While origin matters for transportation rate forecasting, the destination is often times more important. The transportation rates for a backhaul destination are naturally higher than transportation rates for a headhaul market. This holds for all freight moved by truck, rail/intermodal, ocean or air.

Freight forecasters studying freight market trends to forecast transportation rates should always pay close attention to the destination markets for all modes whether it is truck, ocean, air or intermodal.

Freight market balance – Each of the 135 domestic freight markets in SONAR have their own balance of outbound and inbound freight volumes. When outbound freight volumes exceed inbound freight volumes, then the market is described as a headhaul market. When inbound freight volumes exceed outbound freight volumes, then it is a backhaul market.

An individual freight market should be viewed as its own economic region – much like a country with its own import/export dynamic. Freight markets like Las Vegas are almost always backhaul markets. Las Vegas imports many more products for hotels and casinos than it produces and exports to other regions. Since this is the case, inbound freight into Las Vegas almost always exceeds its outbound freight.

Most individual freight markets shift between headhaul and backhaul markets. Some of the common reasons that cause these shifts in freight market trends include outbound and inbound freight volumes, seasonal freight volumes, import/export reasons, and general economic demand for local businesses.

Outbound freight costs for headhaul destinations – Freight forecasters who are predicting transportation rates should expect lanes into a headhaul destination to have a lower freight cost per unit than destinations to backhaul markets. This is because the destination market has more outbound than inbound freight volume. With more freight choices, carriers are able to choose lanes that fit within their operational network.

Atlanta is almost always a headhaul market for carriers because it has more outbound to inbound loads. This limits truck capacity entering Atlanta. Freight forecasters predicting transportation rates for lanes to Atlanta would expect capacity to be easier to acquire than most destinations and place a discount on their rate based on the fact that Atlanta is a headhaul destination. The discount would be heavier if the origin is a backhaul market as this would be highly sought out freight for all carriers.

Outbound freight costs for backhaul destinations – Predicting freight rates for backhaul markets are much more difficult. Backhaul markets have less outbound volume, which leads to fewer choices and more volatility in transportation rates. The premium needed for carriers to take freight to these destinations is based on the limited choices of freight coming out of backhaul markets. With more trucks in the market than freight, the transportation rates in these markets are lower than headhaul markets.

The premium paid for backhaul markets cover variables that include the lack of density of the carrier’s networks and relationships in this freight market, the magnitude of disparity of loads to trucks, the time it might take to find freight and the deadhead miles needed to travel to neighboring freight markets to pick up the next load.

Most of the time, the Northeast and New England are backhaul markets. This region consumes the products it produces, while importing almost everything else from other regions. For loads destined for the Northeast, capacity can be tougher to acquire, so there is a premium paid.

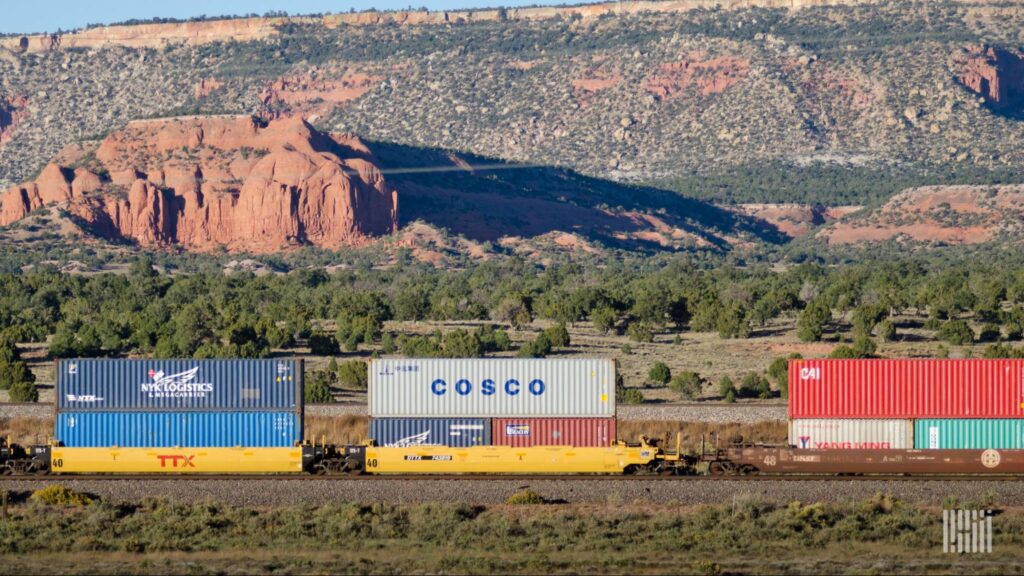

Ocean freight – The U.S. is a net importer of goods. In 2019 this trade deficit with the rest of the world was $616.8 billion. Since the U.S. imports much more than it exports, it is a backhaul market for the global freight market. Much of the full containers that arrive in the ports of Long Beach and Los Angeles are shipped by intermodal rail or truck to the interior of the country like Chicago and Dallas.

Transportation rates are often based on roundtrip miles because the majority of containers are shipped back to the ports empty and then transported via ocean back to Asia to reload.

Freight forecasters can use ocean import freight data like what is included in SONAR to determine ocean ports that are in headhaul and backhaul status along with the magnitude of the imbalance between imports and exports.

Air freight – The domestic and global air cargo markets follow the same principle of headhaul and backhaul markets. For air cargo though, capacity is not measured by the number of airplanes in a market, but by the amount of cargo space. This is due to the difference between air cargo operators and the extra capacity provided by passenger airplanes.

Domestic freight markets often behave much like the freight markets for trucking because domestic consumption is much the same for cargo that is expedited via air as it is for the freight that is trucked. International air freight also follows import and export trade volumes, which places the U.S. as a backhaul lane for most of our global trading partners.

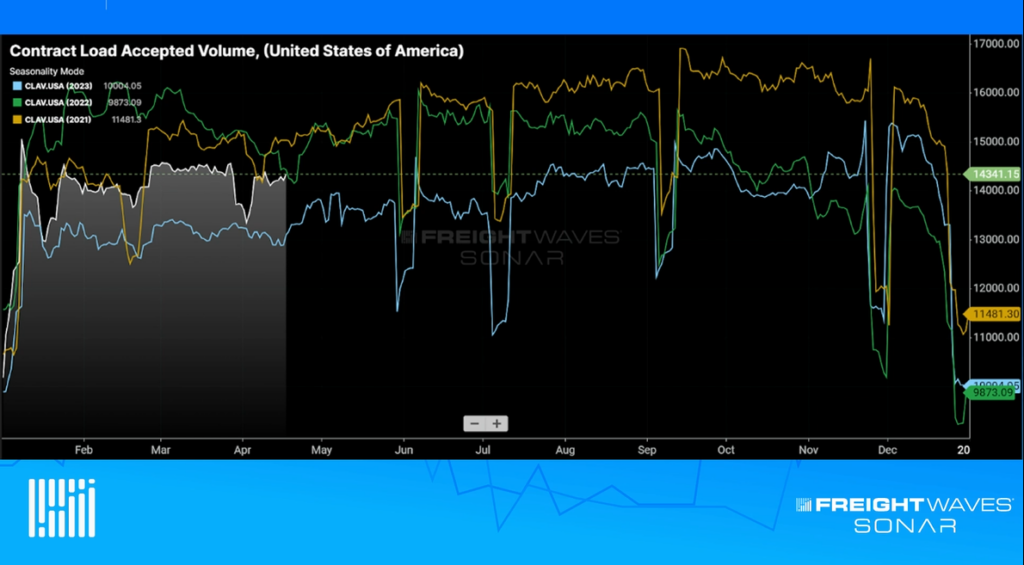

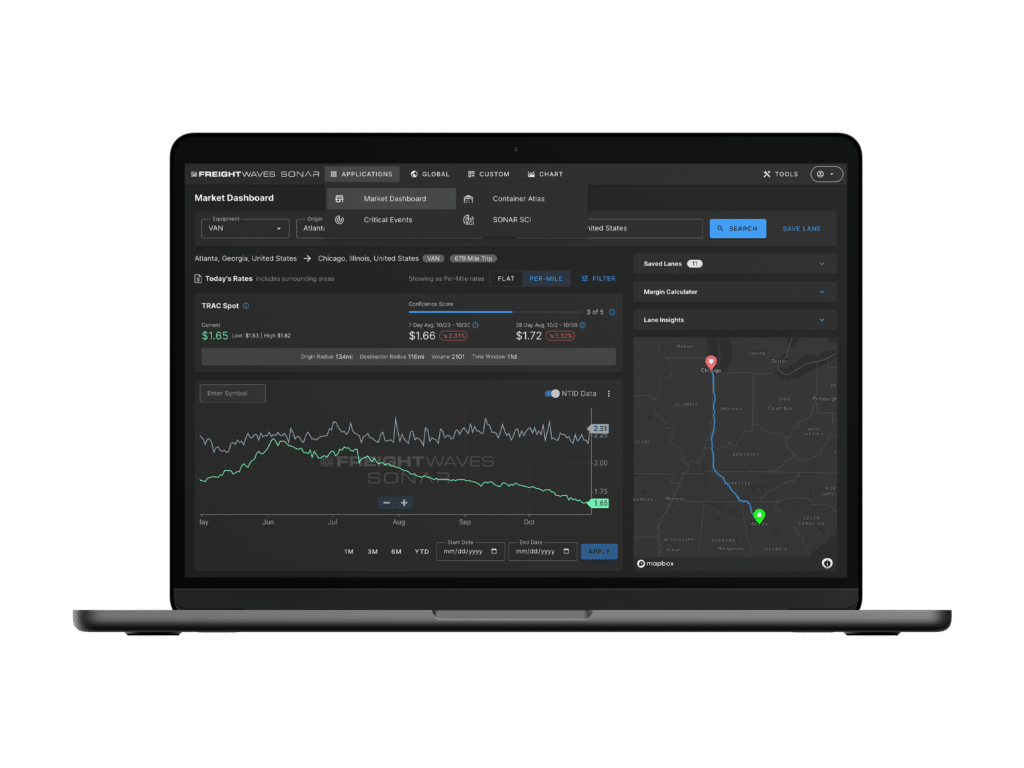

If you are interested in tracking the freight market, including contract and spot rates, FreightWaves SONAR offers over 150,000 indices, most of which are updated daily. The world’s fastest, most accurate freight data includes trucking spot rate indices, tender indices, and market balance indices. SONAR freight tender indices are created based on actual electronic load requests from shippers to carriers, meaning you know that the index is measuring an actual load transaction.

SONAR offers proprietary data that comes from actual load tenders, electronic logging devices and transportation management systems, along with dozens of third-party global freight and logistics-related index providers like TCA Benchmarking, Freightos, ACT, Drewry and DTN.

SONAR offers the fastest freight market data in the world, across all major modes of traffic. The SONAR platform is the only freight forecasting and analytics platform that offers real-time freight market intelligence driven off actual freight contract tenders. To find out more about FreightWaves SONAR, sign up for a demo.