Shipping mode and freight optimization remain a sought-after powerhouse of all modern supply chains. Optimization and its correlating digital transformation propagate double-digit opportunities for ROI growth. But it remains elusive and out of reach for companies that lack comprehensive and granular data. For example, according to Supply Chain 24/7, “simply put, mode optimization means putting the right-sized shipment within the right-sized mode, whether it be LTL, TL, or intermodal. [But] many companies make their decisions based purely on physical weights of multi-piece shipments.” Knowing the physical weight is part of the equation, yes, but it’s not the endgame. Finding the right shipping mode means knowing all the data surrounding all modes and possibilities to achieve the optimized results. Shippers, LSPs and 3PLs should follow these steps to apply data and find the best mode for freight moves.

Going back to the need to manage the full freight bidding process annually, knowing the balance of power between shippers and carriers amounts to more insight into which mode, or modes, will deliver the most efficient moves. The Lane Signal data also alludes to how changes within the market, including the various indices, including OTRI and headhaul indices, respond and change during a disruption.

For rapidly changing market conditions, it may be necessary to re-evaluate moves and mode choices and initiate new bidding processes to access more competitive lanes and more.

Another factor to consider when moving freight involves the trucking capacity limits of originating and terminating movements. By moving freight from a high-capacity to a low-capacity destination, backhaul opportunities may arise. Thus, shipping mode may need to change to tap more backhaul opportunities and add value. Also, taking that action will be seen as favorable to brokers, carriers and LSPs, so they are more likely to result in fewer tender rejections.

Why freight forecasting

is essential for determining

mode optimization

Any plan for maximizing the value of shipping mode must also touch on accessorials and surcharges. These added expenses continue to grow as supply chains endure the COVID-induced stress and the upcoming peak season. For example, as Mark Solomon reported at FreightWaves in early August, “UPS Inc. (NYSE: UPS), bracing for what may be a historic peak holiday shipping season, will impose surcharges ranging from $1 to $3 per package on high-volume U.S. residential shippers.”

That surcharge seemed outrageous compared to peak surcharges of past years. However, it’s the time of COVID-19 and record tender rejections. Now, FedEx and USPS have also announced similar rate hikes. And FedEx has announced an additional accessorial rate that will take effect after New Year’s Day, says Supply Chain Dive.

By looking at total fuel costs and surcharges per lane, shippers can recognize which accessorials are likely to be higher afterward, changing mode selection to derive a better total landed cost.

The application of historical and real-time data across all modes, including multi-modal and intermodal moves, is another opportunity to determine the most effective decision to take with your freight. While intermodal and multi-modal are often used interchangeably, they have very different meanings and may result in significant opportunities to conserve freight resources. Multi-modal usually involves switching modes within the same carrier. Meanwhile, intermodal changes modes and carriers. Therefore, the complexity grows. And the only way to recognize which path, if any, amounts to savings lies in collecting, analyzing and applying shipping mode data for all tendered freight.

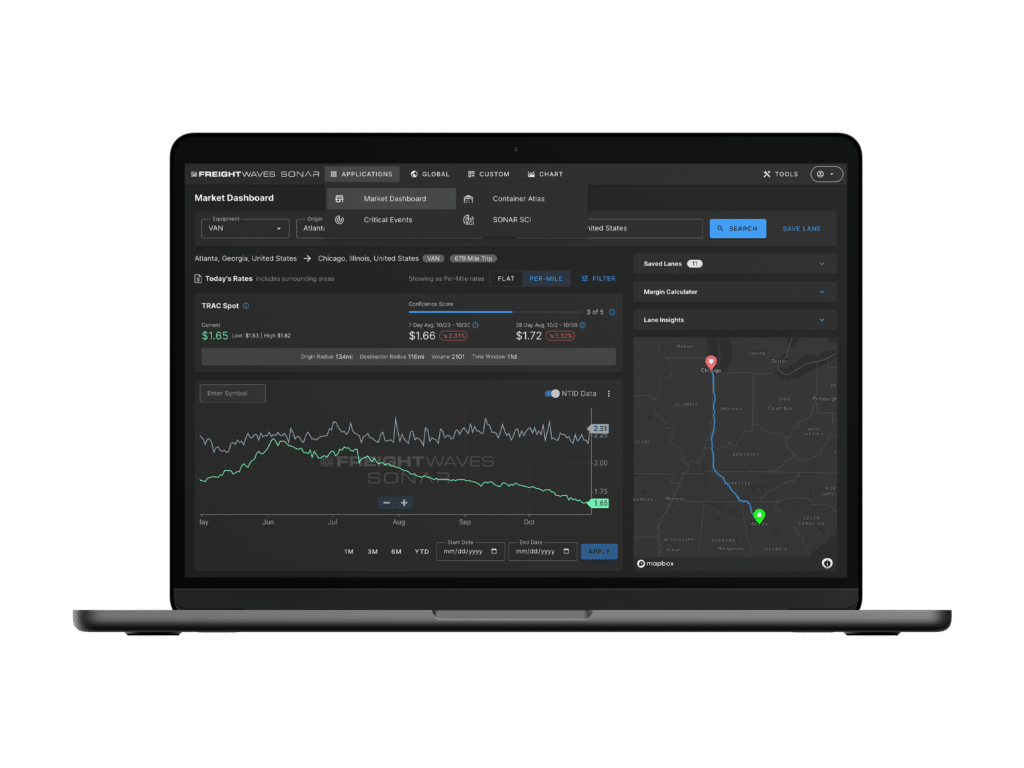

Choosing the best mode and route are two sides of the same coin. However, there may be millions of possible combinations when looking at an origin, destination and mode combo. And finding the best way forward comes from an in-depth analysis of data across all modes and possible moves. SONAR helps sort through the data and bring its real-world impact to life – finding the best combination and path with the most desirable outcome. Connect with FreightWaves and request a SONAR demo online now.