At the time of writing, Yellow has announced that it would defer its required contributions — including those for pensions — for June and July, collectively totaling more than $50 million in missed payments. In response, the International Brotherhood of Teamsters issued a strike notice that could lead to work stoppages as soon as Monday.

Since Yellow’s operations are almost entirely dependent on union labor, it is all but certainly facing bankruptcy should a strike proceed — short of an improbable government bailout, that is. As soon as a strike goes into effect, any of Yellow’s shipments still in transit would be abandoned where they are, unlikely to be recovered by liquidation agencies in the weeks and months to come. Moreover, the company’s customer service department would be unable to rescue these lost packages, as the department would probably suffer immediate layoffs.

In the event of a bankruptcy, the freight market needs to be prepared for disruptions, at least in the short term, as there will be plenty of challenges in moving freight out of Yellow’s network into other LTL carrier networks. These challenges include likely higher prices for shippers as Yellow was notoriously the lowest-priced carrier and increased reliance on outsourcing linehaul moves. While economical, these could cause a short-term catalyst to tighten capacity and firm up rates, something truckload carriers have been hoping for.

With LTL models operating under the hub-and-spoke model, real estate becomes important. Will carriers be able to absorb the freight into existing locations? And which carriers would be able to absorb the amount of freight that will be hitting the market? Shippers will have to be ready to adapt to the changes that are going to arise from the impending bankruptcy. Shippers should look to be proactive and reach out to other carriers in an effort to secure the necessary capacity ahead of those that are going to be caught on the back foot. This also presents a time when changes in transportation strategies could be impactful, given the current market conditions.

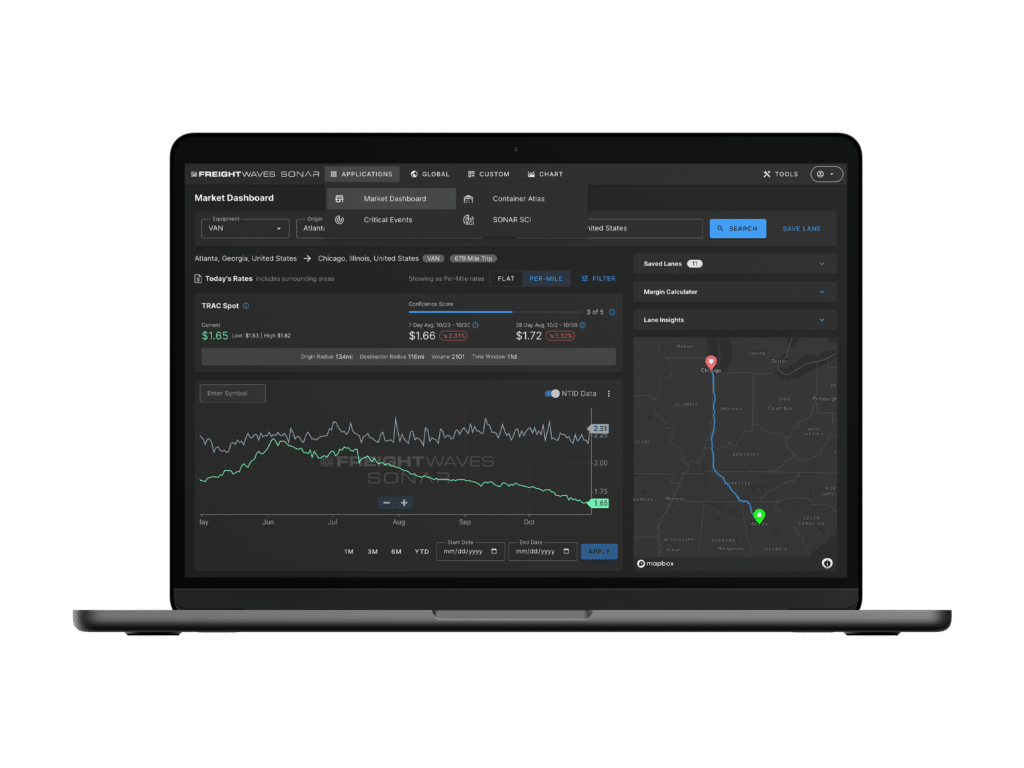

Paying attention to the news around Yellow is only half the battle; having to navigate the challenges that are inbound is arguably the more important half. Having high-frequency data in the repertoire will allow for shippers to be nimble in what will be a fast-changing environment as well as have the data to drive better decisions.