Few areas of the economy carry more confusion or misconception than the for-hire trucking industry. The for-hire industry comprises independent contractors, owner-operators, small brokerages, subregional carriers and more. Locality and minimal resources are the defining characteristics of this transportation sector. However, carriers across the board need to recognize the trucking trends coming out of the for-hire trucking industry as they will inevitably carry over into larger carrier networks as well.

1. Capacity concerns will remain a leader in for-hire trucking trends

The first of the for-hire trucking trends to drive decisions in 2021 is simple— capacity. Trucking capacity concerns are everywhere. The USPS, UPS, DHL and FedEx still are struggling to handle the surging volume from peak season. And even recently, the major carriers have reinstated pre-holiday peak shipping fees. Those charges are a harbinger of increased demand, which will put more pressure on the for-hire trucking industry as well.

2. Owner-operators will purchase more trucks

The for-hire market is also responding to the demand for more capacity. In 2021, market experts predict a surge in freight volume through an acceleration of Class 8 orders at the end of 2020. That growth is likely to be paramount to multiple aspects of transportation, including a demand for more drivers.

3. Driver salaries will help stimulate increased driver training enrollment

While thinking about the growing truck driver shortage amid the current state of “ship it now, get it tomorrow” transportation, it’s important to consider driver salaries. Due to increased demand for spot freight rates, driver wages have responded in kind. According to JTL Truck Driver Training, “A big reason to get into the trucking industry right now is the increase in pay that companies are implementing for beginner drivers. Spot rates are increasing compared to earlier in 2020 due to the high demand and manufacturer supply, which motivates drivers to carry more loads. The average salary for a truck driver right now is between $55,000-$60,000, with an entry-level driver making between $40,000-$50,000.” As a result, an influx of new enrollees is likely. However, it will still be months before these new drivers have finalized all requirements, completed examinations and started actual driving.

4. For-hire transporters will see continued pressure to accelerate transit times as inventory replenishment problems persist

Another trend within the for-hire trucking industry surrounds the need to speed delivery times. Drivers can only go so fast. That much is simple. However, the pressure to accelerate transit time will lead to a continued demand for localized capacity where drivers can make headhaul and backhaul trips in the same day. That much is certain.

5. Elevated consumer spending will push for more demand in the services industry, resulting in more loads across the market

As consumers have grown discontent with the state of the economy, there’s a growing volcano of unrest. There will soon come a time when people flock back to their favored services and begin lavish spending across a variety of industries. In turn, that will generate another demand shock on retailers and business-to-business suppliers – pushing rates in transportation faster than previously imagined.

6. Vaccine distribution will also play a role in for-hire trucking trends

A final concern in the for-hire trucking industry involves COVID-19 vaccine distribution. The reality is that most companies without the resources to handle vaccine transport are out of the equation. However, the vaccine manufacturers have made no secret about their closed contracts with the major carriers for distribution. As a result, the capacity diverted by major carriers to transport vaccines will trickle into the for-hire trucking industry. Therefore, capacity is expected to grow ever tighter for the first half of 2021.

Keep apprised of the trends to make the most strategic decisions for your network in 2021

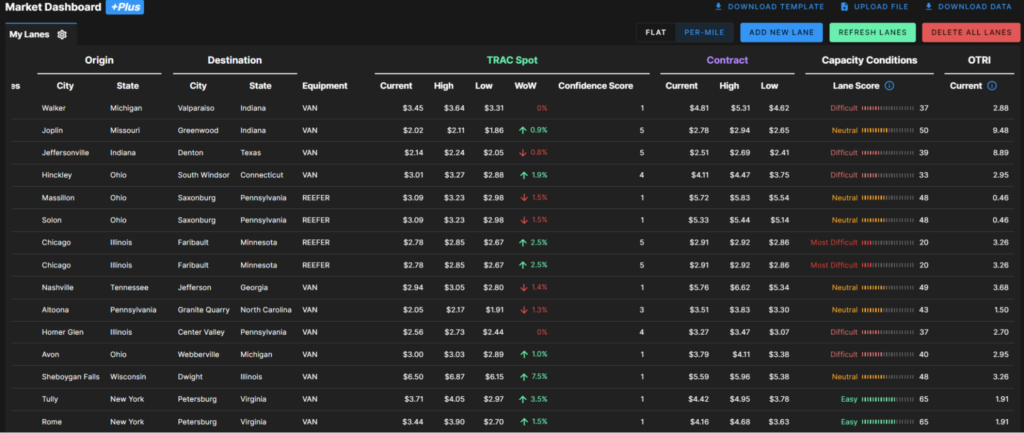

The for-hire trucking market continues to reflect the need for more drivers, more capacity, faster load execution and streamlined management. For-hire trucking companies need to take stock of their operations, implementing clear systems to benchmark, analyze, monitor and forecast demand. That’s the only possible way to thrive throughout 2021. To achieve that goal and more, request a FreightWaves SONAR demo by clicking the button below, and see how data-driven fleet management can be a game-changer for your enterprise.