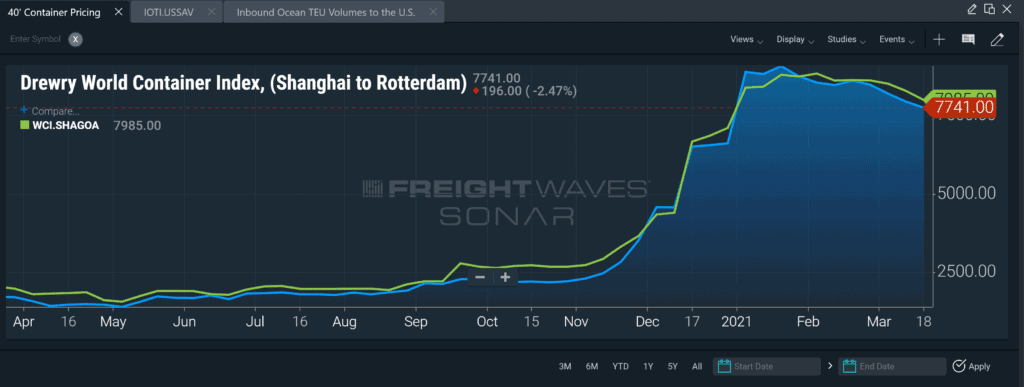

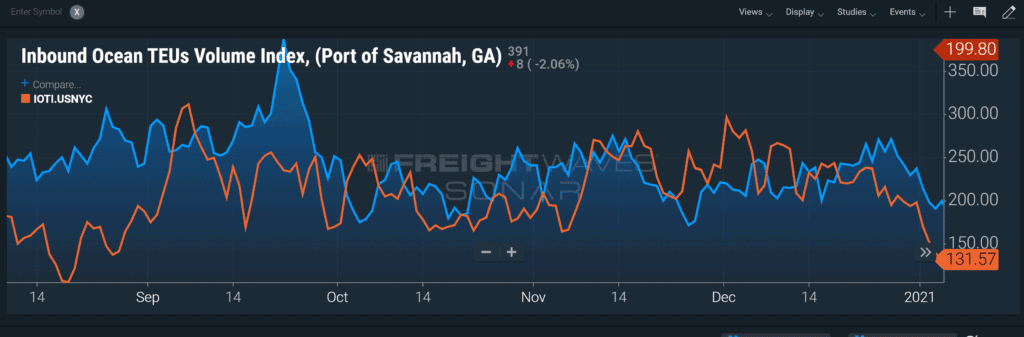

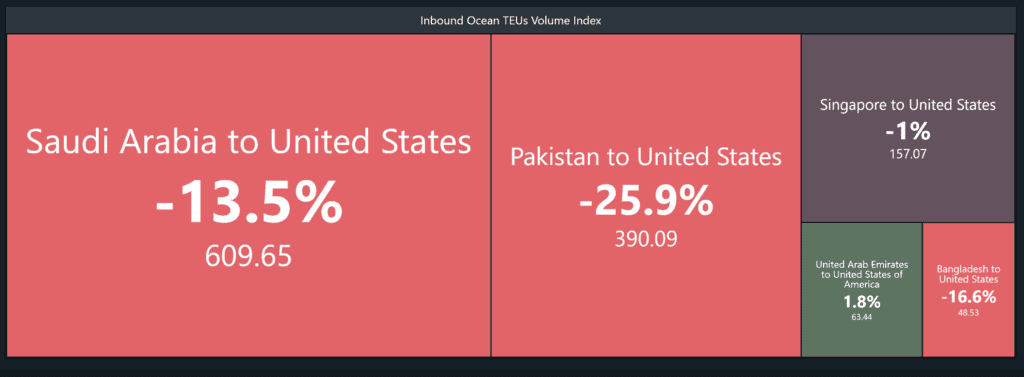

See the Suez Canal Custom Report in SONAR to keep an eye on how the blockade will impact inbound shipments into US ports. The report includes the Drewry World Container Index (Shanghai to Rotterdam), the Inbound Ocean TEUs Volume Index for the Port of Savannah, Inbound TEU Volumes). You can access the report above as a SONAR subscriber or see the images below to see the current state of each index.

When examining the impacts of the Suez Canal traffic jam, it is important to remember that the impacts will be far greater to Europe than to the US if the ship is moved within two days and traffic resumes. While the World Shipping Council estimates that the Suez Canal handles an estimated 10-12% of world trade, it handles a much higher percentage of Europe’s ocean containerized cargo from Asia than it does for the US.

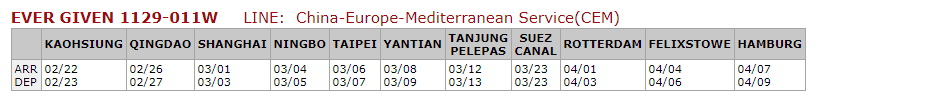

Data provided to American Shipper on Wednesday by project44 listed 36 vessels affected by the canal blockage. The major shipping lines — CMA CGM, COSCO, Maersk, MSC, NYK, ONE and Yang Ming — all were on the list. Rough math shows if all fully laden, those 36 ships, from the 900-TEU BF Esperanza to the 20,200-TEU Ever Globe, would be carrying 127,500 TEUs. Of these 36 ships, only 8-10 are likely scheduled to arrive at a U.S. port. If the Panama Canal had the same issue, the impacts on US supply chains would be far greater.

It is also important to remember the schedules of these ships provide a small buffer for delays that can likely be made-up by increasing the speed of the ship. For the Ever Given as an example, as of yesterday, the schedule posted by Evergreen the expected ETA of the vessel into Rotterdam was April 1st, 2021 (with a scheduled departure date of April 3rd, 2021). So, there is still time for that vessel to make up some lost time and arrive very close to its initial scheduled arrival date.

As for the impacts of the Suez Canal backlog on US supply chains, they have yet to materialize, and may not even be noticeable by the many indices tracked by SONAR. If the ship is moved today, or by early tomorrow, it is likely that we may not see many impacts here in the US, where port congestion is already causing a majority of the issues. The ships that are headed through the Suez Canal and destined for US ports will increase their speed to make up for the lost time. Right now, ocean container rates are still close to their all-time highs in many lanes, so the ocean carriers will be trying their hardest to get this cargo delivered so that they can get these vessels back to their headhaul lanes where they make a vast majority of their revenue. Due to the backlog of vessels that are already present in the US, there are likely already vessels waiting to take their place at terminals within US ports in the meantime. For this reason, most ocean alliances can likely find ways to remain somewhat efficient while the vessels that were caught in the Suez traffic jam try and make up for lost time.

However, if the traffic jam persists for a day or two longer, it could create some fairly major delays from ocean carriers choosing to reroute their vessels, which will take them more time and cost them more fuel. The ocean carriers would then likely look for ways to recoup those costs incurred in the form of increased ocean rates, which will be passed on to shippers, and possibly all the way down to consumers in the end.

Find out more info on SONAR’s Ocean Shipments Reports to track what is coming into all major US ports.