Risk management is important to any kind of investment. One of the best strategies of risk management is diversification of assets or revenue drivers. Brokerage leaders are turning to this strategy for their freight business.

Many small and medium-sized brokerages find themselves entering the freight brokerage market with a specialized niche. You have a relative who owns a produce company or a friend started a new beverage line, and you enter the brokerage business to advise their transportation needs.

As your revenue begins to grow, you start to notice that product is cyclical. When those markets produce less, you bring in less revenue, and when those markets do well, you do well. While it is possible to continue revenue growth, you work extremely hard during down periods in your freight business just to remain stable.

This is why diversifying your freight business portfolio is so important. Your goal in this revenue strategy is to smooth out unsystematic risk, so segments of your business can perform negatively while top performers continue to drive revenue growth.

You see examples of this strategy in large brokerages today.

XPO Logistics strategy has attacked diversity harder in the last few years. After losing Amazon’s $600 million annual spend in 2019, Bradley Jacobs, the chief executive officer of the company, vowed to diversify the freight business portfolio so that no single customer was more than two percent of revenue.

CH Robinson has stuck to this same two percent strategy in recent years, along with its market verticals. In 2019, not one of their market shares was over 20 percent of their total revenue. It implements this strategy into its carrier markets (small, medium and large) and its transportation segments (truckload, LTL, global forwarding, etc) to balance the routine ebbs and flows of the freight market.

Diversification is not just about protecting yourself from market downturns. This process can prepare your brokerage for surprising market upswings as we see in port freight demand.

Port congestion is at its peak, freight brokerages who have spent time developing strong relationships with drayage companies, container haulers and truckload freight carriers will be able to continue to hold their margin while spot market brokers will have a difficult time keeping rates down.

If you are a freight brokerage business that has missed the opportunity to prepare for the increase in port transportation demand, do not take this as a loss, but a learning lesson. Thankfully, you have entered an industry that is very cyclical and there will be other opportunities you can prepare now.

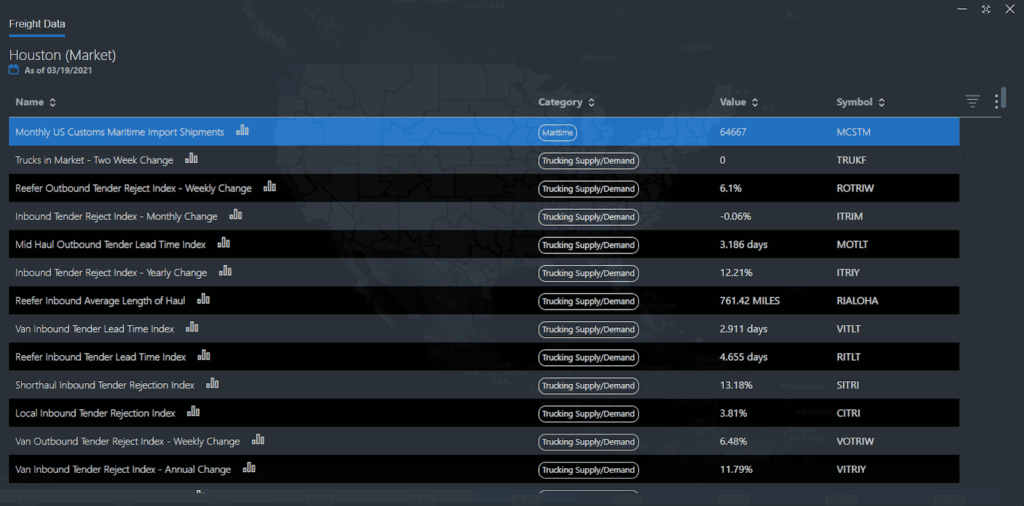

SONAR has the tools for you to watch for market indicators that will help you decide where and when to attack these international shipments. Using SONAR tickers, PIMS, CSTM and FBXD, you will be able to guide your sales teams to diversify your freight business portfolio for long-term, stable growth.

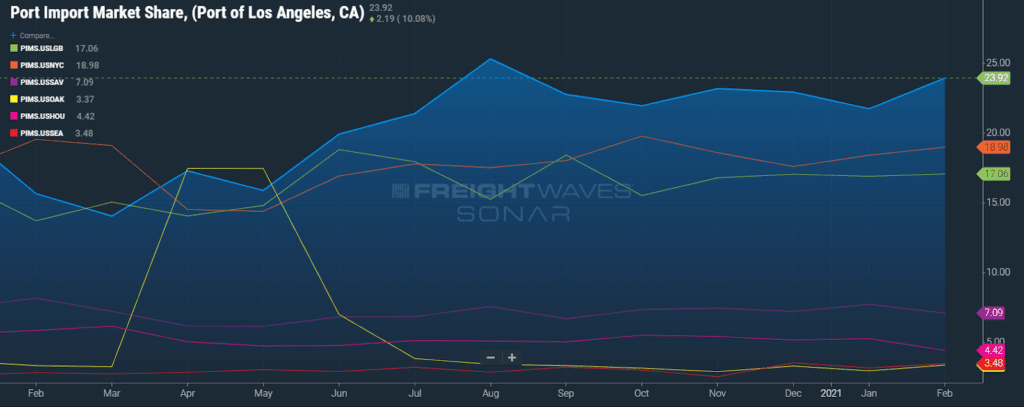

The SONAR Port Import Market Share (PIMS) captures the market share of the total U.S. Customs Maritime Import Shipments on a monthly basis. It consists of imports cleared through customs each month and what market share specific port of entries hold. This data can show you how importers are choosing to route their shipments.

The time period for the SONAR chart is from January 2020 to the present.

We see a large uptick in April market share at the Port of Oakland (yellow) as the largest container ship, the MSC Anna, delivered 19,200 TEU to a port that is most often used for exports. Since freight volumes were so low nationwide, this created a large market share for Oakland.

As a broker, you can use this tool to see target ports that are gaining market share and guide your sales team to discover leads that are bringing in goods from overseas and increase revenue in your freight business.

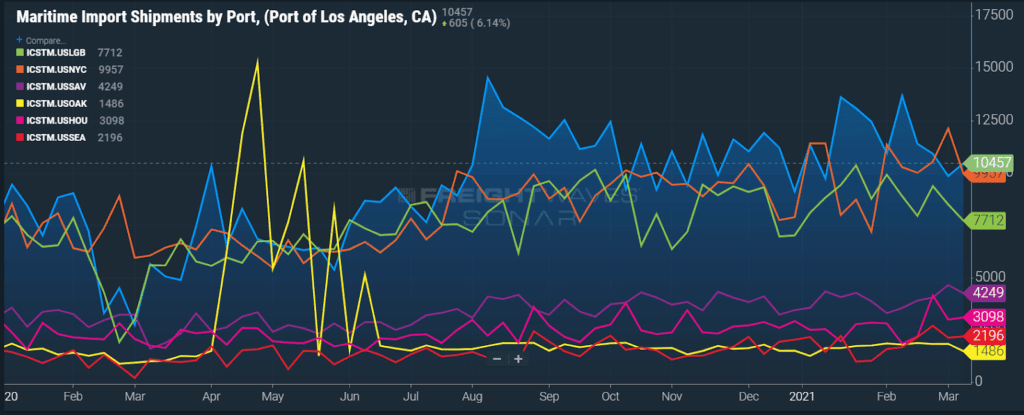

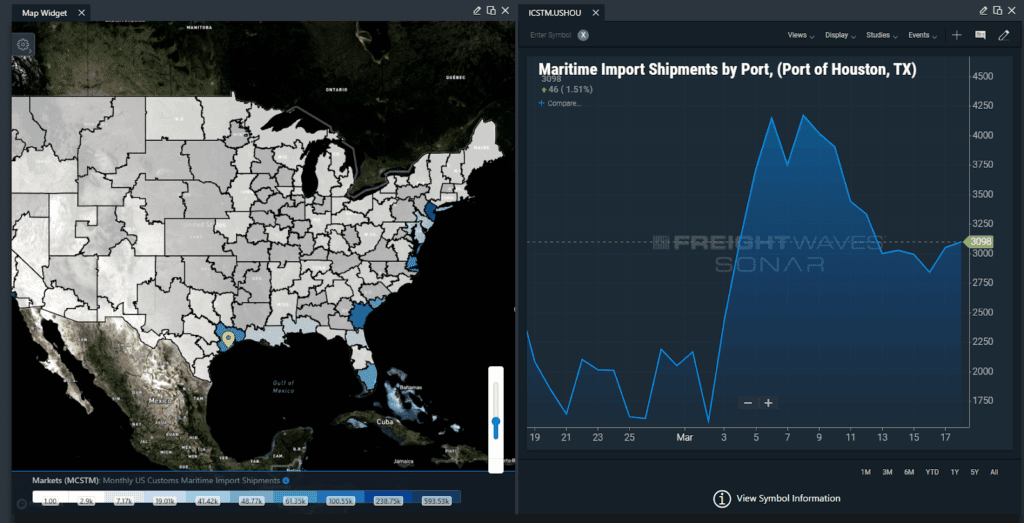

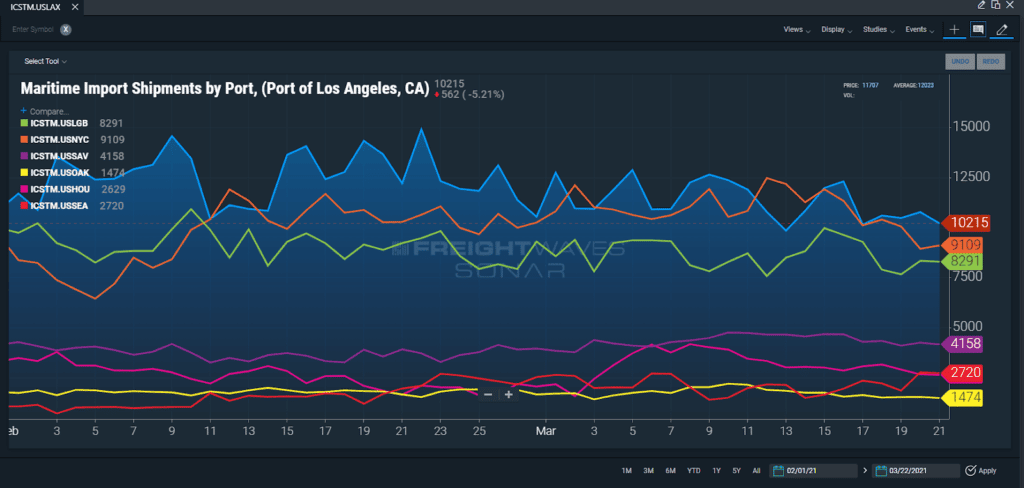

The US Customs Maritime Import Shipment Index is a 7 day moving average of shipments into a given port based on US Customs data. It counts a shipment as a single customs filing, with each shipment assigned to the mark in which the shipment cleared customs.

You can use this index to compare import volumes of various ports to watch for market fluctuations. This can be a leading indicator of intermodal and truckload demand as these goods need surface transportation to warehouses once cleared through customs.

In this SONAR chart, you can see the comparisons of trends seen in the previous SONAR PIMS ticker.

An important detail to note, this data is based on customs clearance, which does not occur until the containers are picked up to leave the port. With shutdown effects during this time, the surge of imports from China takes time to be picked up at the ports, creating the spikes in import shipments you see particularly in the Oakland market from April to June of last year.

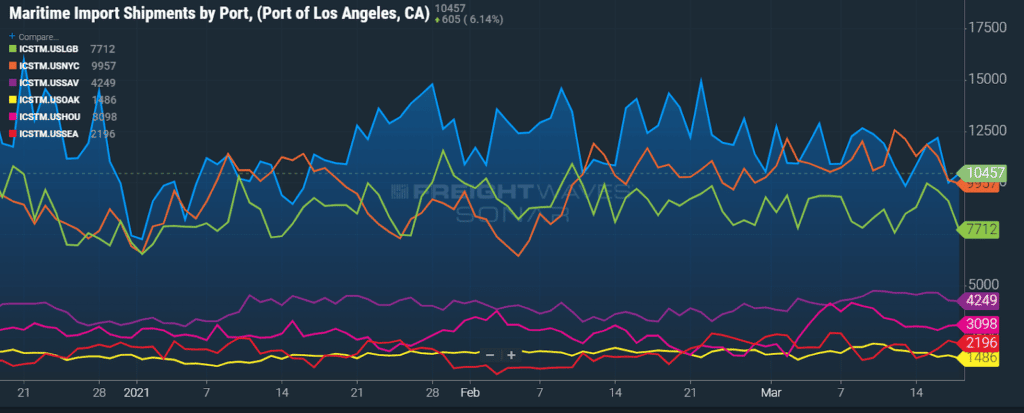

When you zoom in to a more recent time period, you see a large uptick in shipments to the Port of Houston at the beginning of March as they began to grab more market share from rerouted shipments coming from China. In March, retailers began utilizing this port in order to avoid the growing wait times of Western ports.

This port has also recently experienced sustained growth from the completion of the Panama Canal expansion, which gives container ships an alternate route to deliver goods from Asia. With better inventory planning, warehouse growth in Texas and added services from container lines, customers were able to save costs through these alternate routes.

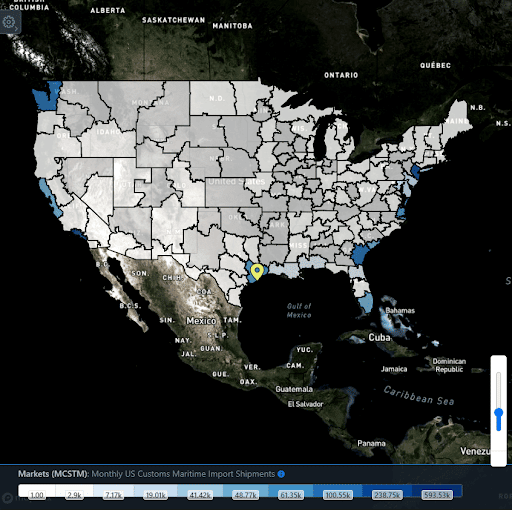

To give your sales reps in your freight business an easier view of the SONAR CSTM indices, you can use the Map Widget to see how markets are trending on a monthly basis on the SONAR MCSTM index. Markets that are shaded darker blue indicate rising monthly volumes, while markets that are lighter show lower monthly volumes.

When you click on a given region, you can see a number of SONAR indices related to that market, giving your representatives in your freight business a quick view of their market power in that region.

When they click on a specific index, it will add a widget to their screen where they can analyze and compare different port CSTM indices.

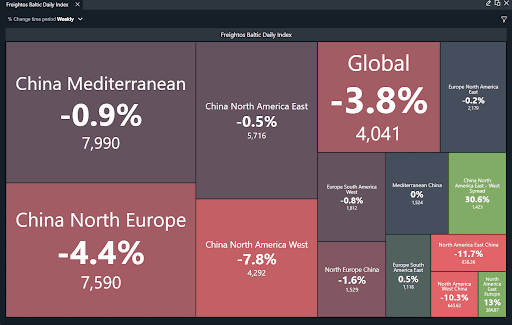

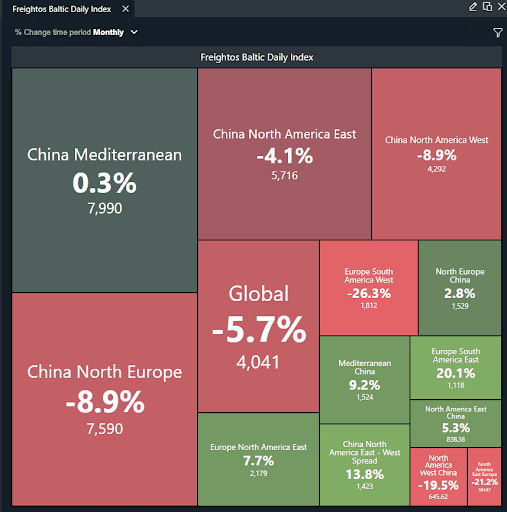

The Freightos Baltic Daily Index can be used to understand current freight demand in a given lane, giving users a sense of freight demand that will occur for inland markets as the freight begins to hit shores. It is the only index in the world that reports daily ocean container prices.

This index measures the daily price movements of 40 ft containers within 12 major maritime lanes. It can be adjusted to show the % change in pricing yearly, monthly, the last two weeks, weekly, and daily. The SONAR chart above shows a 7.8% decrease in container prices going from North China to the West Coast, meaning we should see less freight volumes going to West Coast ports in the next few weeks, loosening demand on trucks needed from port like Los Angeles, Oakland, and Seattle.

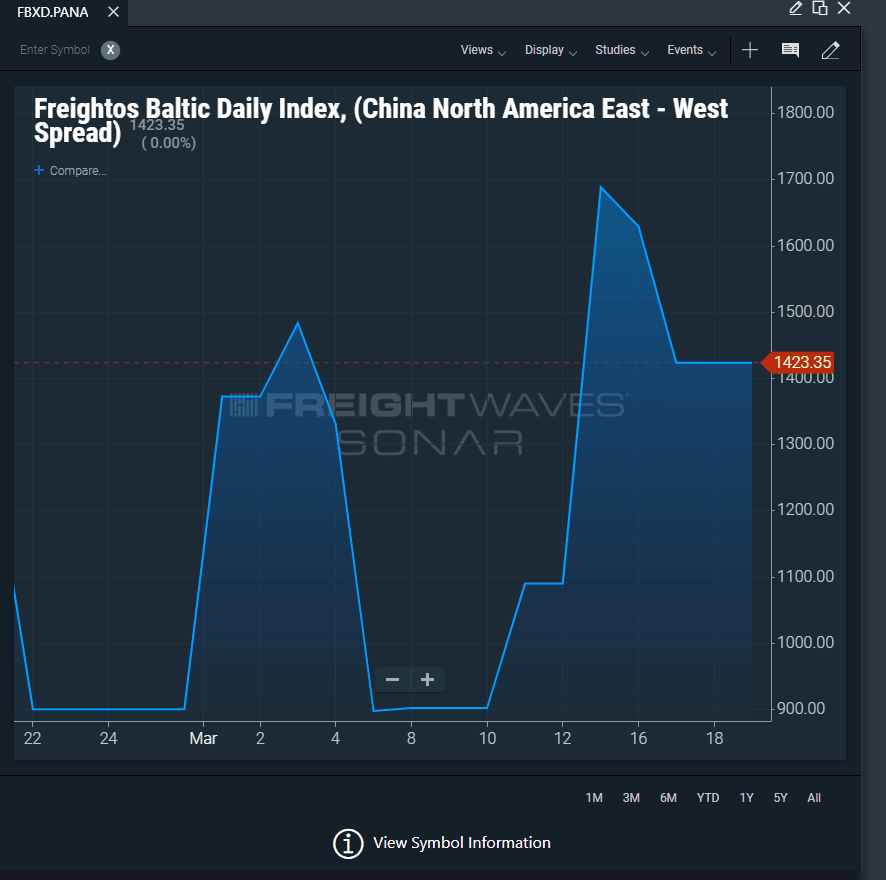

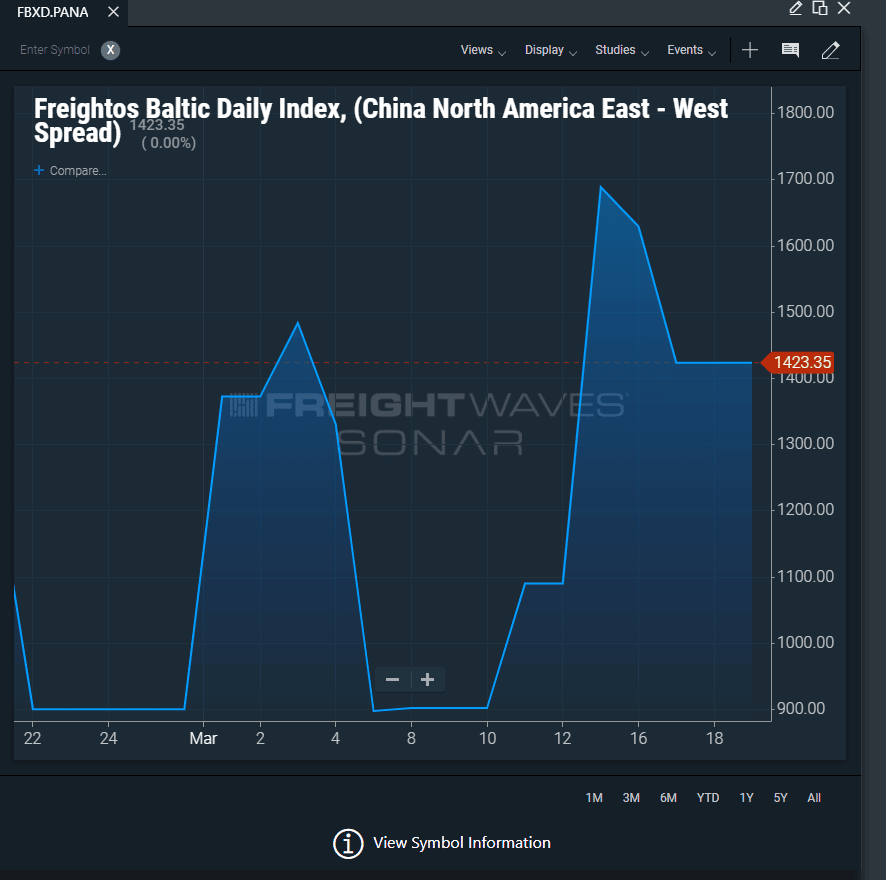

It also offers Panama Canal related spread for shipping from Asia. The difference in container prices from China to the North American West Coast and the North American East Coast is reported as the FBXD.PANA. A positive reading will tell you how much more it will cost to route through the East Coast while a negative reading indicates a discount to ship to the East Coast. In a weekly comparison, this index is up 30.6%, favoring shipping to the West Coast.

When you click the individual lanes within this tool, you can view trends of the individual maritime lanes, including the Panama spread.

As an executive or manager at a freight brokerage, you have noticed a drop in import shipments to West Coast ports compared to spikes in East Coast ports, you direct your freight business managers to dive into the inbound shipments coming in from China over the next few weeks.

Your freight business managers open their Freightos Baltic Daily Index with a monthly change % time period and they notice that the price for a container from China North America East-West Spread has increased over the last month, meaning it is more cost-efficient for companies to route their Chinese imports to the West Coast.

You also know that the cyclical nature of the Panama spread, along with port congestion in the west coast, could cause a dramatic decrease in prices to ship into Houston soon.

As it is your goal to diversify your business portfolio with international shipments, you direct your customer sales and your carrier sales into two different directions.

You can also have the customer sales team of the freight business reach out to customers who have warehouses in these areas to discover who may be looking to bring the product into Houston for faster unloading and cheaper costs but have not developed relationships with the proper drayage and over the run transportation companies to prepare for the change in routing.

Knowing the possibility of the Panama spread soon favoring Houston, it would be best to begin building long-term relationships with carriers who run out of Houston. When that market does flip, the inbound volume will cause an uptick in Houston’s import market share and overall import volume, leading to a lack of trucking capacity in the area. This would enable you to take advantage of higher outbound rates to carriers you have already built relationships with.

If you are currently running a lot of revenue out of the West Coast ports, you will find a large revenue loss when the Panama spread flips. The more you prepare for this scenario to occur, the better chance you have of mitigating your loss in that potential market flip.

This is a simple example of how you can use SONAR tools to strategize a game plan for your company to enter markets you are looking to gain experience in. This is important for the stability of your freight business’ revenue growth, and no matter what size your company is, SONAR has the tools for your team to respond proactively to market demand.

SONAR contains proprietary data that comes from actual load tenders, electronic logging devices and transportation management systems, along with dozens of third-party global freight and logistics-related index providers like TCA Benchmarking, Freightos, ACT, Drewry and DTN.

Whether you’re working from the office or from home, SONAR can provide you the data and intelligence you need to stay ahead of your competitors.

Find out more about FreightWaves SONAR for brokers.