What goes into moving trucking assets? That’s a loaded question for shippers, freight brokers, carriers and 3PLs. Capacity, rates, demand, Mother Nature, politics, compliance regulations, fuel costs, accessorials, peak season flurries of activities, and countless other factors affect market conditions. As reported by Transport Topics, “the latest government reports show an economy continuing to struggle to recover amid a surge in the federal deficit and stubbornly high unemployment. Transportation economists said shifts in normal schedules for sectors ranging from construction to manufacturing to retail have bolstered trucking.” That demand only further pushes the need for more informed responsiveness guided by data to know when market conditions support when and where to move trucking assets. Those assets have one of two moves – headhaul or backhaul.

Freight management parties need to understand how monitoring and analyzing freight data can lead to better resource allocation, how the company can become more nimble by using the FreightWave SONAR features Lane Signal and Lane Score, and why data and insight-rich freight participants increase responsiveness, profitability and efficiency.

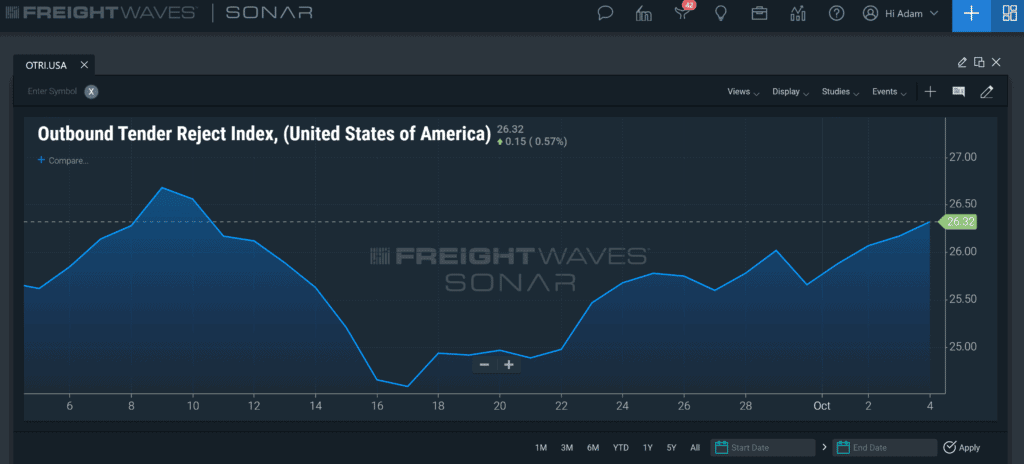

When the leadership of a freight management party lacks data, they are forced to follow nationwide trends. For example, current data within SONAR revealed an all-time high for outbound tender rejections in early September. However, tender rejections within low-volume markets may be at a significantly lower rate. That could result from several factors – including the need to move capacity from those markets with ample capacity and into those where capacity is less available, as indicated by all-time high tender rejections. While capacity appears to be stabilizing trucking assets, it’s only a matter of time before peak season sends bookings and rejections back through the roof. Unfortunately, looking at a single metric for the whole country overlooks critical data for particular markets that can be used to understand lane attractiveness and value and plan for new shipping bids and more. That’s where knowing a real Lane Score comes into play.

SONAR Lane Score is a Lane Signals byproduct. A lane’s “score” derives from looking at the measures of headhaul and backhaul opportunities generated by a thorough review of each applicable origin or destination. The Lane Score comes from two similar scores relying on volume. The Haul Lane Score2 reflects the summation measure of hauls for a given location. Positive values denote ranges from 0.000-1000.000, and negative values represent the opposite in terms of available haul utilization. In other words, inbound versus outbound haul movements. Now, that score alone derives one of six measures, including high, medium and low values for both a negative (red) value and a positive (blue) value.

The various combinations give rise to 36 individual scores that show how strong the inbound versus the outbound market is for each location. As a result, markets with a Lane Score in the red range (1-18) have a greater demand for outbound freight. Scores in the blue range (19-36) have a greater need for inbound freight. It is possible to recognize that these scores consider the flow of both inbound and outbound freight in one of the three (high, medium and low) categories for each respective Lane Score2. As a result, that information can be used for make-or-break decisions. SONAR subscribers can identify which lanes are subject to impending trucking capacity crunches or surpluses, reallocate trucking assets to stabilize the markets, maximize asset utilization, and lanes in turn.

The flow of trucking assets is the only way to respond to market conditions. Think about it. Even if a party were to source carriers, receive confirmation of tender acceptance, and continue operating, it always goes back to the trucking assets. Some moves may involve less-than-truckload or smaller shipments. Regardless, it must get from the warehouse or distributor to an origin or destination before even considering a long-haul, primary lane one way or another. And if the company can maximize each lane’s value with a quantifiable metric, such as Lane Score, they can better plan those other necessary moves. With that in mind, the easiest way to view Lane Score data is to look at markets with tight capacity and try to take advantage of movements that terminate near that location. As such, carriers are more likely to accept the tender below market freight rates simply to maximize other haul opportunities that originate at that location. The same concept applies in reverse as well.

Using data and insights

as your guide to freight

bidding negotiations

Freight resource use and allocation depend on access to the right data. However, today’s freight management parties do not have time to comb through endless datasets and find insights. That’s why FreightWaves SONAR represents a leap forward in applied freight data. It provides the foundation for making faster decisions and maximizing profitability regardless of the segment in which your business operates. Start tracking the real haul implications possible in all freight moves by connecting your supply chain with Lane Score data. Request a SONAR demo online to get started.