Tricky freight, short lead times, and inflexible delivery

windows meant that one consumer packaged goods

shipper was punished when its core carriers fell off and

it had to put its freight into the spot market. By raising

contract rates in certain volatile key lanes identified by

FreightWaves Supply Chain Intelligence (SCI), the same

shipper slashed its spot market exposure in half and cut its truckload spend by 10% on the lanes it put out to bid.

The CPG shipper is one of the leading providers of

specialized supplies, including personal care items,

clothing and electronics, for an array of facilities across

the United States. Two years ago, the company added

a new director of transportation, who had previously

spent several years at a top food and beverage

company.

As the new Director of Transportation, he was tasked with addressing the company’s overexposure in the spot arena. The CPG shipper maintains strict requirements for its carriers, as well as guaranteeing in-stock, next-day delivery to all of its destination facilities across the country. Immediately, the new director understood that they would have to continue paying a premium for transportation, due to their strict requirements and short lead times.

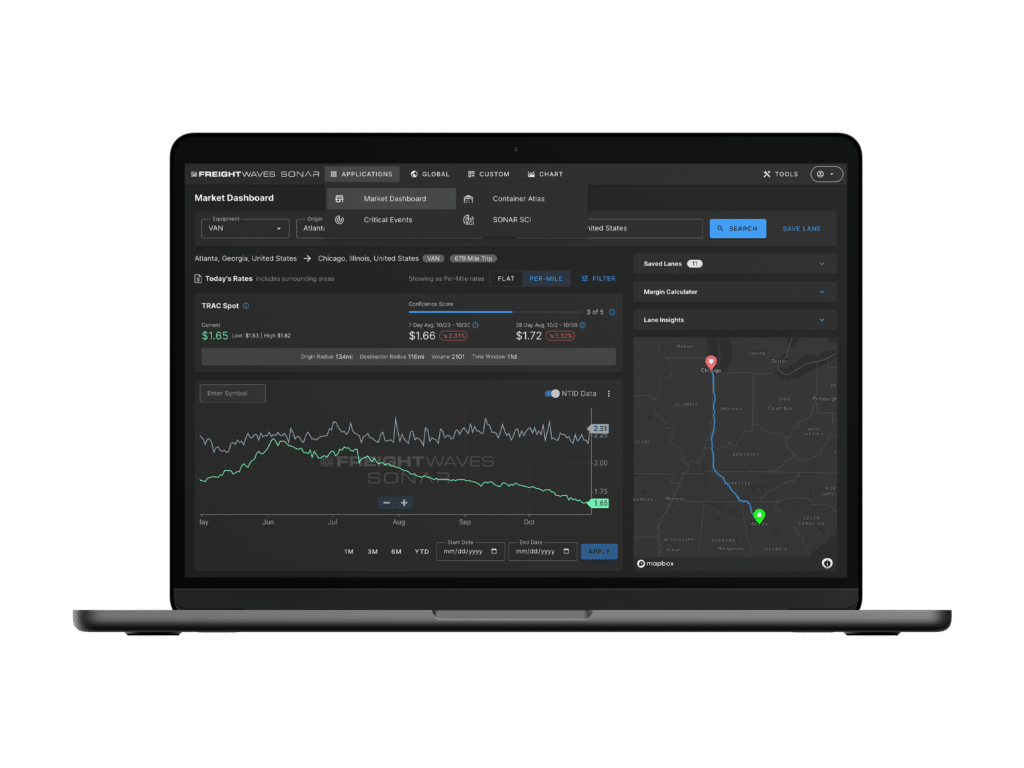

These persistent issues led them to FreightWaves SCI

platform, which helped identify the highest-spend lanes across the company’s network. The CPG shipper

ultimately let 95 lanes out to bid during the summer,

which went live in August 2021. The summer of 2021 will be remembered as a period of exceptional volatility in trucking rates and capacity, as average truckload spot rates on Truckstop.com’s load boards exceeded $3/mile and the national tender rejection rate remained elevated above 20%. It was in that business environment that the CPG shipper sought to firm up relationships with core carriers and stay out of the spot market.

The initial results were better than expected,

generating a 10% savings in transportation spend. The

company was also able to cut its overall exposure to

the spot market roughly in half, from 20% to 11%.

The savings on those 95 lanes alone will generate an approximately 20x return on investment in SCI in the first year, but this CPG shipper plans to optimize its network even further. With SCI’s ability to benchmark risk and performance against the market on every lane utilized, this team has designs on running their entire contracted truckload network through the platform.

Moving forward, they also plan to use SCI to measure

and better understand the premium to market rates the

company has to pay due to the nature of its freight.