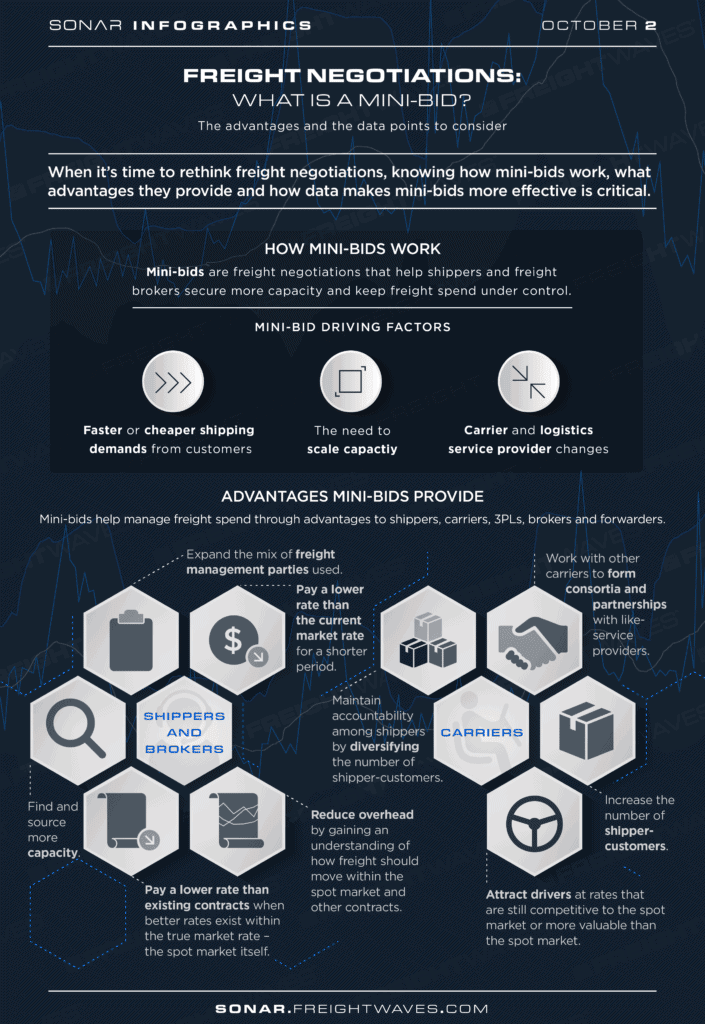

Freight negotiations, such as mini-bids and traditional annual contracts, help shippers and freight brokers secure more capacity and keep freight spend under control. However, not everyone understands the value of looking beyond the typical annual contract. According to an August 2019 survey of shippers, conducted by FreightWaves, when the spot market shifts by 15% or more, two-thirds of shippers move freight into the spot market. This reflects a need to secure capacity due to drivers fleeing to a market that offers better pay. Here is a short review of mini-bids.

Using mini-bids helps shippers and freight brokers to:

Carriers, 3PLs, brokers and forwarders may also engage in mini-bids to reap similar benefits. For example, carriers can apply mini-bids to:

Freight management parties need to know these core data values before shifting to the spot market:

Ultimately, everyone in logistics is watching out for number one. And staying competitive will make or break all businesses. Mini-bids allow companies to adapt to volatile markets without abandoning all hope and using only a spot market freight management strategy.

Yes, there will be times when spot freight is the only way to go for a specific shipment. But with the advancements in freight forecasting and demand sensing, larger supply chain management parties should never go for a spot-only approach.

That would open the door to grave risks and leave little recourse for those that find their level of service lacking.

Fortunately, FreightWaves SONAR provides insight into freight data needed to make an informed decision and maximize the value of mini-bids regardless of whether it’s a bull or bear market.