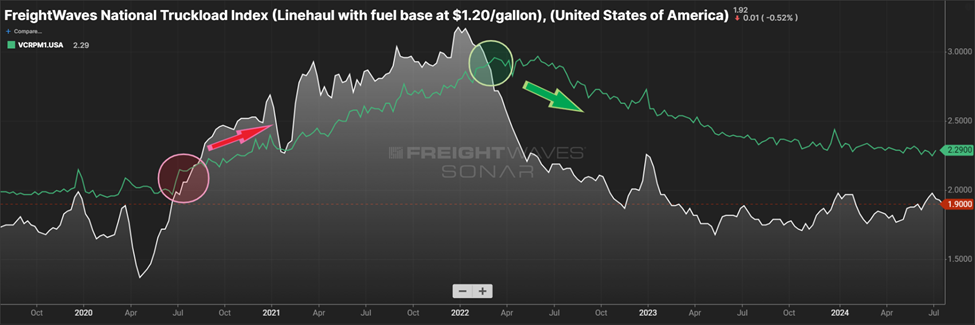

The trucking market has been characterized by an overabundance of capacity — and a stubborn lack of demand — since early 2022. Now, an unseasonable upswing in truckload tender volumes is infusing the industry with a fresh sense of optimism.

Up until this point, 2023 market shifts have more or less aligned with historic seasonal norms. A late-summer demand spike, however, is altogether unexpected.

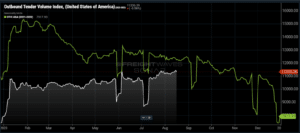

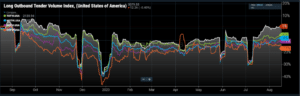

“The national Outbound Tender Volume Index (OTVI) — a measure of the electronic requests for truckload capacity from shipper to carrier — is up nearly 7% versus month-ago levels,” Zach Strickland, FreightWaves’ head of freight market intelligence, reported earlier this month. This is a complete break from tradition — excluding the pandemic-fueled rise in 2020.”

Strickland explained that tender volumes typically climb slowly in May and June before falling again in July. Demand tends to stay in that depressed summer position until retail peak season begins to take hold in September.

This year, demand climbed in late July and early August. This deviation from the norm cannot be attributed to a single source, and the exact origins of the shift remain uncertain. There are a handful of theories that seek to explain the unexpected change, but none of them can be hailed as the one true answer at present.

Government initiatives

The U.S. government could be involved in this demand spike in a couple of different ways, namely stimulus money and infrastructure spending.

Recent government stimulus programs — the Inflation Reduction Act, Build Back Better and Employee Retention Credits — are beginning to be felt in the economy. This boost could contribute to the increase in freight volumes, as people are becoming more willing and able to spend money.

Government spending related to the infrastructure bill could also be causing ripples in demand. This source alone is not significant enough to drive the overall spike, however.

“Government spending from the infrastructure bill could finally be having an impact as bridge and tunnel investment is trending significantly higher, but it is difficult to make that connection with long-haul dry van freight,” Strickland wrote.

Early peak season

As noted above, an increase in long-haul demand is driving overall demand growth. This lends credence to the theory that the current shift may be representative of an early peak season, with growth beginning in July instead of September.

“With rates on the floor, some shippers may be taking advantage of a stable environment with the future still uncertain,” Strickland noted in his recent article. “This would require a return to confidence in their demand planning, something that has been largely absent since 2020, but it does line up with the current maritime narrative.”

It is important to note that this demand surge did not impact rates or tender rejections, which are the usual indicators of demand increases. This indicates that there is still plenty of capacity in the market to meet current demand.

Regardless of which specific factors are powering this demand surge, overriding indicators point to this market shift being a short-term occurrence. That means companies need to act fast if they hope to take advantage of current circumstances.

While high-frequency data is useful in all markets, the forward-looking insights housed in FreightWaves SONAR are the most crucial during inflection points like this one. Relying on legacy data sources and lagging indicators simply does not offer the same advantage.

By utilizing SONAR data, users can pinpoint opportunities before they happen, not after. Additionally, SONAR users can track ongoing market changes in real time, allowing them to act quickly and price accordingly.

Click here to learn how SONAR can help your company take advantage of changing market conditions.