(Graphics created by Emily Ricks)

The trucking industry continues to experience the fall-out of disruption caused by the COVID-19 pandemic. In recent months, capacity woes were a stark reality. As 2021 began there was hope for a return to the typical balance of freight capacity. However, the decisions by FedEx and UPS to reinstate pre-holiday peak shipping surcharges clearly indicate a continued strain on resources, which has resulted in increased enterprise shipper tender rejections. Consider this. As explained by Supply Chain Dive, “As UPS and FedEx are in the middle of a massive vaccine distribution operation, the carriers are getting affairs in order for their core business come the new year.

This time, UPS’ surcharges are based on flat volume, rather than relative volume surge as they were in May, meaning it’s possible more shippers may be subject to surcharges. And shippers should view “until further notice” to mean ‘forever,’ at least for planning purposes.” In addition, the national tender rejection indices continue to reveal the same trend. That’s why it’s important to understand a few factors that increase the risk of enterprise shipper tender rejections among the largest truckload and less-than-truckload carriers.

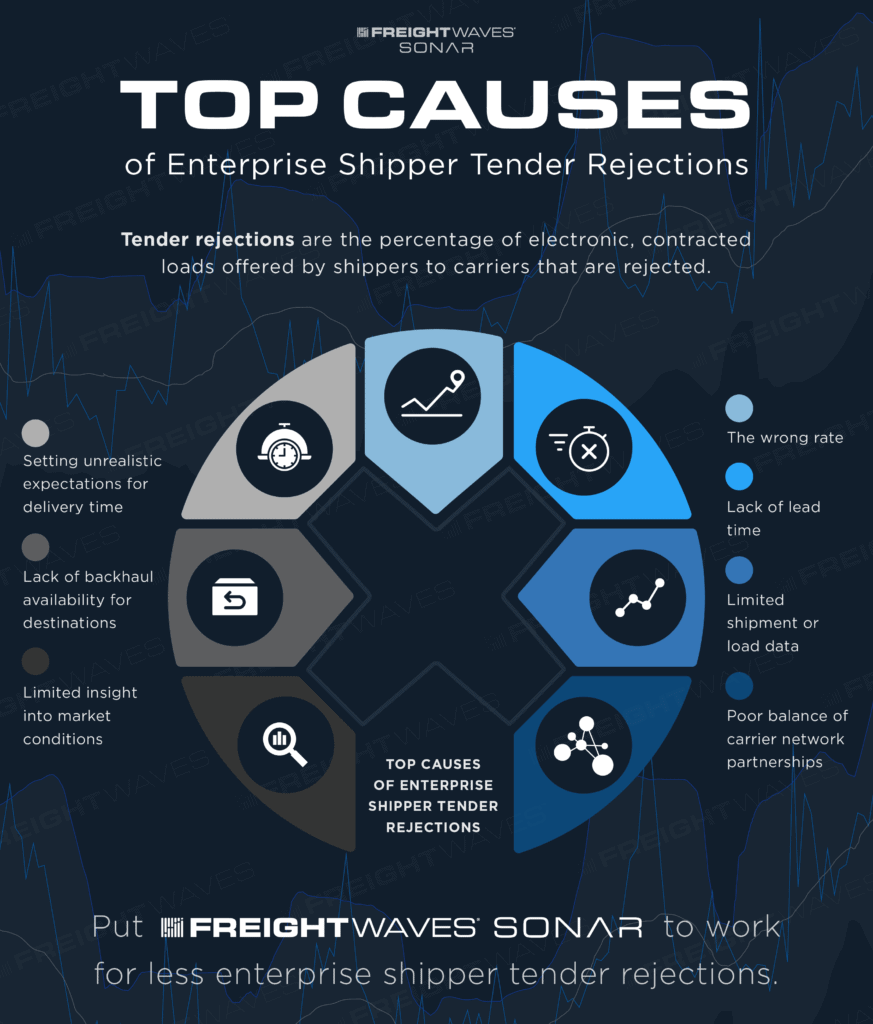

The simplest reason for enterprise shipper tender rejections is tendering a load at the wrong freight rate. Rates that are too high clearly mean something is wonky with the shipment and going to take more resources to move. For instance, this might be present on a white-glove shipment. However, rates that are too low also increase risk of enterprise shipper tender rejections because the carrier simply cannot justify the cost of transportation at that rate.

Carriers have a vested interest in maximizing profitability, and that implies a need to avoid empty backhauls at all times. Without ample lead time, that becomes much more challenging. In addition, tracking average lead time is yet another key point of why tracking near-real-time freight data is crucial to the success of both enterprise shippers and truckload carriers alike.

A lack of load data is a massive risk for carriers. Think about it. If a carrier does not know what to expect from a given load, assessing a quote on that load becomes nearly impossible. Unfortunately, some enterprise shippers continue to submit tenders without the full context for the move. And as a result, total accessorials assessed may increase due to unique equipment or handling requirements. By providing a more complete picture at the time of tendering, shippers lower their risk of rejection.

Part of the problem with rejections derives from a limited network size. More importantly, a limited pool of carriers means there are fewer opportunities to tap added fleet and trucking resources. That includes knowing when to initiate new trucking RFP processes, onboard new lanes, work with more brokers, or expand other business relationships. It also goes back to the need to secure more capacity due to the strong demand on carriers. Remember that we are in the midst of an e-commerce boom. And higher market demand is yet another reason for increased enterprise shipper tender rejections.

Another reason for enterprise shipper tender rejections comes from unrealistic expectations. While same-day delivery sounds great on paper, it comes at a high price. And tenders should reflect that pricing accordingly.

Again, a lack of backhaul availability also plays into rejection risks. However, it’s possible to optimize the overall freight load headhaul route to open the doors to a backhaul opportunity somewhere. In other words, enterprise shippers could pre-optimize the route based on their full network needs to avoid the risk and avoid the chance of a flat-out rejection.

The final condition that often leads to rejections goes back to a lack of insight into market conditions. Without insight, shippers are blind to everything and unable to proactively manage the risk of tender rejection or the likelihood of acceptance.

The freight market is continuously evolving. And as carriers look for opportunities to maximize profitability per load, allocate assets and source more capacity, the risk of enterprise shipper tender rejections will continue to increase. However, enterprise shippers and carriers both generate a proverbial ton of data that can be analyzed and processed to unlock added insight into the industry and what best conditions exist for each load – and therefore lower the risk of rejection. It all begins with getting access to the right freight data. Request a FreightWaves SONAR demo by clicking the button below to find out more about the insights available to your enterprise and how they can lower your risk of tender rejections.