COVID-19 triggered a six-year growth rate in six months within e-commerce and stimulated the supply chain. Now, carriers, brokers and 3PLs are trying to keep up, stay ahead and plan for peak season—all at the same time. Peak season is on track to break records as well, especially if growth continues at current levels. The reopening of the economy did little good to force a rebound of shipping volumes. May 2020 volumes were 23.6% lower than May 2019, and the major indices created by FreightWaves have seen significant declines compared to last year. Then came the July 4th holiday, which saw a sharp increase in freight volumes and continued those strong volumes with the SONAR Outbound Tender Volume Index showing volumes 30% higher than 2019. For shippers, brokers and carriers alike, the market isn’t entirely certain. But for those that look to leverage freight metrics and data to understand lane trends, FreightWaves’ SONAR now includes a remarkable innovation—the Lane Scorecard.

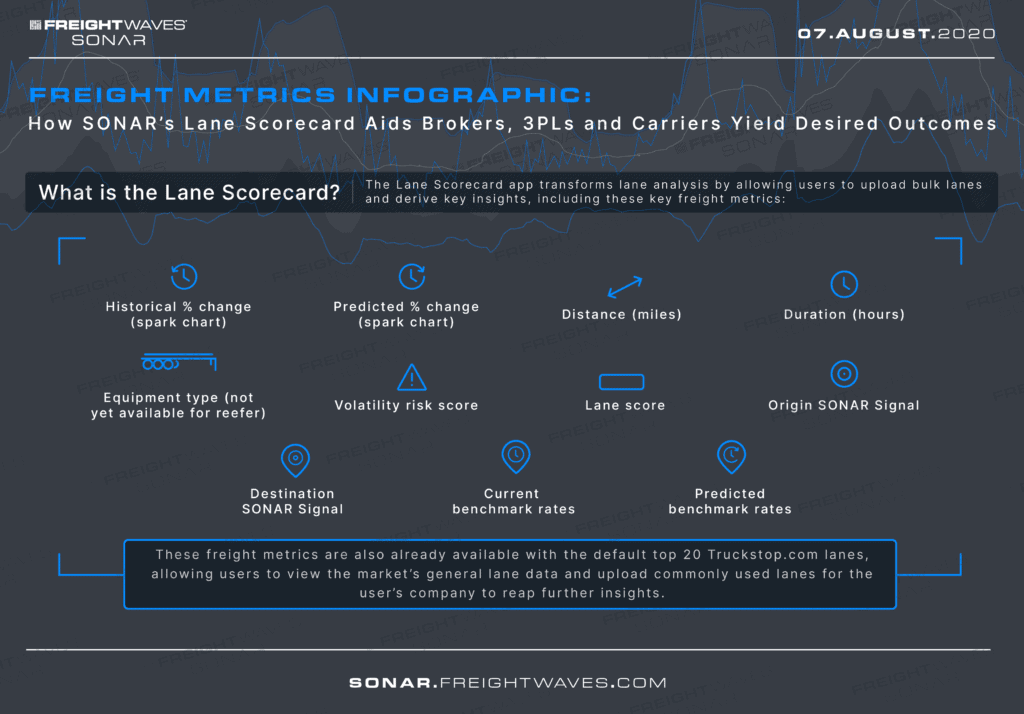

The Lane Scorecard app transforms lane analysis by allowing users to upload bulk lanes and derive key insights, including these key freight metrics:

These freight metrics are also already available with the default top 20 Truckstop.com lanes, allowing users to view the market’s general lane data and upload commonly used lanes for the user’s company to reap further insights.

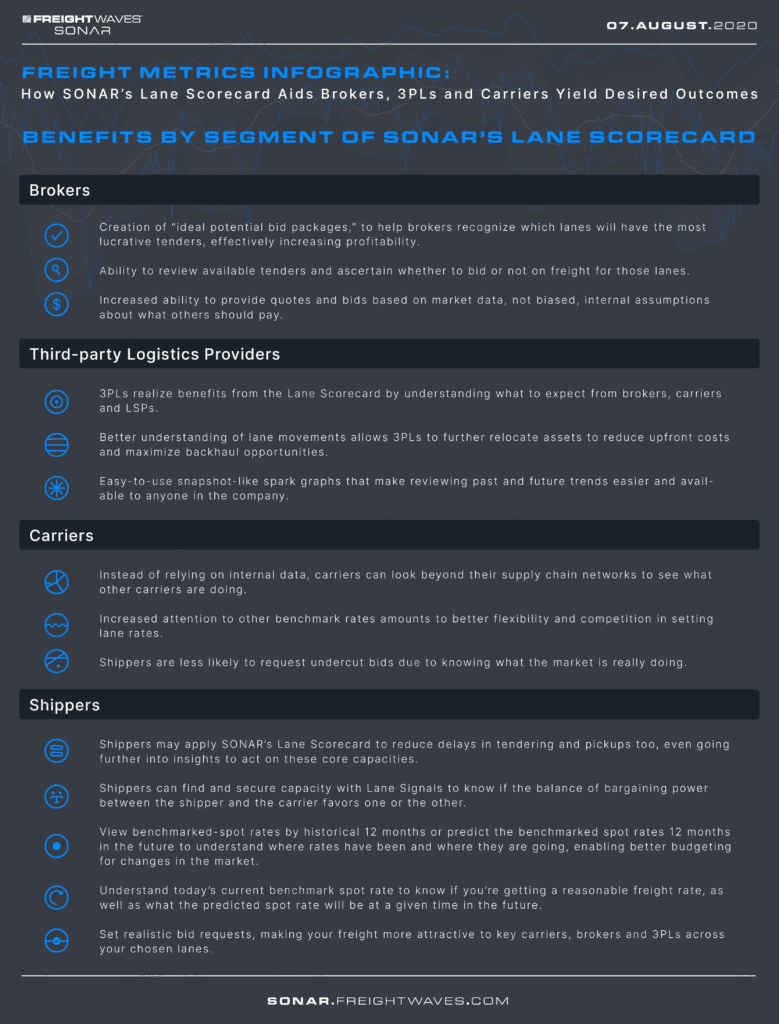

How the Freight & Logistics Industry Players Benefit from the Freight Metrics in SONAR’s Lane Scorecard

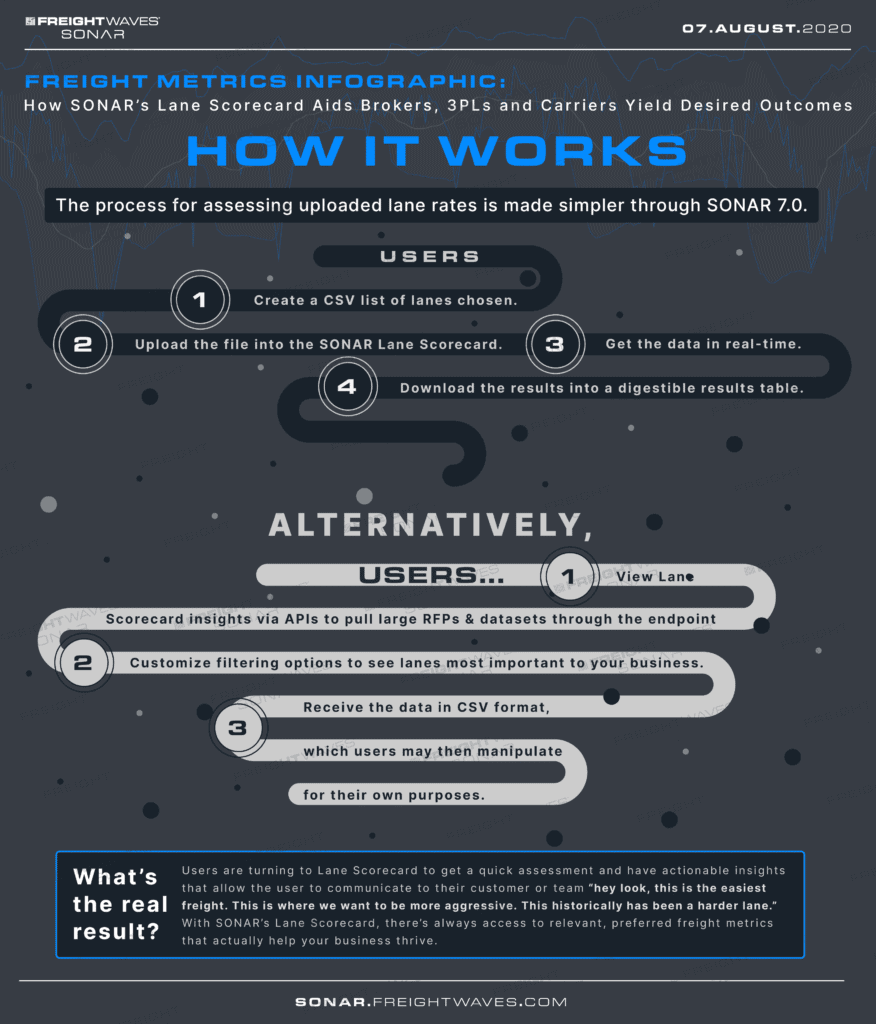

The process for assessing uploaded lane rates is made simpler through SONAR 7.0.

Users…

Alternatively, users…

Users are turning to Lane Scorecard to get a quick assessment and have actionable insights that allow the user to communicate to their customer or team “hey look, this is the easiest freight. This is where we want to be more aggressive. This historically has been a harder lane.” With SONAR’s Lane Scorecard, there’s always access to relevant, preferred freight metrics that actually help your business thrive.

*Click to see the large version and save.