The trucking industry remains subject to influences inside and outside of the global supply chain. Freight network disruptions are inevitable, and Mother Nature is always in play. At the same time, responding to changes within the market remains an archaic process for most freight market participants. While they may leverage freight data to make informed decisions, this data does not rise to the level of timeliness, insight and granularity needed to really make an impact on the bottom line. In fact, many companies continue to rave about whether to work with spot versus contract freight carriers and drivers. It is an archetype that is anything but accurate and nor indicative of the actual health of the freight market.

For that reason, freight market participants need to stop discussing the old spot versus contract conversation and instead turn to a new metric – the freight market rate – to really understand what is necessary to survive. To achieve this feat, this white paper will explore:

- The misconceptions contributing to the limited views of the spot versus contract approach to freight management.

- Why comprehensive freight data access and insight into the spot-driven realities of the market determine true capacity.

- How spot rate market data correlations and insights help predict rate deviations and strategic planning to secure and understand industry capacity.

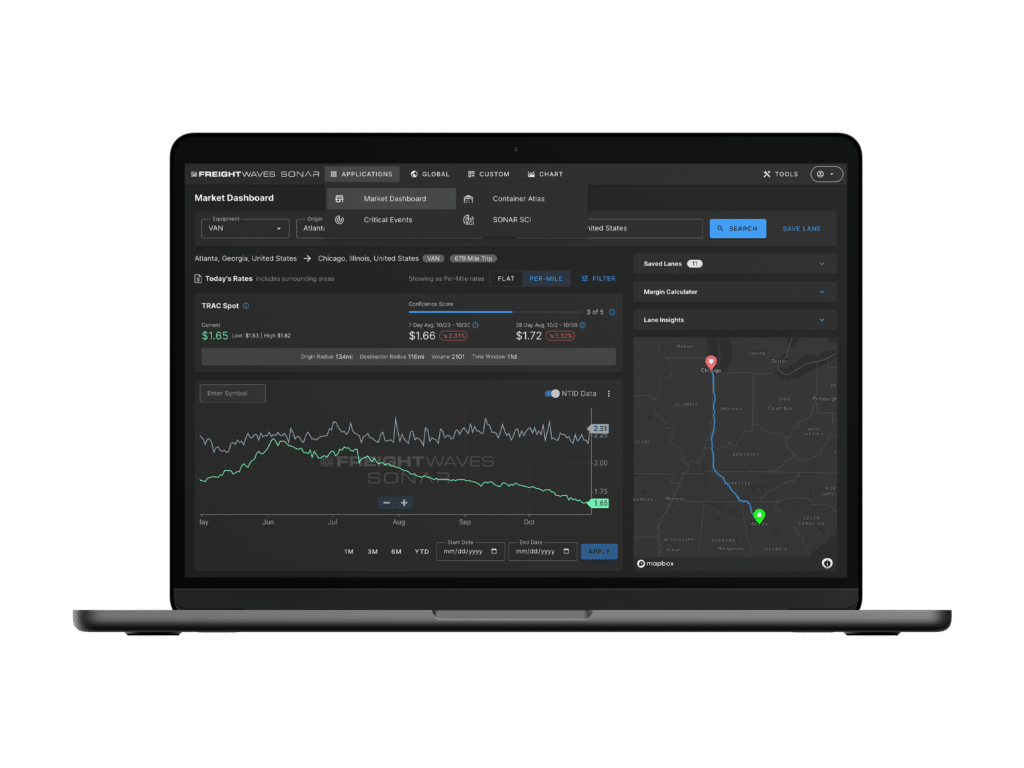

- The steps necessary for supply chain partners to apply freight data properly and how FreightWaves SONAR indices reveal insights.