Fuel costs have a direct and significant impact on the prices shippers pay to move goods. When fuel prices soared in 2022, surcharges climbed as high as 30%. These extreme fees can have a serious impact on a shipper’s bottom line, sometimes even comprising their overall profitability.

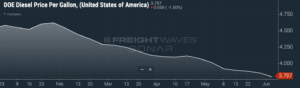

Fuel prices have dropped significantly since hitting a peak last year, recently falling to $3.797 per gallon – the lowest weekly price since Jan. 24, 2022. This change of direction does not, however, make tracking prices any less crucial as shippers and brokers face market shifts and economic downturns.

With diesel costs on the decline, fuel surcharges have dropped as well. Despite lower costs, shippers and brokers need to understand the data that drives fuel surcharges to ensure they are receiving a fair price and avoid being caught off guard by inevitable future upswings.

In SONAR SCI, shippers and brokers can track diesel fuel prices and rates via several different views. SONAR SCI also allows for both broad views and market-level granularity for more accurate forecasting compared to what is visible to the general public.

Retail to Wholesale Fuel Spread

This view illustrates the gap between retail fuel rates and rack prices. Knowing the difference between retail and wholesale prices enables shippers to predict future cost changes and identify inflated fuel surcharges.

DOE Diesel Price Per Gallon by PADD regions

This view shows the DOE PPG by Petroleum Administration for Defense Districts (PADD) regions (the cost as of the previous day), as well as the percentage change over the last month. This allows shippers to pinpoint which specific regions are experiencing significant swings in diesel prices in order to avoid overpaying for fuel.

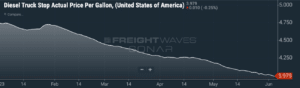

Diesel Truck Stop Actual PPG by market

This view provides users with a denser, more up-to-date fuel rate than the Department of Energy. Shippers can analyze the Diesel PPG rate for the day before and the day-over-day rate change for real-time cost information.

Why track fuel prices during a decline?

When fuel prices are on the rise, shippers and brokers can safeguard their bottom lines by tracking changes. Deep awareness of diesel prices in this kind of environment allows companies to be proactive by planning ahead for cost increases and even reworking routing guides to unlock lower fuel surcharges. When fuel prices are on the decline, shippers and brokers can use pricing data to negotiate with their carrier partners and ensure fuel surcharges are reflective of current pricing conditions. Having access to accurate, real-time data gives shippers more leverage entering into these conversations.

When shippers and brokers track fuel prices, they are able to identify trend shifts early. In an environment of increasing fuel prices, this means:

- picking up on dropping prices

- renegotiating fuel surcharges to avoid overpaying

In an environment of declining fuel prices, it means:

- noticing upswings in advance

- preparing for rising costs ahead of time

Want to see what SONAR data can do for you? Click here to connect with us!