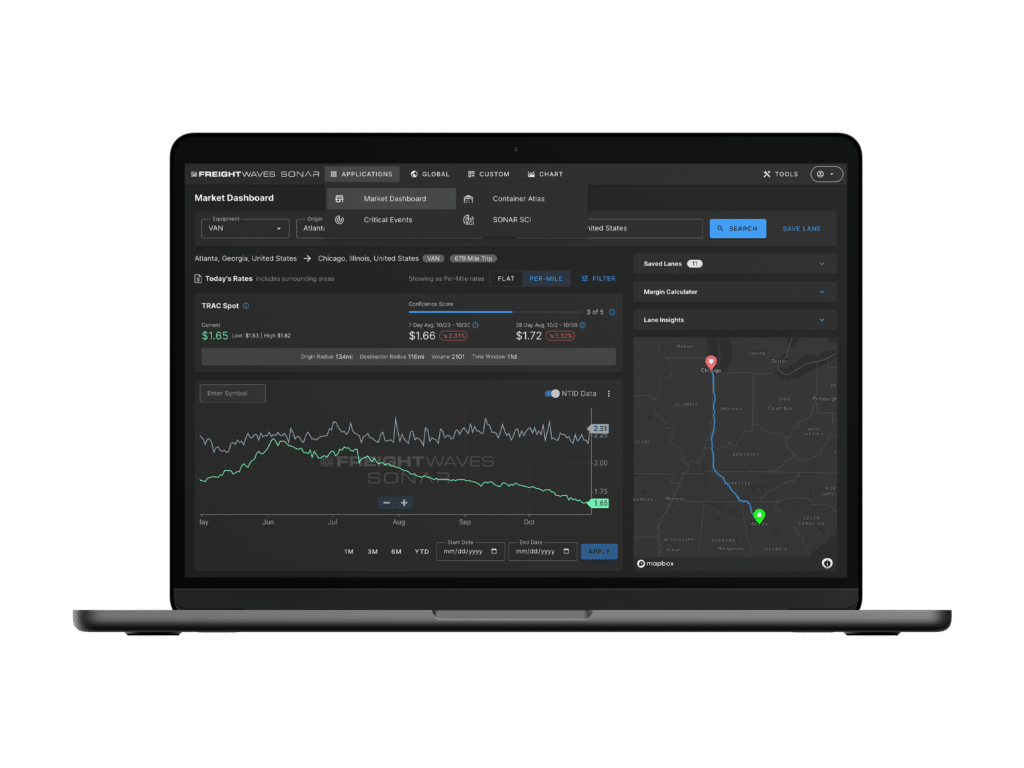

FreightWaves released the Trusted Rate Assessment Consortium (TRAC) spot rates last week. The newly published spot rates represent an assessment of the prior day’s average buy rate (rate that brokers are paying to carriers for capacity). The data is derived from sourcing spot rates from more than a dozen 3PLs and freight brokerages. To enhance accuracy, an algorithm developed by FreightWaves data scientists places greater weight on the most recent loads and loads with origins and destinations in closer proximity to a user’s requested origin-destination pairs. The resulting data tool is the new Market Dashboard application, which provides average all-in spot rates for more than 650,000 unique dry van lanes and over 300,000 unique reefer lanes that are updated every morning. No single data contributor accounts for more than 25% of the contributing loads in each lane.

FreightWaves TRAC differs from other data providers in that it is targeted for use by brokers and shippers by focusing on buy rates (what brokers and shippers pay to carriers for capacity) rather than sell rates (rate that shippers pay brokers). The algorithm developed by FreightWaves enhances the spot rate accuracy by placing greater weight on more recent loads. Focusing on the most directly comparable loads is also a differentiating feature. Other spot rate tools place too much weight on stale rates or rates taken from irrelevant lanes. In addition, FreightWaves TRAC provides greater transparency than other spot rate tools by detailing the metadata behind the spot rates, such as volume and the radius of the loads that serve as input.

The clearest use case for FreightWaves TRAC is simply that it gives freight brokers and shippers the ability to look at what peers are paying to move spot loads with similar characteristics. Brokers can use Market Dashboard in a well-known and dense lane to refine their bidding process and can use Market Dashboard in a remote lane to get an idea for where to start in a negotiating process. Market Dashboard should also help brokers prioritize covering loads that promise to be higher-margin and/or difficult loads to cover.

For brokers, the decision of how high to bid for capacity is a balancing act – bid too low and brokers run the risk of the load not getting covered (hurting its relationship with the shipper in the process) and bid too high and brokers will earn substandard margins. Market Dashboard supports brokers’ bid process by providing real-time spot rates that include not only a point estimate, but also a range, showing spot rates in the 67th and 33rd percentiles, respectively. So, brokers can decide where they want to position their bids within a range of options.