Each week, you’ll learn about another index found within SONAR, the freight forecasting platform from FreightWaves. This week the Lane Signal app, which provides a summarized view of SONAR’s data translated into an indexed signal and rate per mile, is highlighted. Read further to learn what the Lane Signal app is and how combining Lane Signal with other SONAR indices and data sets inform freight market parties about current and future truckload capacity so they may proactively plan transportation procurement activities and pricing.

The Lane Signal app is designed to help users easily see what direction truckload capacity is moving by lane. Lane Signal does this by displaying SONAR signals, common language SONAR index data descriptions, and calculated inferred rate changes. Its current iteration is focused on dry van data. The Lane Signal app is based on tender data variations that measure freight market balance, volume and carrier acceptance rates and their changes relative to historical baselines. The values range from 0 (representing markets favoring shippers) to 100 (representing markets favoring carriers). A score of 50 indicates both shippers and carriers have equal negotiating leverage in a market.

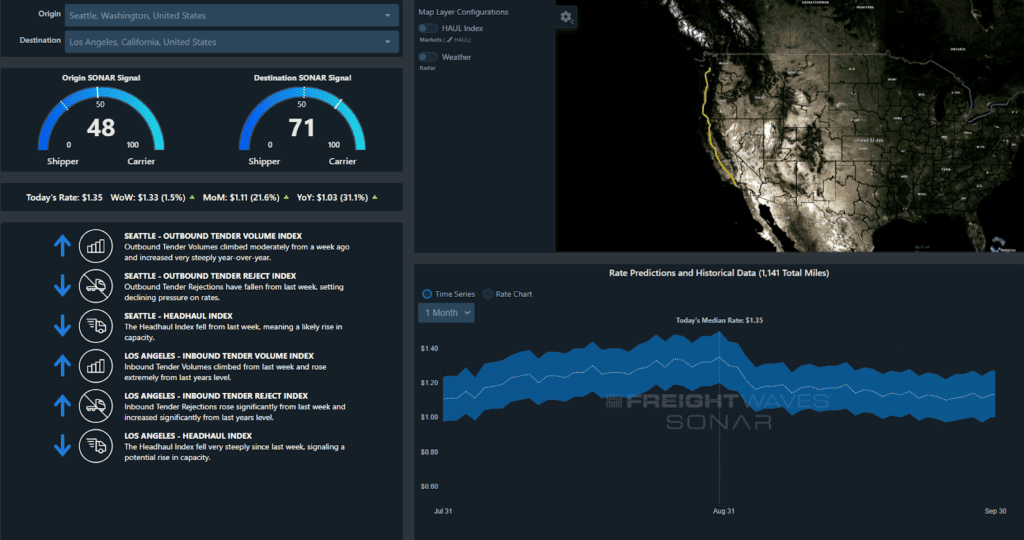

The rates and rate changes positioned directly under the SONAR Lane Signals (as seen below the gauges in the screenshot of Lane Signal) are calculated based on average carrier costs as a baseline from the current Truckload Carriers Association (TCA) members, along with implied rate changes based on tender data. The historical and predicted freight rates are displayed in the bottom right corner. The blue band enclosing the line represents the high cost (top boundary) and low cost (low boundary) range, not a margin of error. Rate predictions are based on a predictive model forecasting multiple cost and tender data points.

The common language descriptions in the lower-left corner of the app (below the rate information) illustrate the conditions contributing to the signal and rate information by explaining some of the more significant movements in the background data.

On the Lane Signal page above you can see the Seattle to Los Angeles lane displayed, with Seattle having a relatively low score – favoring a shipper looking for capacity – compared to Los Angeles, where there is a slight edge to a carrier looking to find freight.

With SONAR Lane Signal, users can access freight analytics down to the granular level of a lane. Lane Signal is a consolidated dashboard that gives shippers, carriers, and brokers real-time trucking spot rates, pricing power information, and volume and truckload capacity data on any origin-destination pair in the continental U.S. Lane Signal automatically aggregates and analyzes data from a number of sources to give operators a clear read into lanes they search.

Lane Signal’s Pricing Power gauges utilize numerous SONAR indices along with proprietary algorithms to distill and score whether a shipper or carrier has negotiating strength on a particular lane. The Lane Signal app shows the current day’s and the previous week’s negotiating strength on a lane-by-lane basis.

Let’s take a look at how various parties interested in granular lane data would use Lane Signal:

Lane Signal translates multiple data points into simple, understandable indices and a rate per mile while giving a historical perspective to establish a point of reference. The primary purpose of Lane Signal is to enable users to have a summarized view into each lane in a simple interface. Users enter their origin-destination pair in the top left corner and can see what the implied rate direction is today or is projected to be over the next several months. Using daily information helps you manage daily transactions while the longer-term information will help you manage the long-term transportation cycle with contracted business.

A hallmark example of how to use Lane Signal is during produce season. Each year’s produce season is important to any carrier or shipper that does not haul produce because it can have a notable impact on national truckload capacity due to the potentially high cost of moving this type of freight. Many reefer carriers will abandon contracted freight to cover produce markets because the operating margins can be so much higher, thus putting upward pressure on rates in non-produce sectors as shippers lose their carrier options. This is one reason the Reefer Outbound Reject Index for California (ROTRI.CA) was rising so rapidly in late May and early June 2020, an expectation freight market participants can reasonably have year-to-year during that time period.

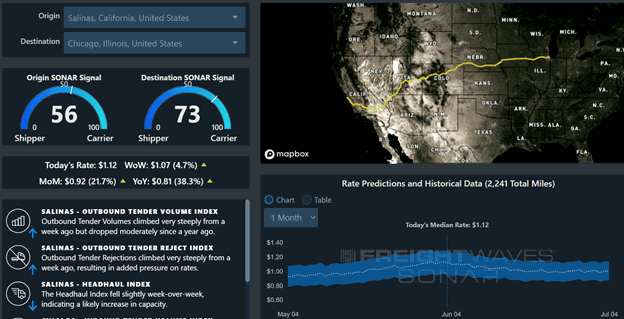

Why would carriers risk their relationships, though? The answer is simple – they can earn as much in one produce load than they can in multiple regular loads. Looking at Lane Signal application in its SONAR platform, a median cost carrier should be fetching around $1.12/mile moving from Salinas, California to Chicago. Assuming about $0.23/mile for fuel, this totals around $2,924, over $2,700 less than a load of produce on the same lane right now.

It is important to note Lane Signal is based on dry van data, but the base cost of operating a truck hauling a reefer trailer versus a van is a few cents per mile in fuel costs and the purchase of the reefer trailer. It is certainly not $2,700 on a single load.

The bottom line is a hard thing to argue when hauling freight. Many carriers are hauling freight making a penny or two on the dollar on a good day just to keep their truck moving. In the example above, that would mean making $60 on the standard load or over $2,800. Not many business owners could turn down that kind of payday when they are struggling for survival.

This scenario may be a warning for shippers who have “locked-in” their low rates in the spring without regard to potential truckload capacity shortages if the second half of the year is more robust. If carriers are on life support, good relationships may not be enough to salvage route guides.

In uncertain times, freight market participants need certainty to stay ahead of the freight market and understand the freight demand occurring in each participant’s most important lanes. The premier freight forecasting engine, FreightWaves SONAR, allows participants to benchmark, analyze, monitor and forecast freight demand and costs. SONAR ensures more proactive responses to the market, the ability to provide a solid customer experience by offering transparency, as well as make faster, more informed decisions. Get a demo of SONAR to see what the platform can do for you.