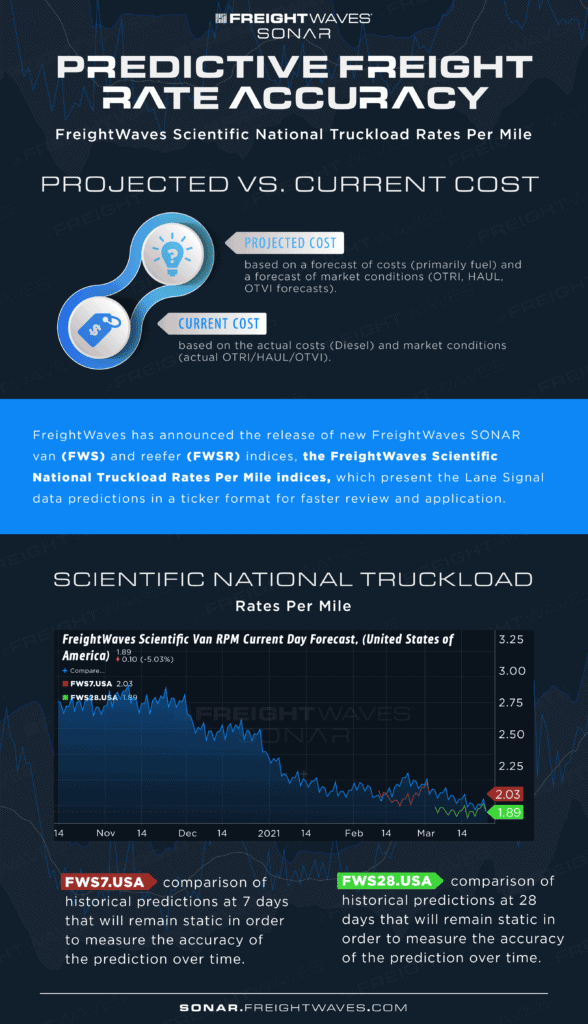

Much of the debate over freight analytics rests on how well predictive analytics aligned with what was observed in the market. That’s the crux of predictive analytics in any industry. It’s comparable to projected costs versus observed costs. As explained by the Small Business Chronicle, “Projected costs are based on prior sales numbers and anticipated increases in expenses. [Observed] costs result when money is actually spent on the various supplies, services and other expense categories used by the business.” But that concept often falls by the wayside in supply chain analytics, especially when assessing the accuracy of predictions using freight data or a forecasting engine. However, that’s changing with the release of new FreightWaves SONAR Van Current Day Rate (FWS) and reefer (FWSR) indices, the FreightWaves Scientific National Truckload Rates Per Mile indices, which present the Lane Signal data predictions in a ticker format for faster review and application.

But before explaining these new index implications, let’s first consider the reality of analytics platforms and their algorithmic alignment between projections and outcomes.

A problem is brewing as more analytics platforms offer predictive insights. As analytics platforms use machine learning to aid in deriving predictive insights, increasingly it’s vital that these platforms have a mechanism in place to check the accuracy of those predictions. Predictive insights take massive amounts of data from market conditions and yield a potential outcome of what is likely to occur.

While that is a fundamentally sound principle, it can quickly lack value if those insights do not pan out into reality. Effective transportation procurement depends on having an outlook to cost exposure, and analytics platforms need to ensure their predictions offer up accurate freight rate projections, measuring how well they align with the final, observed rate per mile. After all, wide deviations within predictive freight rates can still add up to big trucking revenue changes over a week, month or year. Instead, knowing how well those truckload rates stack up is critical to maximizing their use and pricing or buying strategies.

The value of FreightWaves SONAR lies in its use of tendered data to derive meaningful, actionable insights. The tender data rates of today, as found within Lane Signal, provide plenty of insight into what is likely to happen for each lane. Remember that the Lane Signal app contains views into 780,000+ lanes across the country. Shippers, brokers, and carriers who manage millions in truckload freight depend on Lane Signal to evaluate market activity in hundreds of daily shipments by looking at origin and destination pairs to see how hard a load is to cover and the potential prediction of rates per mile 1 day, 1 week, 1 month, 3 months, 6 months, and one year out. But what about those other organizations that want a true market-wide view and need a way to gauge the accuracy of truckload rates per mile they saw within Lane Signal itself?

For example, if ocean shipping imports surge, how will that affect the overall state of predicted truckload rates. The only way to really know is to measure all predicted Lane Signal data manually and see how it compares to today’s observed rates. That is where the FreightWaves Scientific National Rates Per Mile Indices come into play.

The proprietary algorithm that powers Lane Signal works within the new FreightWaves Scientific Rates Per Mile Indices as follows:

Freight management parties can find comparable indices for reefer truckload rates by accessing FWSR.USA, FWSR7.USA and FWSR28.USA respectively, allowing both shippers and carriers to stay strategic with managing logistics.

The rates within these new indices provide a predictive freight rate accuracy outlook for national truckload spot rate fluctuations and a way to view how market conditions have changed over time. They further add merit to the value of using FreightWaves SONAR as a freight data resource as these new indices validate the accuracy of SONAR’s predictions. That holds specific truckload rates’ impacts based on freight management segment, including the following:

Additionally, these metrics form a strong business case for freight management parties working to justify investment in FreightWaves SONAR for the first time or when considering an upcoming renewal of an existing FreightWaves SONAR contract. Since the values show the deviation between predicted and observed rates within Lane Signal data, it’s also easier to determine how closely to set pricing and tendering standards within those respective enterprises based on current Lane Signal data.

For instance, periods of disruption may result in a more significant deviation. Still, in retrospect, those deviations and having the data in your hands amount to improving overall operational excellence and building trust within FreightWaves SONAR data for truckload rates.

The evidence is clear and supports the robust use of FreightWaves SONAR data in all freight management segments. These new indices are only the latest iteration of advanced analytic insights and their benefits to ensure company stability against tendered data. Since all tenders are created equal within FreightWaves SONAR, it promotes the most accurate and realistic reflection of real-time market conditions. And over time, the FreightWaves Scientific Truckload Rates Indices will continue to grow in value. After all, the longevity of this index proves the value behind a freight data armada. And natural use cases will arise to include side-by-side comparisons of these indices against other core indices, such as OTRI, OTVI and even benchmarking capabilities. Find out how your enterprise can benefit from the platform to navigate the freight market by requesting a FreightWaves SONAR demo via the button below today.