The right route planning and route optimization strategy will reduce total landed costs and offer substantial advantages over traditional freight approaches. Shippers, carriers and brokers can apply freight forecasting data to generate actionable insights that lower rejection risk and streamline operations. The costs of taking advantage of such capabilities have dwindled. According to Aaron Huff of CCJ Digital, “Traditionally, only businesses with significant IT resources and density in their freight networks would invest in advanced software to optimally match freight with capacity. Recent developments have leveled the playing field, giving companies of all sizes new, affordable options that tap the power of machine learning and cloud computing to make better load planning decisions.” Shippers, and by extension, freight brokers, need to start thinking about applying new advances, including SONAR Lane Score, to understand market conditions and overcome significant challenges.

Assessing freight lane conditions remains a problem for shippers relying on public resources. Popular load boards often involve week-old data. And as a result, that data may not reflect real-time market conditions. Thus, shippers may end up overrating tenders and paying more for shipping. At the same time, using outdated, stale data contributes to a higher risk of tender rejections. As further reported by Transport Topics, “Route planning plays a significant role for companies that deliver thousands of items available for immediate shipment daily. In some cases, depending on business objectives, deliveries can be made same-day or the next day – even if customers place orders the night before. The technology helps assist in organizing these big shipments, optimizing both the amount of trucks needed and miles covered that a driver completes, as well as the right number of products that go onto those trucks so that each route is as efficient as possible.”

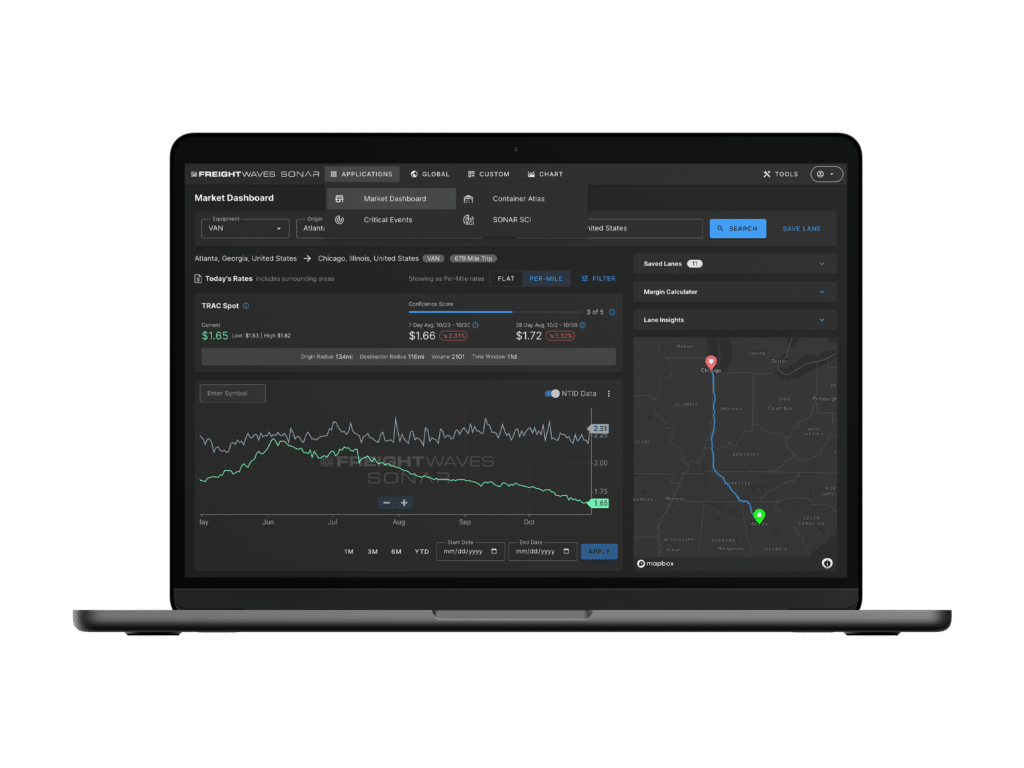

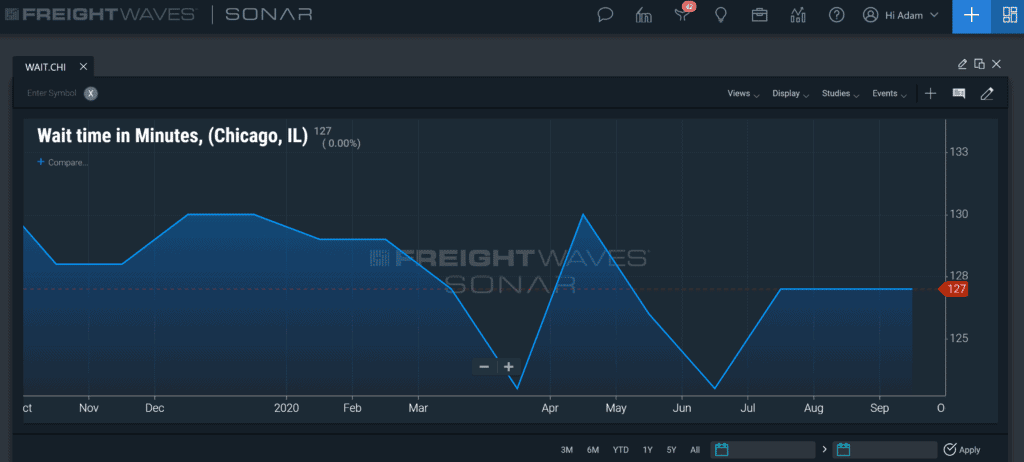

Lane Score data provides immediate insight into volume and strength of hauls in both directions from all locations. In a sense, users create a more proactive route planning strategy by conducting a Lane Score risk assessment. That assessment compares all Lane Score data to isolate the most lucrative markets and generate insights to manage assets better. It’s that simple.

Carriers may also conduct similar assessments of Lane Score data to identify market weaknesses and seek out the most profitable loads. At the same time, that information holds value by giving carriers a way to justify rate increases and build additional relationships with brokers, 3PLs and LSPs, including those operating in-house fleets. The increased access to trucking capacity helps to stabilize the market through route planning and resource use.

A Lane Score risk assessment uses Lane Score data to make informed route planning and mode optimization decisions. It’s easy to see how applying Lane Score’s insights leads to these critical steps to improve freight management:

Route planning agility revolves around identifying and taking advantage of opportunities to maximize efficiency. Since modern freight management focuses on data-driven decision-making, accessing and applying Lane Score data to create a comprehensive risk assessment for all traveled lanes – depending on the logistics segment – will help lower total landed costs and improve efficiency. It’s all about better management and picking the low-hanging fruit. Learn more about how your company can pre-empt the market with the benefits of Lane Score by requesting a SONAR demo online today.