Chart of the Week: Reefer Outbound Tender Reject Index – USA, USDA Produce Truckload Spot Rate – Los Angeles to Dallas, Reefer Outbound Tender Reject Index – Los Angeles SONAR: ROTRI.USA, AGRATE.LAXDAL, ROTRI.LAX

It is widely known at this point that the winter plunge that hit the central U.S. a couple of weeks ago sent shockwaves through trucking networks that are still being felt throughout the country. As dry van capacity has somewhat started to recover, reefer capacity has become even more scarce as national reefer rejection rates once again hit an all-time high, topping 50% this past week. Somewhat surprisingly, this capacity crunch is located largely in areas that the storm did not directly affect, such as Southern California.

Though prone to wild swings in price just about any time of the year, the cost of temperature-controlled or reefer capacity does not typically see this level of increase in tightness and spot rates until early April into June. Historically, that is when several produce harvests begin in earnest out of the state.

At this time of the year, most of the produce that is sourced from California like lettuce, peppers and tomatoes originates from other parts of the world. Most of the lettuce production — one of the state’s largest crops by revenue — has moved to Arizona, where conditions are better during the winter months, notes Joe Satran of the Huffington Post. In fact, the “Imperial Valley across the California border produces about 90% of the leafy vegetables grown in the US” during the winter months. And crop-rotation regulations also make it necessary to relocate some of this production. Mexico carries the bulk of the load for many of the other crops.

This recent tightness seems to be derived from a supply side contraction more than a seasonal increase in demand from resulting harvests. The Reefer Tender Reject Index for the Los Angeles market shows a dramatic increase from Feb. 15 to 19, surging over 20 percentage points from 30% to 51%.

This sudden increase coincides precisely with the initial impact of the arctic plunge that pushed subfreezing temperatures all the way to the Gulf of Mexico. This series of unfortunate weather events left the state of Texas crippled for days as the power grid went offline in many areas.

Reefer demand jumped in Texas after the storm, indicated at the top of this page by Chart: SONAR – Reefer Outbound Tender Volume Index, Reefer Outbound Tender Reject Index – Texas

The power outages meant many goods were left without a way to manage their environment, putting many perishables and other goods at risk for spoilage or damage. Demand for reefer trailers exploded in Texas, with the Reefer Outbound Tender Volume Index for the state increasing over 50% in a 10-day stretch, potentially leaving a vacuum in other parts of the country.

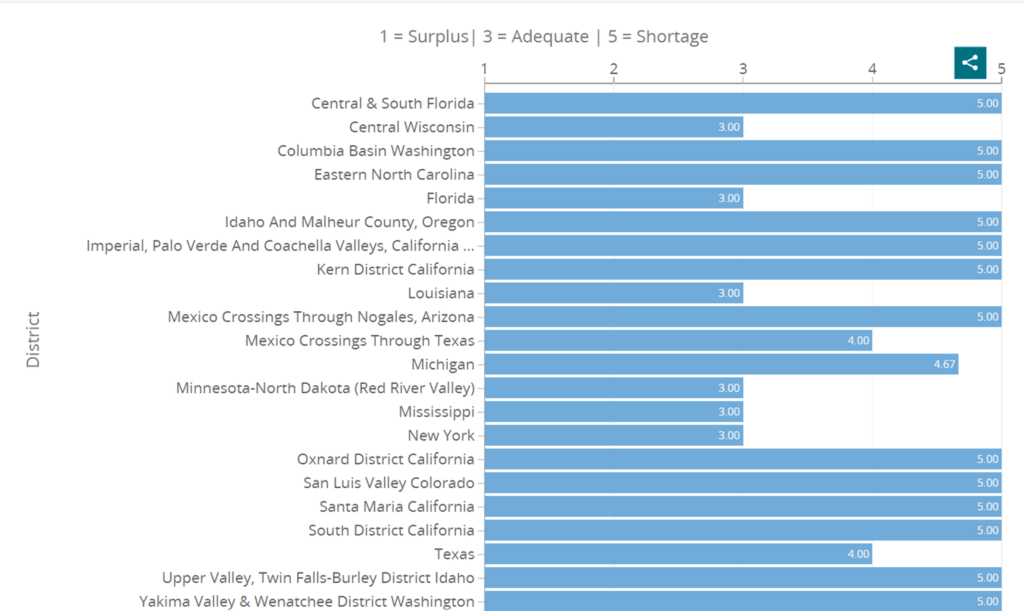

The USDA is reporting capacity shortages for many major produce growing regions across the U.S. outside of the traditional peak. Source: USDA

California is not the only state affected by the reefer capacity grab. The USDA reported severe shortages for produce capacity in Florida, North Carolina and the Pacific Northwest over the past week.

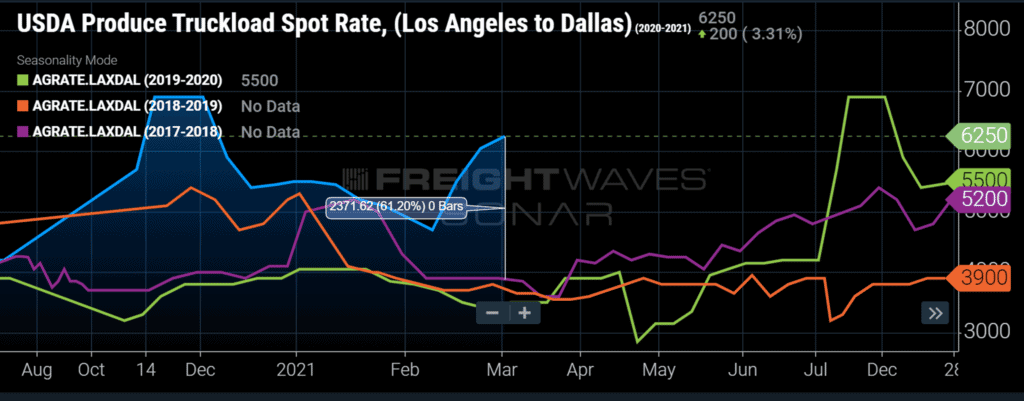

Spot rates for produce truckload moves is over 60% higher than the previous three years from Los Angeles to Dallas as reported by the USDA. Chart: SONAR – AGRATE.LAXDAL

Spot rates for produce from Los Angeles to Dallas were at $4,700 all-in the week of February 10. That same lane averaged over $6,200 per load last week, more than 60% higher than each of the previous three years’ values.

Some of the difference can be accounted for in the change in general market conditions from the previous years, but traditionally rates do not start to increase in this lane until late March and certainly not on this scale.

With capacity already running at a premium, this year could be one for the record books once domestic produce starts moving in earnest. The freight market was collapsing as it hit last year, but made a fierce return in late fall when capacity was at its most limited for all modes.

There is a little time to recover before the spring rush, but weather has proven to be a fickle player when it comes to produce and transportation.

The weather events did not merely halt transportation for the duration of the storm. Their effects continue to be felt and show just how far they may stretch. However, not all areas were affected equally, and it’s possible to circumnavigate the challenges presented by tapping into the value of near-real-time freight data, shown above. Request a FreightWaves SONAR demo by clicking the button below to get started.

(Epilogue by Jason Vanover)