When load volumes increase out of Atlanta at a higher rate than the number of trucks coming into Atlanta, then trucking spot rates increase. When load volumes are falling faster in Atlanta than the number of trucks entering Atlanta, then trucking spot rates decline. When load volumes and truck capacity are increasing or decreasing at the same rate, then trucking spot rates remain relatively constant.

These are the dynamics that change daily to determine how the trucking spot market is priced. It is the matching of real-time demand with real-time capacity on a daily basis.

Trucking spot rates are volatile and are different from market to market. Spot rates change not only day-over-day but at varied times within a day in much the same way the most famous spot market, the stock market, changes millisecond by millisecond.

While the spot market for trucking represents only 20% of truckload volume, the daily changes in rates are the prime predictor for the much larger contract market for trucking. Sustained increases or decreases of more than 10% in the spot market usually precede rate changes in the contract market by three to six months.

Freight market conditions are changing continuously in each of the 135 trucking markets that FreightWaves SONAR tracks. These constant imbalances between load volumes and truck capacity cause significant and non-stop changes in spot rates.

These constant imbalances are caused by hundreds if not thousands of variables. Among those variables are weather events, missed deliveries by trucks, rush shipments, large shippers in a market lowering freight volumes and seasonal fluctuations like produce seasons.

For most freight forecasters trying to predict spot market rates, though, there are a handful of accurate freight indexes that can be tracked in near real-time.

These key variables include tender load volumes, tender reject rates and headhaul indexes. Other factors to consider when forecasting trucking spot rates are unique characteristics of the load like weight, commodity type, the day of the week, and the lead time for pickup (same-day loads).

Luckily for those who monitor the freight markets to build freight forecasting models, accurate data is now available in FreightWaves SONAR in near real-time for each of these variables.

Tender load volumes are outbound and inbound contracted truckload shipments that are electronically tendered. As tendered load volumes decline day-over-day with a stable amount of truck capacity, freight forecasters should expect trucking spot rates to decline because there are more trucks than loads. Each market is made up of both outbound and inbound load volumes that affect both demand and supply. For example, if outbound tendered load volumes are decreasing in Houston but inbound load volumes are increasing, then trucking spot rates should decrease as more truck capacity enters Houston than there are available loads moving out of Houston.

Tender reject rates is a measurement of trucking capacity in a given trucking market. It is a measurement of the rejection rate of electronically tendered loads in the contract market. For example, if the tender reject rate for the Kansas City, Missouri, market is 7%, this means that carriers are rejecting seven out of 100 tendered loads in this market. While the absolute tender reject rate matters, the daily rate of change indicates how truck capacity is tightening or loosening. In this example, if tendered load volumes in Kansas City are steady while tender rejection rates rise day-over-day from 7% to 10%, then a freight forecaster should expect trucking spot rates to rise to reflect this mismatch between supply and demand.

Headhaul and backhaul markets are freight indexes measuring the ratio between outbound and inbound volumes in any given trucking market. For the Los Angeles market, when outbound loads outnumber inbound loads, then the market is considered a headhaul market. Trucking spot rates would tend to increase for outbound loads out of Los Angeles as carriers would have a large selection of loads to choose from. Spot rates for loads going inbound to Los Angeles should decline, though, as it is a market where carriers want to go for the higher rates. On the flip side of this, when Los Angeles is a backhaul market – with more inbound loads than outbound loads – carriers would ask for a premium to deliver to Los Angeles as more competition and lower spot rates are available for an outbound load.

Tender market share measures the size of the market for tendered load volumes. Another way to view this is the liquidity of the market. In much the same way as in other markets, the more liquid a market is, the lower the day-to-day volatility. Chicago to Dallas is a liquid lane between two large markets. While trucking spot rates will move day to day in this lane, the variance will be much narrower compared to a lane with far less liquidity. Muskogee, Oklahoma, to Medford, Oregon, is an example of a lane with very little volume or liquidity. Trucking spot rates for this lane will move widely daily as load volumes and trucks seeking to go to Medford might be a market of one.

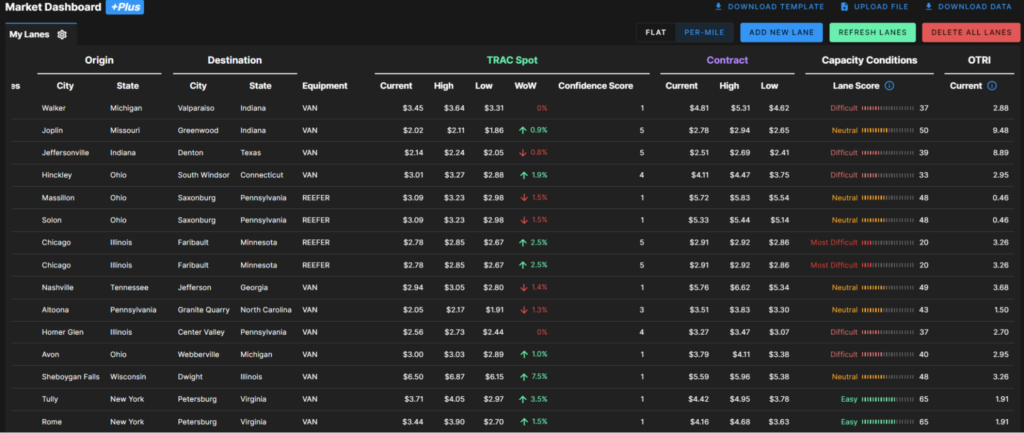

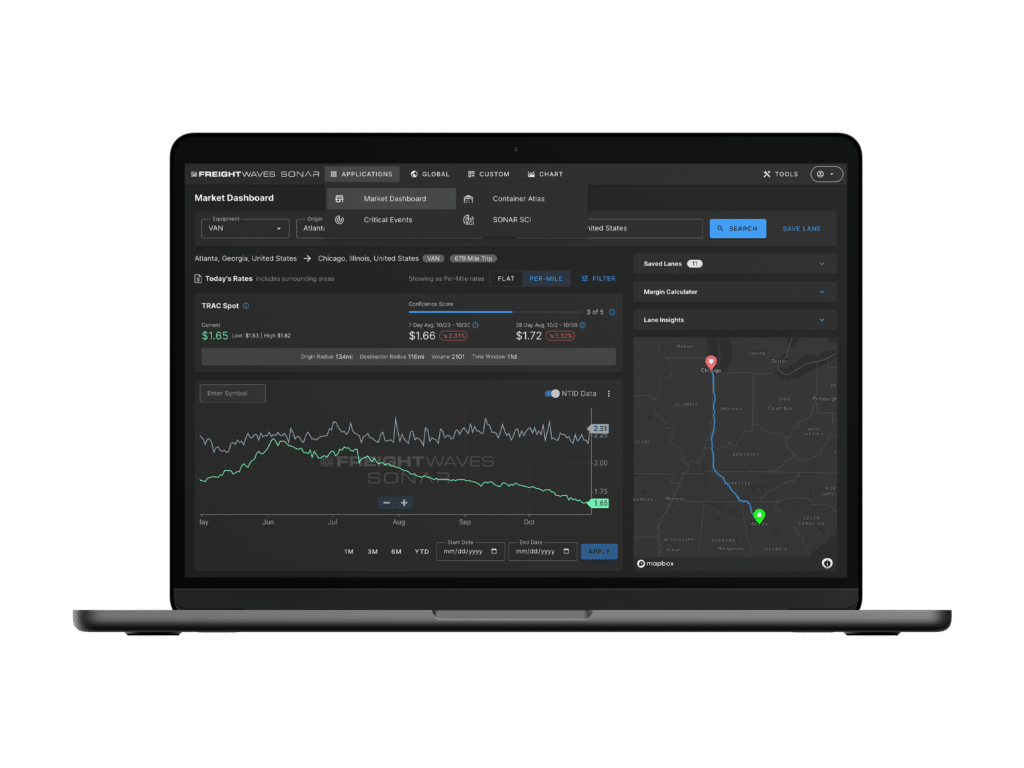

If you are interested in tracking the freight market, including contract and spot rates, FreightWaves SONAR offers over 150,000 indexes, most of which are updated daily. The world’s fastest, most accurate freight data includes trucking spot rate indexes, tender indexes and market balance indexes. SONAR freight tender indexes are created based on actual electronic load requests from shippers to carriers, meaning you know that the index is measuring an actual load transaction.

SONAR offers proprietary data that comes from actual load tenders, ELD devices, and TMS systems, along with dozens of third party global freight and logistics-related index providers like TCA Benchmarking, Freightos, ACT, Drewry, and DTN.

SONAR offers spot rate data from Truckstop.com, including all-in truckload spot rates, per mile truckload spot rates, and trucking load volume.

To find out more about FreightWaves SONAR or to sign up for a demo, click here.