The freight market underwent a significant change during the second quarter. The spot market softened significantly, fuel prices soared, inventory levels were among the highest they have ever been and operating ratios improved.

The warehousing real estate market, led by Prologis, continues to show strength as retailers combat elevated inventory levels, as signaled by pre-announcements by companies like Target, Best Buy and Walmart. Occupancy levels are at or near record highs while demand for warehousing space has yet to subside.

Truckload carriers reaped the benefits of a softening spot market, using the time to reduce spot exposure for higher-paying contract rates. Carriers also benefited from higher fuel surcharges in the quarter, in some cases more than doubling fuel surcharge revenue year over year.

Freight brokerages were also beneficiaries of the slowing spot market. Freight brokerages, which buy capacity on spot pricing and sell that capacity to shippers on contract pricing, traditionally benefit from the beginning of a down cycle in the freight market. This quarter was no different as margins expanded in the quarter thanks to the higher contracted rates, those paid by customers, and lower spot rates, the costs for freight brokers.

The less-than-truckload market remained strong throughout the quarter, as five of the major LTL carriers reported stronger revenue per hundredweight on a yearly basis, constituent with the double-digit general rate increases that had been announced over the course of the past year. Old Dominion Freight Lines continues to lead the way in terms of operating ratios, posting a sub-70% operating ratio in the quarter. The other LTL carriers followed suit, reporting improved ORs on a y/y basis.

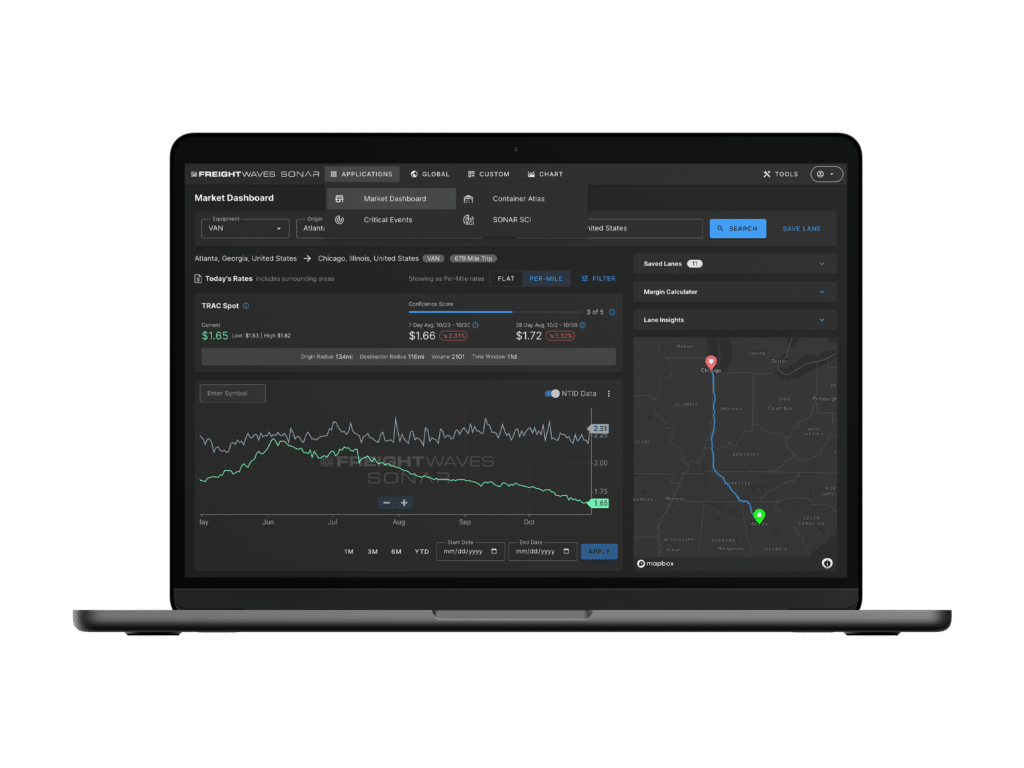

This report breaks down management commentary, financial results and SONAR data to paint a broader picture of how the publicly traded companies stacked up in the second quarter.