Operational costs continue to increase for carriers year to year. Although many carriers have worked diligently towards reducing operational costs and increasing profit margins, there is still work to do for the top for-hire truckload freight carriers to improve. While descriptive analytics can help carriers understand what happened, knowing when to refuse loads or charge a higher cost can be difficult. Quite simply, it costs money to ship freight and the amount can vary significantly by region, zone, mode and more. When carriers take advantage of the various freight technology insights in freight analytics platforms, they ensure their goals will meet expectations. And accepting more higher-paying loads will have a resounding impact, including improving driver retention rates and promoting your brand through preferred status among your shippers.

Consider this; according to Convoy, “showing your shippers that you have taken steps to understand their business will help you provide them with better service, and understand what their expectations are – as well as give you an opportunity to share what your expectations of the relationship are.” In turn, the carrier freight technologies used can effectively increase a carrier’s eligibility for carrier-of-choice status, lower your operating expenses and maximize your profitability per load. Let’s look at seven ways that freight technology and data achieves that goal.

Freight technology advancements, such as carrier-managed scheduling and seeing total market activity for a given area, will reduce waste by ensuring truckers spend less time loading and unloading trucks. Dwell time remains one of the biggest issues facing the industry in terms of expenses and time utilization. New advances in data-driven transportation management help reduce dwell time impact by streamlining scheduling and avoiding bottlenecks in the yard. Decreasing time wasted while idling and waiting will significantly boost productivity and profits; it amounts to more paid drive time. And if wait times do grow too long, carriers can turn to freight data to show general trends and bill detention charges accordingly.

Maximizing truck utilization and cargo space is another core benefit of using technology to manage asset allocation. Meticulously organized routes, insight across popular shipping lanes and accepting freight across viable transportation routes delivers a stronger ROI for carriers. After all, trends, lane shifts, throughput and transparency data can now be used to make more hauls and avoid unexpected costs or delays.

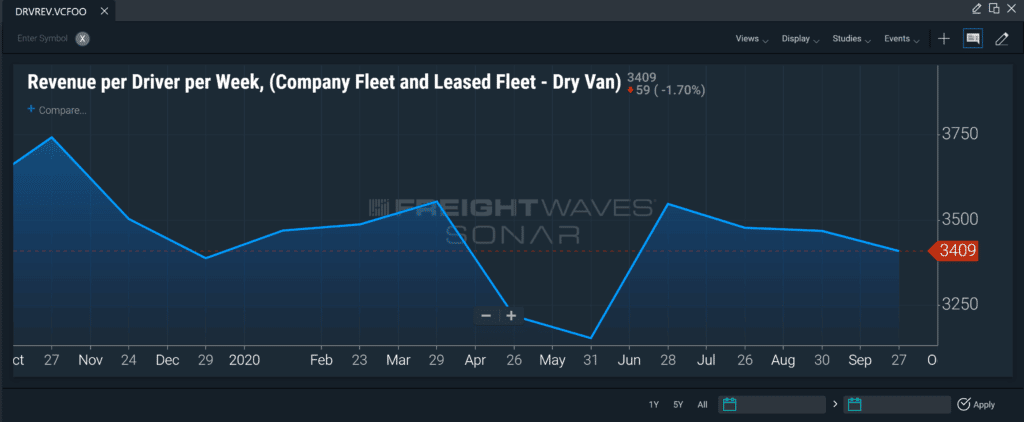

For added return on investment, carriers use freight technology features in FreightWaves SONAR such as the Operating Ratio and Revenue Per Driver Per Week indices to gain the following benefits to aid in reducing costs and increasing profits:

Using this information as a freight benchmarking figure, SONAR subscribers can get a good idea of how van, reefer and flatbed carriers are navigating the freight market each month. When revenue per driver per week is increasing, carriers are more effectively utilizing their drivers either from increased rates, volumes or equipment and personnel management. There is a correlation between revenue per driver per week and freight market intelligence on activity.

Revenue per driver per week is updated monthly and is based on a sample of over 300 carriers mixed between primarily dry van, flatbed and reefer trailer types. The fleet sizes range from small to large, representing a well-balanced mix of carrier types.

When carriers understand the revenue per driver per week they can improve truck utilization and increase awareness of the activities in the freight markets that are important to them. Carriers can benchmark their driver and truck utilization numbers against the three main equipment types in the industry.

The Operating Ratio (OPRAT) index in SONAR provides total operating costs divided by operating revenue, which is derived from the Truckload Carriers Association (TCA) members and is reported on a monthly basis. OPRAT is segmented into dry van, reefer and flatbed carriers. OPRAT is a measure of how much of every dollar received from customers is spent on moving the freight. Expenses include items such as driver wages, truck lease, insurance, maintenance, etc. Debt servicing is excluded from this calculation. High operating ratios (ORs) are indicative of lower profit margins and ineffective operations or competitive conditions.

Operating ratios are a measure of operational efficiency. The formula is operating costs/operating revenue. A 100 OR indicates that for every dollar made in revenue, 100% of it goes to funding the cost of doing business, leaving nothing for debt or investment. In freight carrier operating costs are things like driver wages, back-office support, and maintenance costs. Debt and interest payments are not included in these costs.

Most freight carriers carry some amount of debt in order to fund some of their growth as many trucking companies are low on cash. Purchasing equipment and buildings are some of the more commonly financed items. In general, many carriers consider making five to ten cents on the dollar a success, or a 90 to 95 OR.

Watching freight carrier ORs can be useful in identifying the health of the trucking sector. When ORs are too high (over 100), carriers may be more willing to take lower-priced freight but are at a higher risk of parking their trucks and leaving the space. Lower ORs are indicative of well-run carriers, but also stronger market conditions in which freight rates are elevated. Having insight into the trucking sector’s health allows you to see if you or your carriers are in a strong or soft market.

Every transportation line has an order process and protocols for all shipments. If any software were to streamline the process and make it faster, costs would be cut dramatically. Freight technology and automation improve shipping processes across the board by eliminating poor transparency in global logistics. For carriers, that means seeing real-time market dynamics, rejecting low-priced spot freight when trucking capacity tightens and planning ahead. And using data helps trucking managers create a more organized chain that is easier to manage. That’s a win-win for everyone involved. The same processes also translate into proactive trucking request for proposal (RFP) processes, maximizing trucking rates and benefiting your drivers in tandem.

Customer demand fuels trends that govern the transportation industry. Getting customers what they want and when they want it without wasted time, energy, or resources cuts costs for carriers of all sizes. Embracing freight technology innovations makes it easier to meet customer demands, keep customers happy and maximize profits. And since customers get their products on time and without delay, they are more likely to return for future purchases. Increased purchases by customers amount to more work for carriers, adding to profitability. And by working with shippers to understand the flow of capacity, your brand will inherently generate a more substantial ROI.

Delays will happen, but carriers must not let road closures or other factors reduce profit margins. Freight technology and applications can help improve delivery times, reduce shipping errors, allow for faster response to customers, and proactively manage in-transit and empty capacity both in the short-term and long-term.

How?

Technology promotes efficiency and accountability. Take the fact that a customer may return an item due to late arrival. In turn, the shipper would require a delivery guarantee from a carrier. But if the carrier accepts those terms, and runs into an ice-storm, they run the risk of losing money.

Now if the return resulting from this late delivery is eliminated, it becomes possible to mitigate those costs in the first place. By using real-time freight data, carriers could see tightening capacity due to road closures from within the last day. Thus, advances in technology allow for better service levels, avoid unnecessary complaints, and reduce the return rate.

When the same process gets repeated, it’s easy to derive more waste. Unfortunately, that’s an adverse effect, and the only way around it is to identify those wasted processes, correcting them before they contribute to losses. Shaving a few seconds off the process, such as accepting or rejecting a load, can yield huge dividends in the long term. Advances in freight technology make it easier to spot problem areas, such as excessive wait time or ample capacity in a market, access data, and effectively address the issue. It also offers more innovative ways to improve services.

For example, avoiding trips to areas with ample capacity might seem odd. But if you choose an O/D pair with higher outbound demand, finding a backhaul opportunity will be easier. And advancements in freight data make it easier to avoid empty backhauls and maximize your trips.

New freight technology advances come in many varieties, but one of the best tools for carriers is automation. Smart machines and artificial intelligence (AI) technology are the way of the future. Automating routine tasks saves time and money and will set managers up for tremendous success. Since everyone is continuously faced with the prospect of higher demands from e-commerce growth, staying ahead of the competition means taking advantage of every opportunity for improvement. And by combining scheduling tools with freight data, carriers can define rulesets for when to accept loads, set appointment times, invoice, and more. Also, invoicing is another area where carriers can turn to freight data to avoid unexpected losses, justify accessorials and grow revenue per load.

Rising transportation costs are the one constant in global supply chains. And the risk of disruption continues to increase in tandem. Fortunately, more insight and visibility into the network through technology and advanced freight indices can make a difference. See how carriers can maximize the benefits of embracing this technology by requesting a FreightWaves SONAR demo or simply clicking the button below.