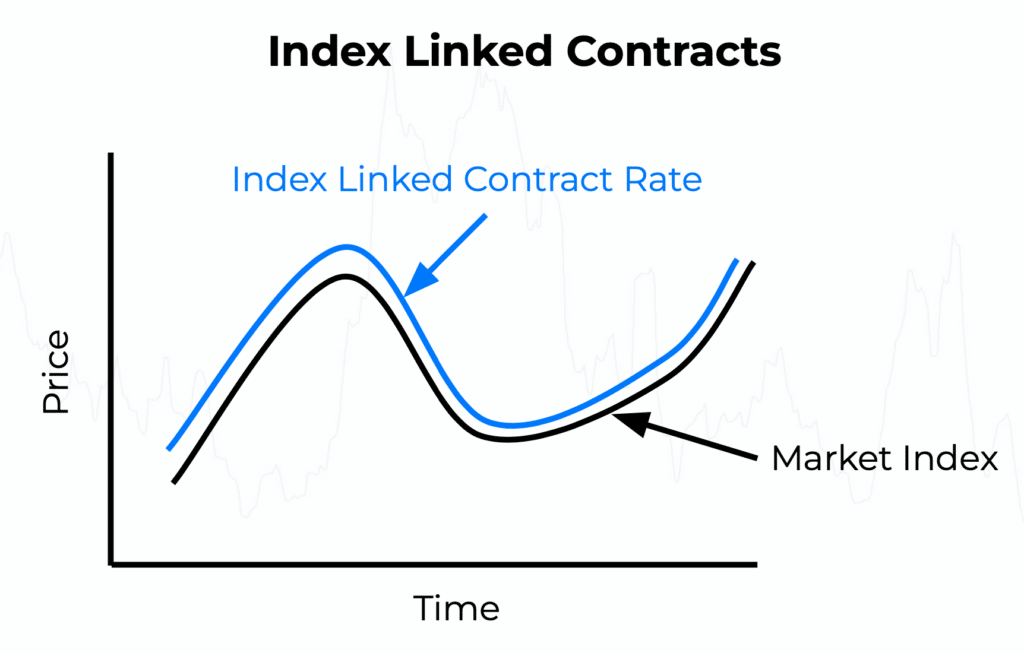

Index-Linked Contracts allow shippers and transportation providers to peg their contracted rates to a market benchmark. This is a standard practice in many industries, from energy to agriculture and metals and mining. Midsize and large trucking carriers even do this for fuel, often buying diesel at a price based on wholesale or rack prices that move with the market. But index linking hasn’t been built for trucking procurement due to the lack of timely, comprehensive pricing information that can serve as the basis for a benchmark.

FreightWaves changed that with the release of SONAR, the first supply chain data platform with rates built on automated data streams of bookings from transportation management systems rather than payments, which arrive well after the load has moved. Now SONAR serves as the basis for Index-Linked Contracts, which will float with the market and make sure that both sides — shippers and carriers — are getting a fair price.

Supply chain participants using Index-Linked Contracts have a lot of flexibility in implementation. In addition to spot rates, Index-Linked Contracts can be linked to FreightWaves’ contract rates, with quarterly or monthly adjustments. Different rules can be set for different lanes; for example, a shipper might want to award freight on a troublesome lane at the index plus 50 cents per mile, while a lane where capacity is more abundant might be set at the index plus 10 cents.

With Index-Linked Contracts, rebidding freight and constantly negotiating price is no longer a sticking point: Shippers get consistent service and carriers get reliable volumes. That certainty builds trust and unlocks further benefits too. First, dependable volumes make it easier for carriers to commit specific assets to specific lanes to build their networks around, lowering their overall cost to serve. Index-Linked Contracts also make it easier for shippers to give carriers more volume, because the shipper no longer has to worry about a carrier with too much wallet share artificially driving rates higher; the carrier will only be able to charge a fair price based on prevailing market conditions.

At first glance, it might seem like Index-Linked Contracts would introduce volatility into a shipper’s transportation budget. But on closer inspection, these budgets typically assume a fixed shipping cost based on the rates given by the primary carrier at a precise moment in time — no tender rejections, secondary or tertiary carriers, or spot market transactions are typically built into shippers’ transportation budgets. If a shipper’s transportation spend forecast turns out to be accurate in a given year, it’s due to luck. It’s never the case that primary carriers accept 100% of tendered loads for a full year.

By making price a little bit more flexible with Index-Linked Contracts, shippers can avoid the service failures that put their freight into the spot market and drive up costs in extreme, unpredictable ways. Better yet, shippers, carriers and brokers can stop the constant grind of rebidding freight and haggling over price and focus on what they do best.

To learn more about Index-Linked Contracts, click here.