Kyle Taylor and Luke Falasca, the co-hosts of #WithSONAR, are joined by Henry Byers, FreightWaves Maritime Market Expert. They discuss the amount of truckload volume that comes from ocean imports. They also cover why the current bull market in freight may continue to see elevated levels through the end of 2020.

The American Shipper/FreightWaves Global Trade Tech Summit was taking place on the day this show was recorded.

Watch the episode below:

The Summit’s keynote speaker was Gene Seroka, the Executive Director of the Port of Los Angeles, the busiest container port in North America. Byers said, “The Port of Los Angeles has never been more important to the domestic transportation network.”

Byers has been on both sides of the third-party logistics (3PL) industry. He started his career at Access America Transport in Chattanooga in 2013. Access America merged with Coyote Logistics, which was then acquired by UPS. At that point, Byers made the leap to international logistics. “I realized how different the international industry really is from the domestic freight industry,” Byers said. Key staff from Access America started Steam Logistics, and Byers worked there for four-and-a-half years as director of pricing and business intelligence. “I fell in love with datasets. And that’s what led me here to FreightWaves.”

Like many other sectors of the global logistics/supply chain/freight world, the maritime industry is investing in technology in order to modernize and automate processes to create more visibility.

“It was hard for many companies in the maritime industry to make the leap into the modern age. The Port of Los Angeles has worked with General Electric on a port optimizer and done very well with it. And I think now they’re ready to really launch it and get it out into the market.”

Taylor commented, “I think everyone in the industry understands how volatile the market is right now, especially the domestic truckload market. But less and less freight is produced domestically, so surface transportation providers in the U.S. are reliant on the maritime industry moving freight from overseas to this country.”

“About 70% of truckload volume is generated by imports. So the trucking industry is dependent on what happens overseas and how much volume is being produced and then moved to the U.S.,” Byers stated.

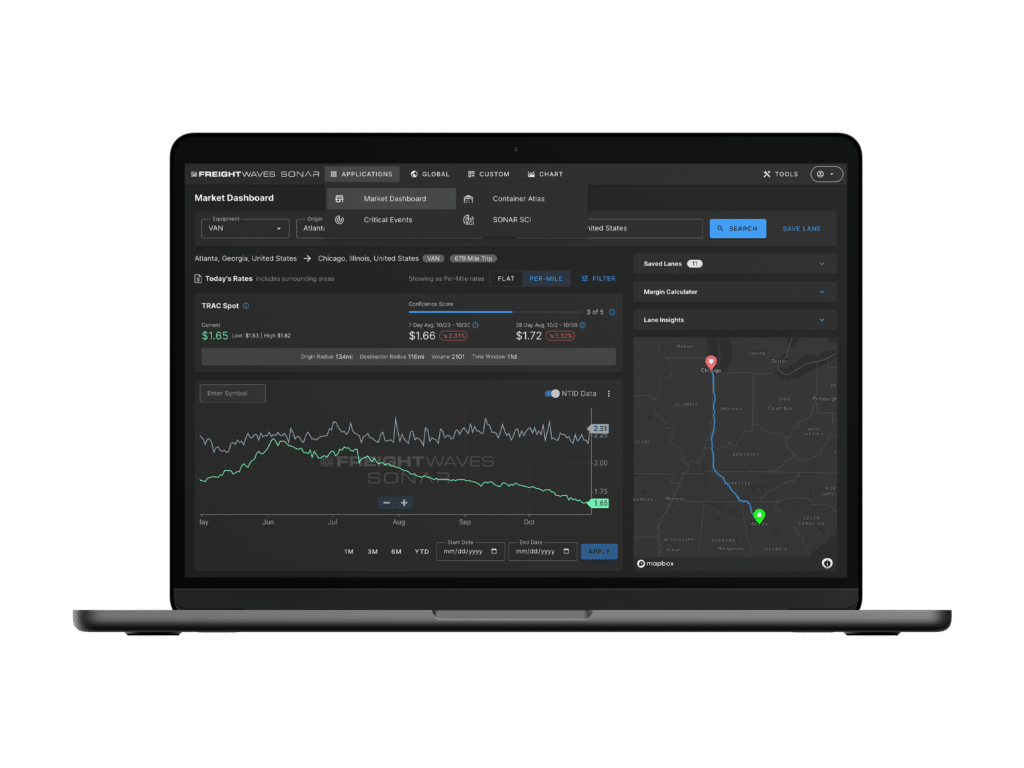

Falasca reacted, asking, “For those who work in surface transportation, how can they use the maritime data contained in SONAR to their advantage?”

Byers replied, “U.S. companies have goods manufactured in China or other countries in Asia, and then ship most of it by ocean carriers to ports in the U.S. So there have to be very detailed logistics network designs – many of which have been disrupted by coronavirus and ongoing trade tension between the U.S. and China. No matter what port freight arrives at, it has to be transported – whether to a relatively nearby distribution center or across the country. For trucking and intermodal companies, knowing what freight is coming into which port and when helps them plan and seek opportunities to move that freight. That information is available from SONAR’s Ocean Shipments Report – and not from any other source.”

Falasca said, It’s amazing how correlated the SONAR data is to moves in the market. The ports, such as the Port of Los Angeles, really do correlate very closely with the domestic truckload volume.” Much of the freight from the ports of Los Angeles and Long Beach is shipped to the nearby city of Ontario, California, which has millions of square feet of warehouse and distribution center space. Drayage carriers take freight from those ports and deliver to those warehouses or distribution centers in Ontario. From there, the freight shows up as outbound tender volumes originating from Ontario and moving all over the country.”

Taylor pointed out that because of the coronavirus-related changes in 2020, a percentage of shippers have had to bypass Ontario and ship freight directly to population centers in the Midwest and on the East Coast. “This has increased intermodal rail volume from the West Coast ports to Chicago, Dallas and Atlanta particularly, as well as smaller volumes to other cities.”

Taylor, Falasca and Byers cover other topics on the show, including how SONAR freight volumes reflect new buying patterns by consumers and how they have impacted transportation patterns.

Know more, faster – and find just what you need with SONAR!