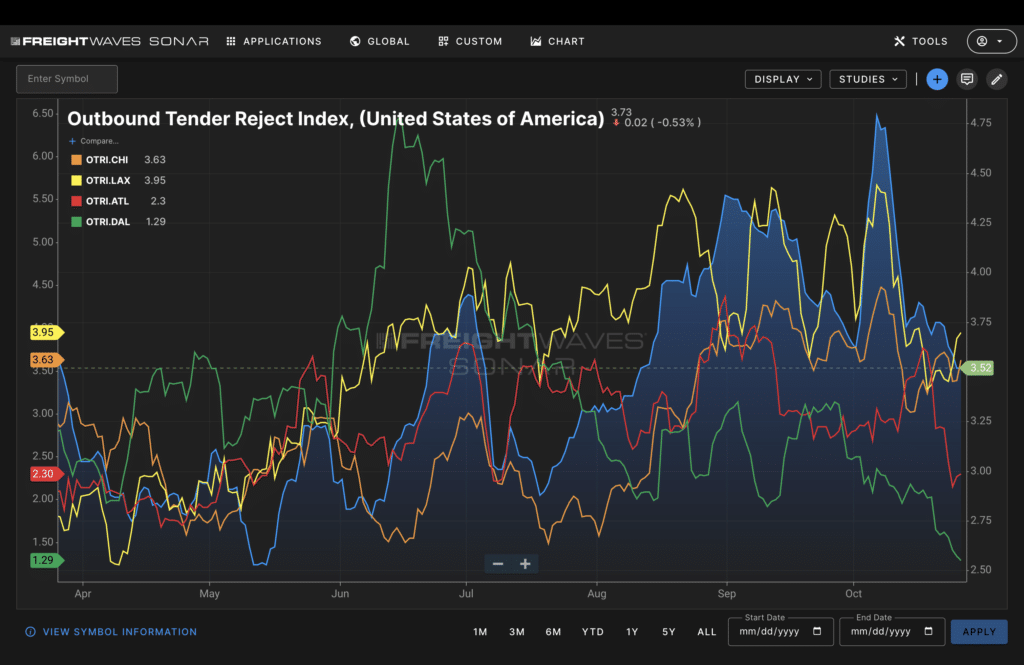

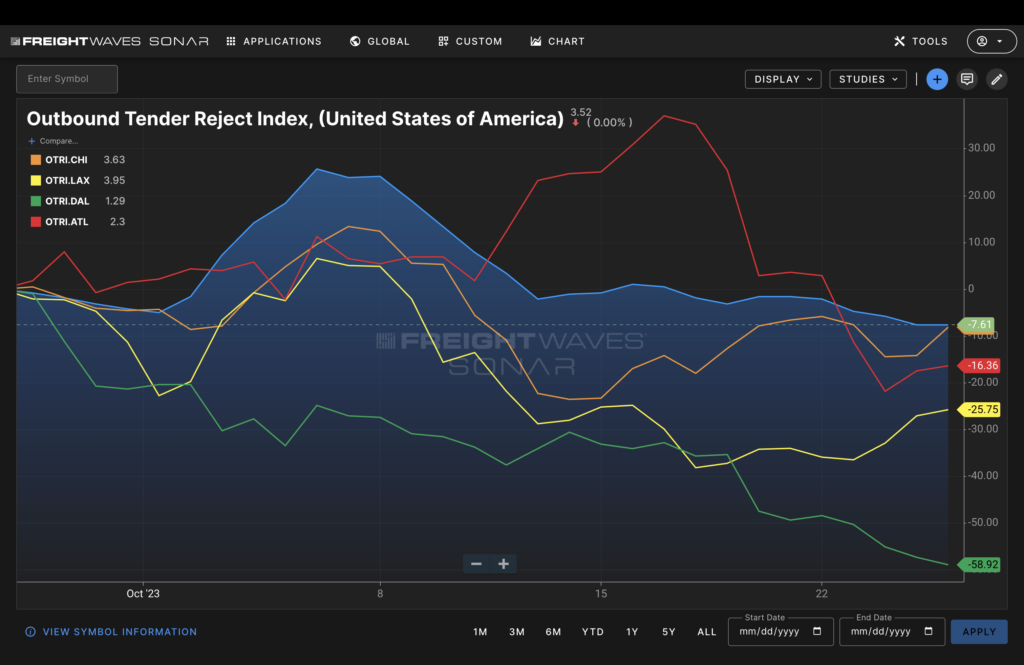

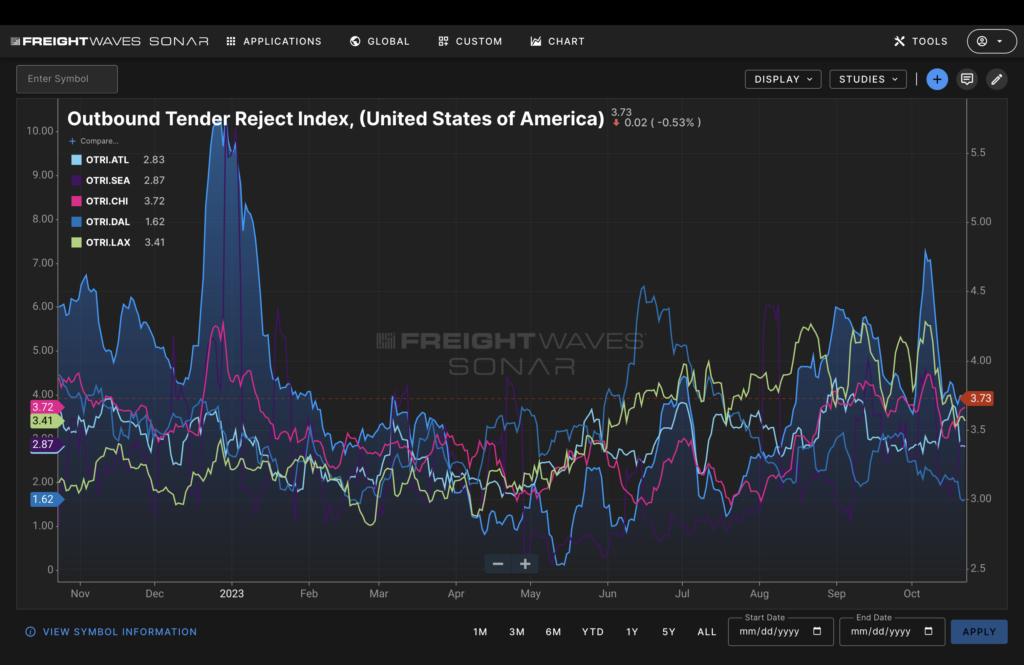

FreightWaves SONAR Outbound Tender Rejection Index (OTRI) is an anonymized measurement of mid-sized to large truckload carriers’ willingness to accept the loads that are offered (or tendered) by shippers. OTRI is an indicator of capacity availability in contracted surface freight markets. It is expressed as a percentage of loads of rejected freight to total loads tendered. This index provides data at the national, regional, state and market level. Motor carriers reject load requests for two reasons: As demand for freight hauling services exceeds supply, load requests are rejected; and if the price of a tendered load is considered too low, it is rejected.

Shippers, freight brokers, fleet managers, transportation executives, owner-operators, economists, financial analysts, investors and bankers rely on this data. This index allows supply chain teams to visualize freight movement patterns, volatility and price movements.

OTRI denotes supply and demand dynamics in freight and logistics.

When OTRI is high due to insufficient truckload capacity to meet demand, outbound rates tend to increase.