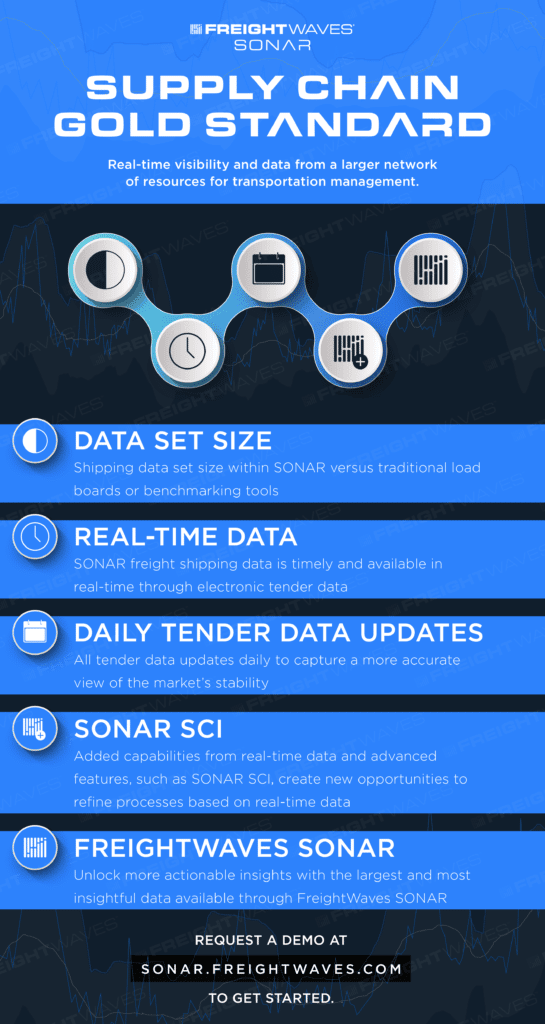

Real-time visibility and data into all things freight shipping is a supply chain gold standard. And nearly one-half of the industry’s freight market participants can see their data in real-time. Unfortunately, that doesn’t always amount to capturing real-time data outside of an individual company’s four walls. Now consider this. According to Forbes, “49% of Supply Chain Leaders (the top 12 % of respondents) can capture real-time data insights and act on them immediately, while 51% use AI and predictive analytics to capture insights.” In other words, it’s possible to get the data from internal resources, but only by seeing the data from a larger network of resources, such as those within FreightWaves SONAR, can any party hope to achieve a more strategic transportation management strategy. Let’s take a closer look at how real-time data in SONAR stacks up to lagging, stale data of traditional load boards.

There are a few obvious competitors to SONAR that can be characterized as load boards or benchmarking services. However, these competitors typically only provide posts of spot freight shipping and rough moving averages of rates in a range of 7 to 28 days. More importantly, those resources can include inaccurate or possibly even misleading data. Furthermore, the volatility within the freight shipping market means that using data from last week is opening the door to risk. Instead, SONAR captures data on executed, tendered loads, provides forecasting up to a year in advance and can ensure that data is no more than 24 hours old.

SONAR data comes from a network of electronic tender data, as well as countless connections to some of the biggest repositories in the country. That includes $200 billion in annual electronic tender data TMS platforms, brokerage software, APIs and of course, additional systems from manufacturers. However, the ability to generate meaningful insights comes from the fact that the data is accessible, reliable and accurate at all times across LTL, full truckload intermodal and the full market.

Seeing tender data with a daily update roster provides a better view into total market stability. Remember that SONAR’s Outbound Tender Rejection Index, or OTRI, can be used as a proxy for instability, so seeing declining rejections is a proxy for stability as well. Of course, on a larger scale, that lacks value beyond broad plans. However, capturing the data and breaking it down into all 400+ freight shipping markets will go a long way to capturing the overall state of the market and how it’s going to affect shippers, brokers and carriers.

Additionally, real-time data aligns with the continued digital evolution of the supply chain tech stack. As such, it adds value in perpetuity and provides a track record of what happened and what may happen. And with a larger market share of resources, it is both more accurate, objective and representative of tenders actually picked up by carriers.

Other advances within freight data analytics from SONAR have further promoted the expansion of the data set to provide actionable insights on day one. There are many ways to apply freight data, but the simple truth is that the most actionable resources are the easiest to visualize and apply. That’s where the array of FreightWaves SONAR tickers, charts and functions can add the most value while keeping data as fresh as possible.

Actionable insights and meaningful process improvement are the cornerstone of successful freight shipping management. And it all begins with the realization that the existing data sources on the market may fall short and result in added costs to your budget. However, SONAR can provide a better, more accurate and real-time view of the market without sacrificing on quality or ease-of-access. Request a FreightWaves SONAR demo to learn more about how data can be deployed to empower your full network and all freight management participants. Click the button below to get started.